Probably the most anticipated IPO in 1H 2024?

EatSleepTrade77

Publish date: Sat, 18 May 2024, 10:35 AM

Did you grow up surrounded by the joy of cartoons? If so, you have experienced the magic of 2D animation.

For many of us, cartoons provided endless entertainment. However, behind these animations lies a vast business encompassing advertising, promotions, and copyrights.

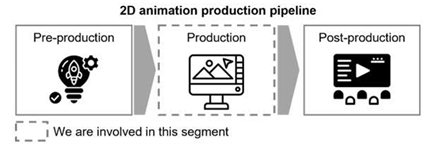

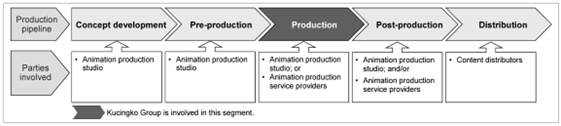

Creating animations is a complex process that includes pre-production, production, and post-production stages.

Pre-production involves conceptualising the storyline, writing scripts with scenes, actions, and dialogues, storyboarding to sequence events, and designing characters and backgrounds.

Kucingko Berhad is a leading 2D animation production company in Malaysia, commanding about 3% of the animation market.

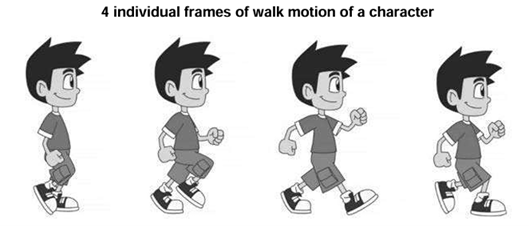

To understand the effort involved, consider this: a single second of 2D animated content typically requires 24 to 25 frames per second (“fps”). This means that every minute of animation requires 1,440 individual frames (24 frames x 60 seconds).

Kucingko oversees the entire project management and 2D animation production process, including asset creation, key and in-between animation, compositing, reviewing, and rendering.

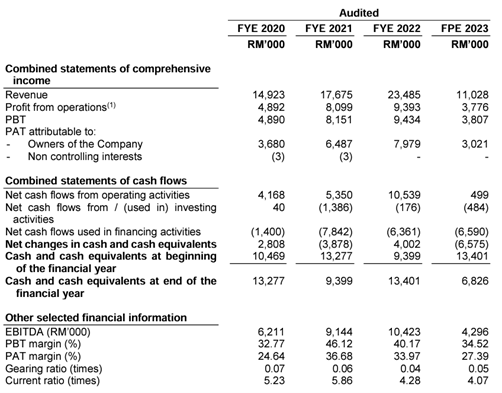

Why is Kucingko “probably” the most anticipated IPO of 1H 2024? Let’s examine their financial performance:

Kucingko's revenue has been growing robustly, with a significant increase in Profit After Tax (PAT) from RM3.68 million to RM7.98 million. The company's PAT margin is impressively healthy at 33.97% for FYE2022.

On Bursa Malaysia, few businesses can boast such a strong PAT margin. While there are other lucrative options, few in the 2D animation sector offer such potential.

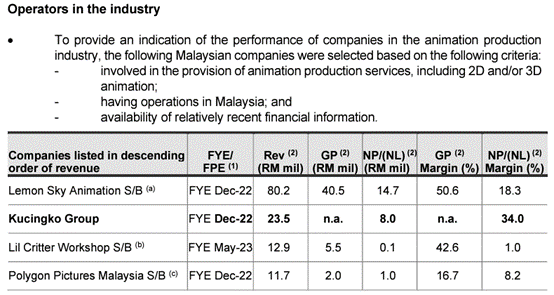

Here’s a look at their peer comparison:

With its unique business model and strong profit margins, Kucingko is attracting a lot of investor’s attention.

Could this fortune cat (no pun intended) be one of the most anticipated IPOs of 2024?

Discussions

https://www.bursamalaysia.com/regulation/prospectus_exposure/kucingko-berhad-kucingko

Ya, they haven't even put the price and date in the prospectus

2024-05-19 12:43

That being said, this company really has potential due to the following reasons:-

1. Kenanga is a good sponsor;

2. The business model of the company is scarce in Bursa Malaysia; and

3. The company had high growth and strong margins.

2024-05-19 21:30

Jeferson

What is the IPO issue price?

2024-05-19 07:23