Is DNeX for Value Investment ?

Wonder88

Publish date: Thu, 27 Oct 2016, 09:36 AM

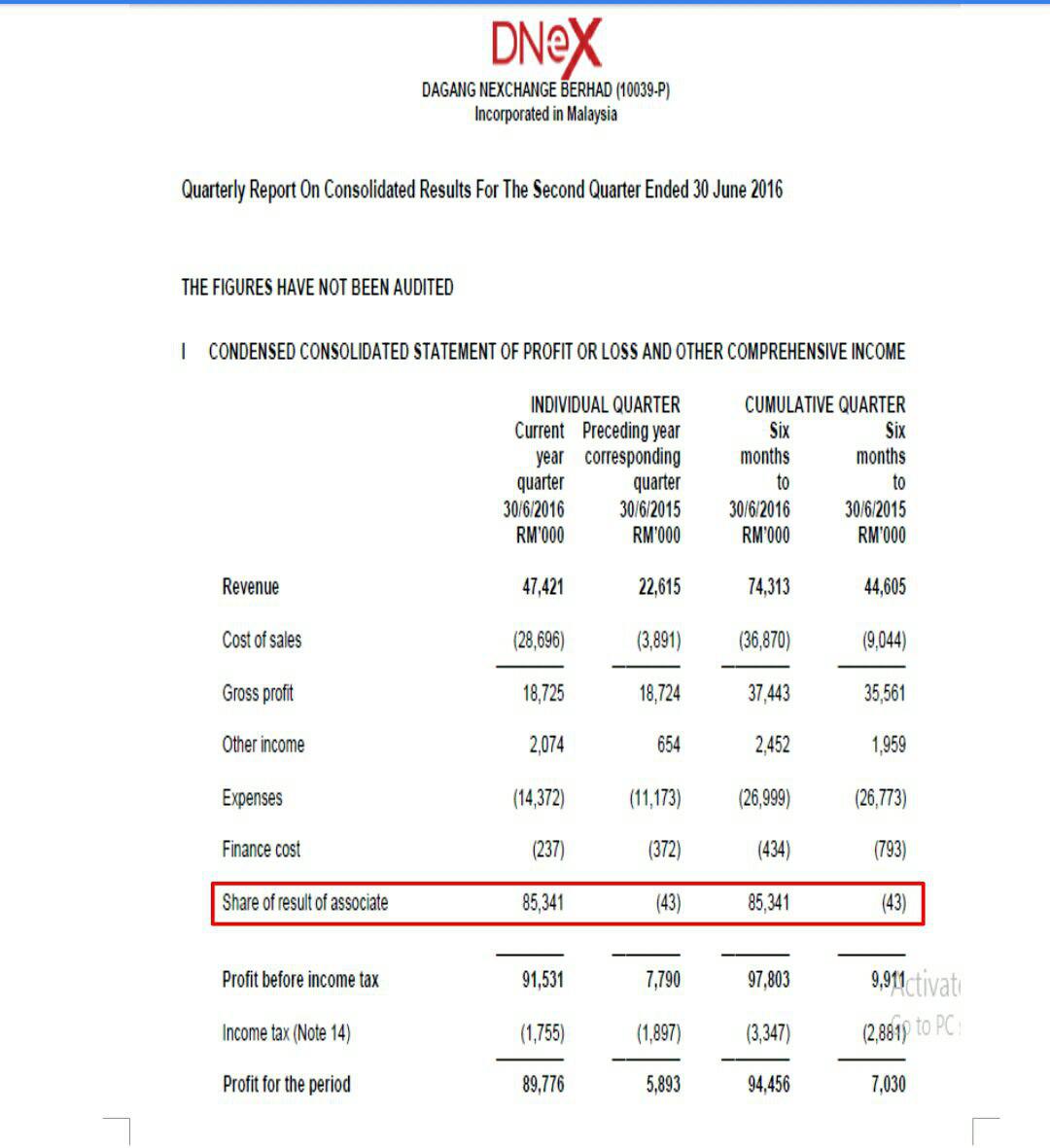

A)Income Statement

From the Income Statement, the contribution of Profit before income Tax for associate is RM85.3million.

