What does FAST (0084) tells us now?

jonathansiew

Publish date: Mon, 27 Dec 2021, 07:31 AM

What does FAST (0084) tells us now?

How should investors really react to lower trading volume of a stocks?

Well, it depends.

Under normal circumstances, we would define the reduced volume as reduced interest in a stock, which is definitely not a good sign. However, that’s quite the polar opposite for a downtrend stock, just like our case study today for FAST.

You see, investors had a bad reaction on rights issue and triggered some panic selling for FAST. Fortunately, we are seeing an obvious reduction in trading volume in the last 15 trading days. This means that whoever wants to sell had already sold their shares, and thus the selling pressure had decreased drastically.

For now, I would like to draw your attention to one of the new announcements made by the company.

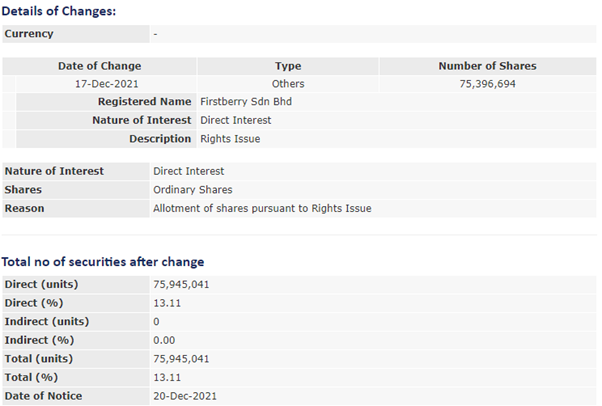

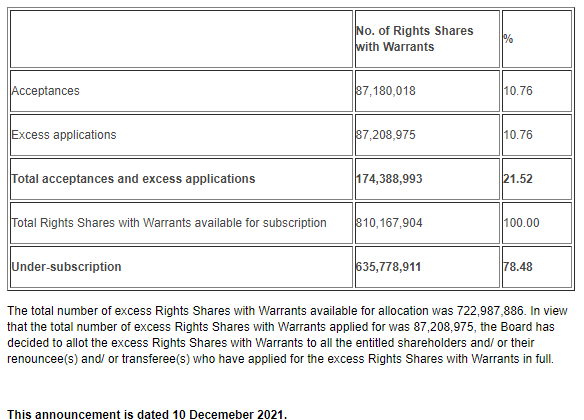

Did you notice that the major shareholder of the company had subscribed 75.39 million new FAST shares? Most might not notice an announcement back on 10th of December 2021, which is critical for the new directions for FAST.

If you had noticed, the major shareholder – Firstberry is in fact the company who oversubscribed the shares for FAST. Let me ask you a very simple question, if you are the major shareholder of a company, would you still inject fresh capital if the prospects are dim?

No.

As such, I’m certain that something is brewing for FAST, and given that the selling pressure is lower now, we are near a historical low risk position to buy the shares and wait for potential announcement in the coming months.

I’m not asking you to buy now, but this will be an interesting case study, do keep an eye on them.

Peace.

More articles on Uncovering Gems

Created by jonathansiew | Apr 26, 2021