Results Review — Meta Bright Group (KLSE: 2097)

OptionOracle

Publish date: Wed, 28 Feb 2024, 11:55 PM

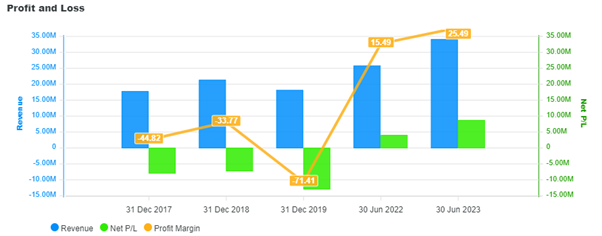

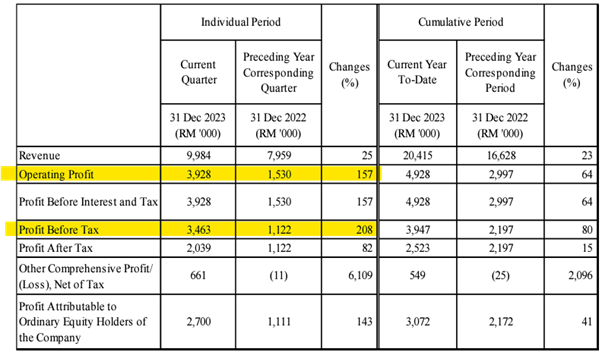

Meta Bright Group Bhd, or previously known as Eastland Equity Bhd, published their quarterly results yesterday, with a revenue of RM10.0 million, and most importantly with a core profit, or operating profit of RM3.9 million.

Since the change of major shareholders and key management team, we could see that the financials of the company are improving significantly. For this quarter alone, which is Q2FY2024, the company’s revenue growth mainly contributed to the property development, leasing & financing, as well as energy related segment, such as the energy efficiency business.

Most notably, the operating profit and PBT of the company increased by 157.0% and 208.0%, respectively. This is considered incredible given how challenging the current market was, and the relative peer of Meta Bright is not showing a similar rate of growth.

And going forward, Meta Bright will be expanding their hotel building and facilities, and is on the look for new potential development projects. As a matter of fact, Q2 FY2024 does not factor in any revenue or profit from Expogaya, a new subsidiary of the company specialised in the building material business, which expects to give out consistent PAT to the company of over RM5.0 million per year.

On the bright side, currently Meta Bright’s share price is retracing back to RM0.170 level. This is very interesting as the company’s fundamentals are improving, the share price, on the contrary is retracing. But for us, as investors, this might be an even better opportunity for us to accumulate Meta Bright at the low price.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on BuildingMaterials

Created by OptionOracle | Jan 28, 2025