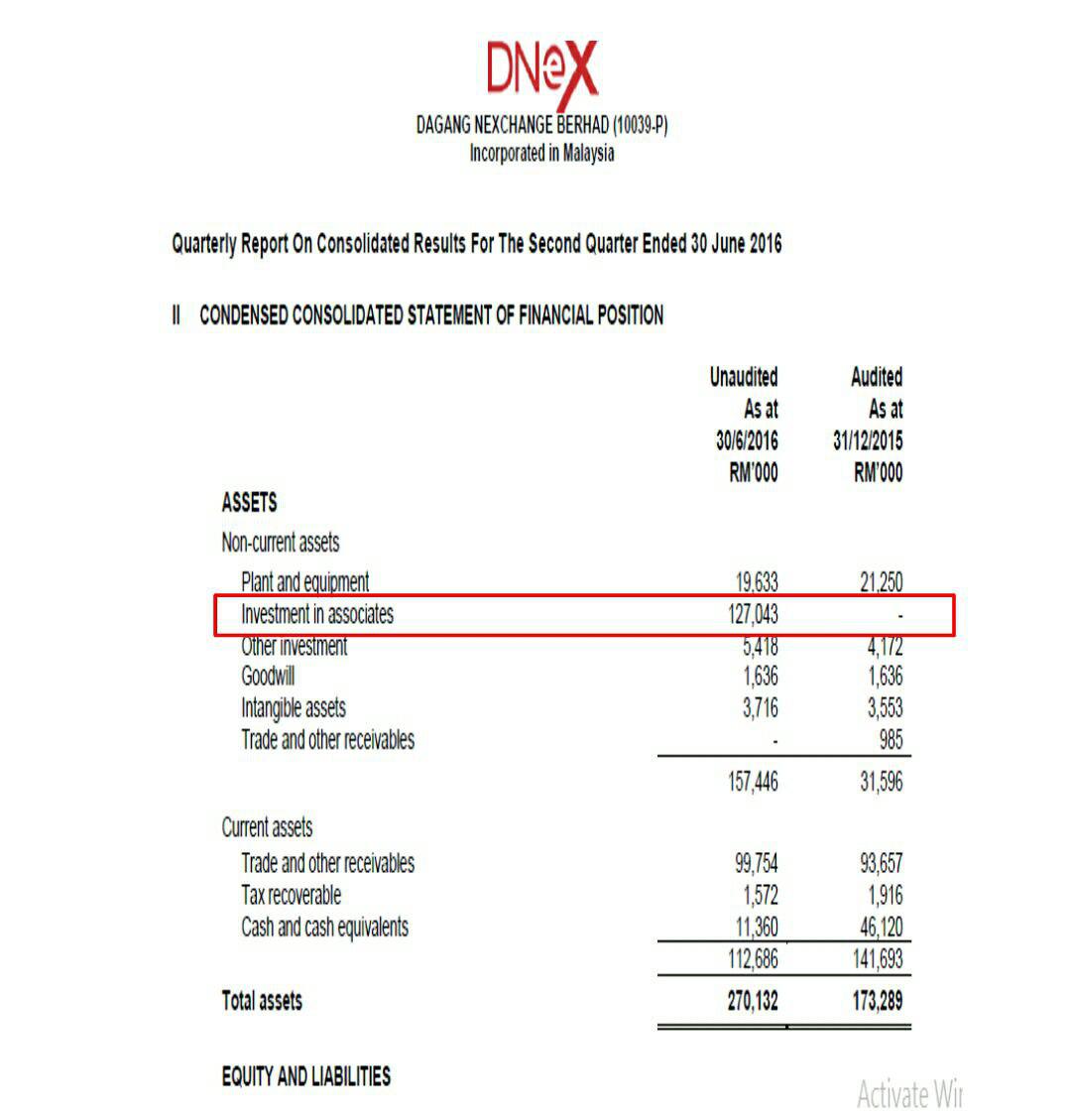

B)Balance Sheet

1)The Subscription in subscription shares in Ping had been completed by DNex Petroleum Sdn Bhd ("DNex Petroleum")

on 30 June 2016.

2)DNex Petroleum currently hold 30% equity interest in Ping.

