Stock on The Move - YX Precious Metals

AmInvest

Publish date: Tue, 25 Apr 2023, 09:40 AM

Company Background. YX Precious Metals (YXPM) is principally involved in wholesaling, designing and manufacturing of gold jewellery. YXPM’s other related products and services include sale of scrap and pure gold bars, manufacture of silver chains and provision of refining services for precious metals. The group focuses on 916-gold jewellery which contains 91.67% pure gold content alloyed with other metals. Malaysia is its principal market with >90% in sales.

Prospects. (i) Expand the range of hollow gold jewellery to meet the needs of customers, mainly jewellery retailers who intend to target a wider cross-section of end-consumers due to its lower price points compared to solid gold. (ii) Expansion and upgrading of operational facilities to automate processes to improve production efficiency. (iii) Provision of refining and assaying services to external customers to enlarge customer base and generate additional revenue stream.

Financial Performance. In FY22, YXPM reported higher revenue of RM298mil (+12.3% YoY) with a PAT of RM9.4mil (+32.3% YoY). This was mainly due to the increase in sales volume of gold jewellery from customers in Malaysia and Singapore as well as better profit margin from the wholesale segment.

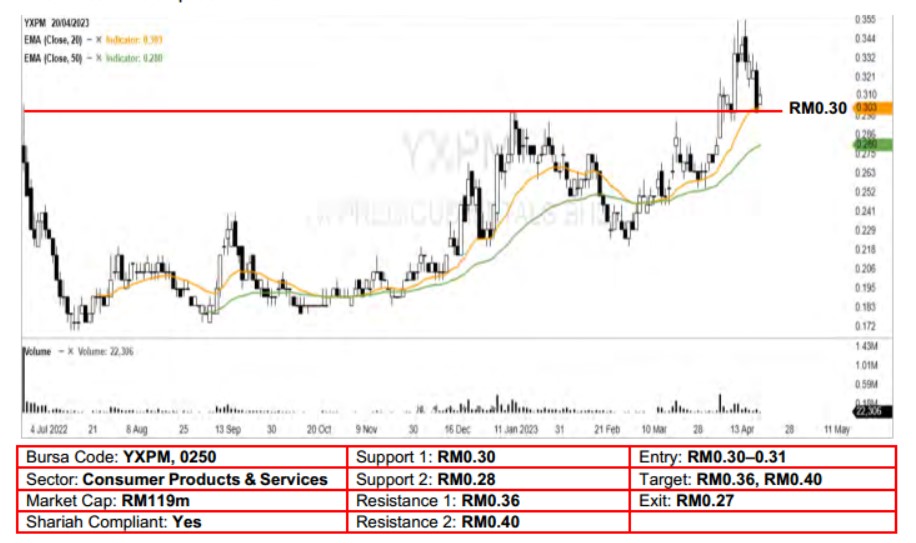

Technical Analysis. YXPM’s buying interest is back after it pushed above the key RM0.30 resistance with a long white candle 3 weeks ago. With the 20-day EMA remaining above the 50-day EMA since the bullish crossover in mid-March, the uptrend may continue in the near term. A bullish bias may emerge above the RM0.30 level, with a stop-loss set at RM0.27, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM0.36, followed by RM0.40.

Source: AmInvest Research - 25 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024