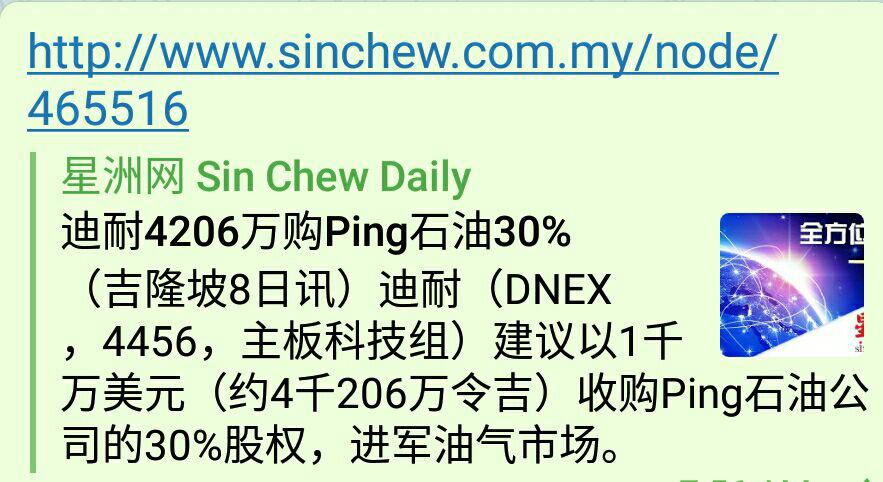

3)Sin Chew Jit Poh Article

Means only RM42.6million (out of RM127mil invested in associates) is used to invest in Ping Petroleum.

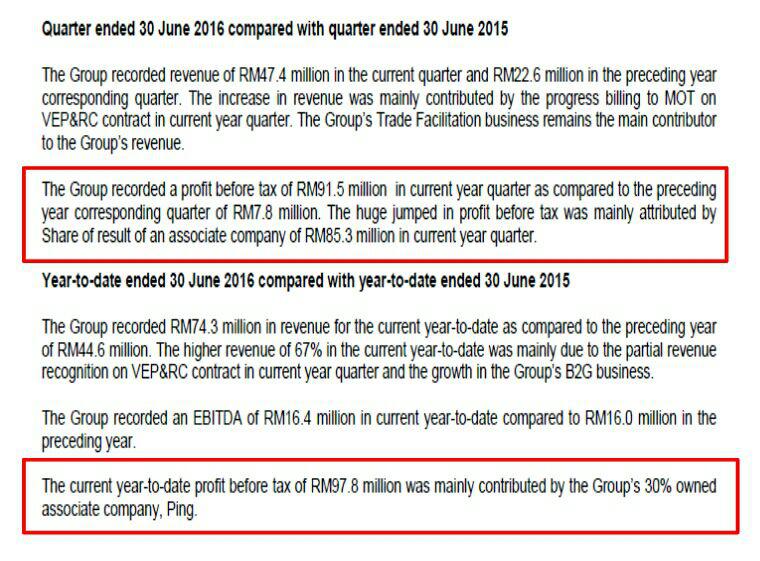

C)Quarterly Performance Review

The HUGE jumped in profit before tax was mainly contributed by Share of result of an assoicate company of

RM85.3million in current year quarter

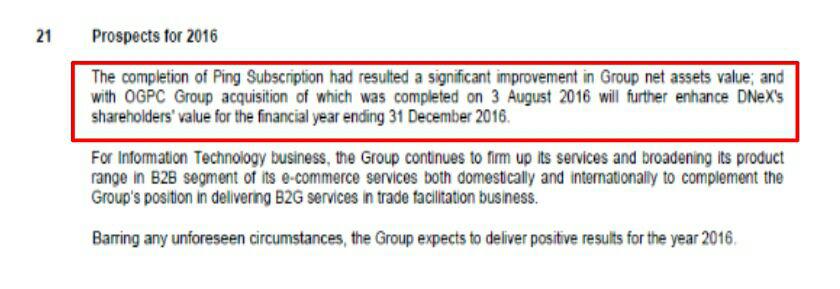

D)Prospects for 2016

As higlighted in Prospects for 2016

1)The completion of Ping Subscription had resulted a SIGNIFICANT improvement in Group net assets value;

2)OGPC Group acquisition , which was completed on 3 August 2016, another associate that going to

contribute in Q3 16.

E)DNex article published by Sin Chew Jit Poh

Highlight of above article (Apologized if there is translation error)

1)In IT sector, DNex is the BIGGEST Electronis Trading System in Malaysia

a)Posses 13 thousand Business Clients

b)National Single Window (NSW) Sole Proprietor, Currently is main revenue contributor

2)Successfully acquired 30% Ping petroleum equity

3)Successfully acquired (RM170 mil, through Offer Right) OGPC Group whcih supply O&G equipments.

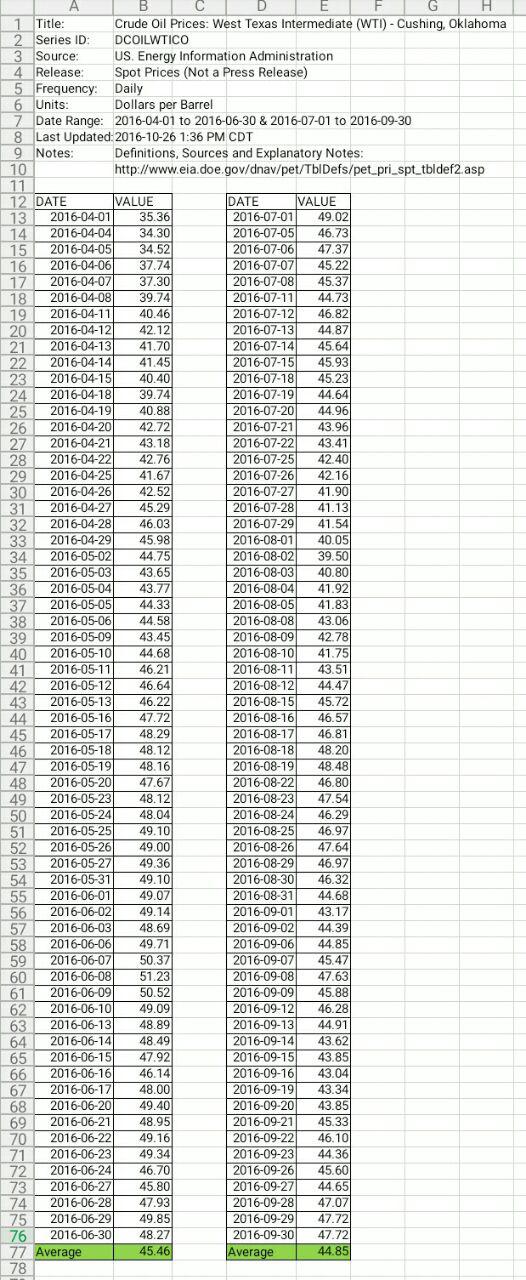

4)Cost of Production is US34 per barrel, If Q2 16 make RM85.3mil with Crude Oil price around US45.

What about Q3 16, is DNex going to have Huge profit again with Crude oil price around US45!

Please read also the link below:

http://www.sinchew.com.my/node/446564

F)DNex article published by TheEdge Financial Daily (updated on 31/10)

Highlights

1)Investment in Ping was done at time when Crude oil prices were soft and volatile-acquired it at less than US2

per barrel, for the reserve it has.

2)DNex O&G div has been awarded an umbrella contract in April 2016 for the provision of directional drilling services to

Petronas Carigali Sdn Bhd.

3)DNex had secured a vehicle entry permit point(VEP) and Road Charge (RC) IT infrastructure job in Johor fr the MoT

earlier 2016 for rm45mil. This coming quarter, will bill another 40%, with the balance 20% in the subsequent quarter.

4)Still waiting for the operation and maintenance contract of the VEP and RC system.

5)The plan was for the VEP and RC system to be extended in stages from the Johor border to other road entry point,

Brunei-Malayisa, Indonesia-Malaysia, Thailand-Malaysia, that is another 12 other entry points.

6)The group's Electronics Trading facilitation system, dubbed the National Single Window (NSW), is a system allows

exporters to conduct almost all necessary cross custom procedure on it single internet portal. The Dnex is the only

system provider of the NSW in the country.

7)NSW will soon be phased out, despite the two years extention til sept 2018. The system to be replace by uCustoms.

DNex has been appointed as one of the two service providers of uCustoms.

8)FY17, group revenue will double to RM200mil (Q1+Q2 revenue is only RM74 mil, another average of RM63 mil per

quarter to go) since there will be first full year consoldiation revenue recognised from OGPC sdn bhd and PGPC O&G

sdn bhd.

9)OGPC has been reporting some RM100mil revenue and RM20mil net profit over the past few years.

10)Group MD hopes to grow all the business steadily over time, hope revenue would hit RM400mil to RM500mil in

5 years.

Conclusion

DNex invests in fair value (assumption made since invested during low crude oil price and make huge profit at crude oil

price US45) in Ping Petroleum. So as us, as a value investor to invest in DNex with such as low PE, reasonable P/BV

and Low EV/EBIT.

Valuation at price 0.29

PE=3.6 <10 Good

P/BV= 1.91 <1.5 max 2 ok

EV/EBIT=2.2<8 Good (include associate RM85mil, otherwise EV/EBIT=9.8)

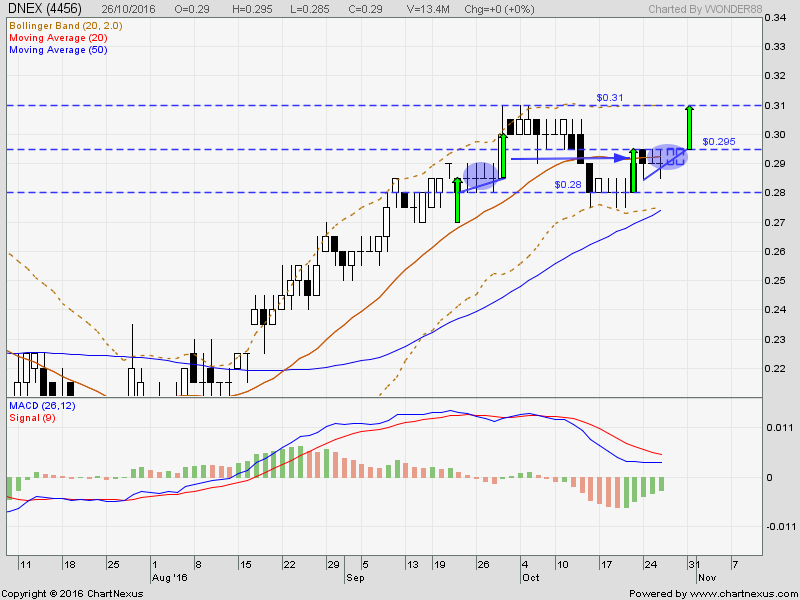

F)Technical Chart

Based on Chart, expect 2 to 3 days to challenge price 0.31 again

Disclaimer

This is not a buy or sell call, please invest with your own risk.

More articles on DNex - The Next O & G Giant

Discussions

it would be great if author can delve more into the Anasuria oil field (cash generating investment), the cost (mostly in British Pound) and the production rate of the field. coming new contribution will be from OGPC, NSW, on top of 30% in Ping Petroleum, rental ard 300k a day from Bakers Hugh, Drilling contract from Petronas.

2016-10-27 10:11

.

klsetitan@

You seems like having some insights with this company. Might to share your advise for long term ? Electric vehicle is a definite disruption and do you think the future of O&G would so be intact with the going forward of DNEX ?

.

2016-10-27 12:29

Most of what I know is from the sources shared by other authors. I'll relist what others have shared:

-OGPC has a increasing profit record for 4 yrs (2012-2015) of 17m-23m continuously (this shows that it has solid moat, believe to be monopoly in supplying equipment and valves for new and maintenance to O&G especially petronas). 2016 net profit shd not be less than 17m

-National Single Window (NSW) just renewed for another 2 yrs. A lucrative monopoly business

-30% in Ping Petroleum. Ping and Hibiscus each own 50% of Anasuria oil field in North Sea. Anasuria is a oil producing asset therefore cash generating asset. If u believe the valuation of Anasuria cluster it is worth RM840+m with its reserve (new estimate by 3rd party). daily production rate ard 6000-7000 barrels, cost of production abt USD23 per barrel (could be lower due to lower Pound Sterling). You can do the maths with the average oil price lately average USD40-45+-. Most cost are in British Pound as it's in British water. However, the profit is highly dependent on how many times the oil is offload from the FPSO. Last qtr only 2 offloads, if more this qtr profit will be more. For more detail pls refer Hibiscus report, u js need to focus on Anasuria part.

-average 330k rental receive from Baker Hugh. Contract period 4+2 yrs, starting frm June 2015

-Dnex Oilfield recently won a 3+1yr contract from Petronas Carigali starting from April 2016-2019.

-VEP contract. Another lucrative monopoly business, commission for each car entry -to Malaysia initially started at Singpore-Malaysia border , now project extend to Thailand border. Can u imagine how many cars in and out of msia?

-Renewable Energy with China Everbright, Broadgate ENgineering & Hydro China (so far no contribution). Pls google China EverBright and Hydro China

-E commerce (Global Halal Exchange)

Hope you enjoy reading.. :)

2016-10-27 18:22

Hi klsetitan,

Thanks that you have provided some simple but good information. Anyway, I have extracted some good information from the Theedge Financial Daily (published on 31/10/16) and updated into my article, probably you and interested investors can go through the article.

2016-10-31 05:10

Gen2

.

The huge jump in ping investment is derived by equity method, therefore it is not continuous but one off item.

2016-10-27 09:59