TOMYPAK - A Turnarund Thematic Play

BursaGemAnalysis

Publish date: Sun, 18 Oct 2020, 11:17 PM

Tomypak Holdings Berhad is an investment holding company which currently has a single operating wholly owned subsidiary, Tomypak Flexible Packaging Sdn Bhd (“TFPSB”).

Tomypak Group is involved in the manufacture and marketing of flexible packaging materials. The products manufactured and marketed by TFPSB are primarily for local and international food and beverage companies who use these printed, laminated and metalized packaging materials either in roll or bags form, to pack their final products such as sauces, seasoning, noodles, beverages, oil as well as snacks.

The main categories of products are generally divided into the following:

a) Foil, which generally are made for the sauce, seasoning, snacks and beverage products;

b) Metallised, which are made for the noodle, seasoning, beverage and oil products; and

c) General, which are primarily made for the noodle, oil, seasoning and beverage products. Production Facilities.

Telegram Channel: https://t.me/BursaGemAnalysis

TOMYPAK HOLDING BERHAD (7285) - Turnaround Thematic Play ![]()

- Turnaround Co with huge potential with increasing better margin export sales of more than 70% of total revenue compared to about 50% in FY 2019

- Based on range of estimated projected EPS, depending on Mr Market reaction, at forward PE 15, its valuation could be 93.5 Sen to 115 Sen and at forward PE 18, its valuation could be from 112 Sen to 138 Sen respectively.

- Projecting a record top and bottom line in Q3 confirming the turnaround is in place. Outlook should be good given the directors continuous buying of shares in Aug and Sept.

- If management can deliver 2 qtrs of continuous profits, it is very likely Tomypak is on the road to recovery to make profit and the worst is over.

- During the AGM on 18 Aug, under intense questionings by shareholders on its poor performance and outlook, (thru an unintentional slip by the management) shareholders was guided that to-date (YTD) the Group had achieved 88% of the FY 2019 revenue of RM158 mil which is RM139 mil achieved.

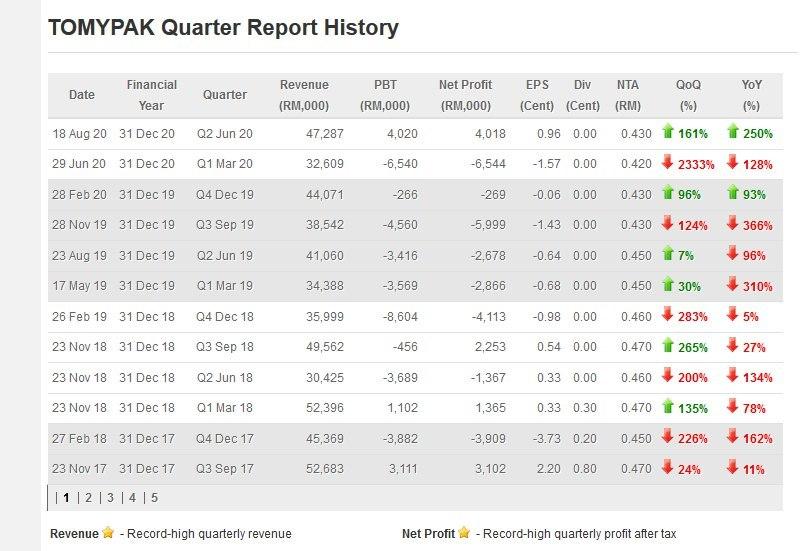

- Netting off 1H revenue of RM80.4 mil, at half way mark for Q3, the sales achieved to 18 Aug was RM58.6 mil compared to Q2 revenue of RM47.8 mil and reported a PBT of RM4.02 mil and net profit of RM4.0 mil and EPS of 0.96 Sen reported for Q2.

- Based on above information on revenue, I am expecting a record qtrly top and bottom line. I am projecting the revenue to be RM70 mil to RM80 mil with a net profit of RM6.5 mil to RM8 mil.

- The EPS for Q3 would be from 1.56 Sen to 1.92 Sen. Annualising it, the next 12 mths EPS could range from 6.24 Sen to 7.68 Sen.

'' At forward PE 15, its valuation could be 93.5 Sen to 115 Sen and at PE 18 its valuation range would be 112 to 138 respectively''

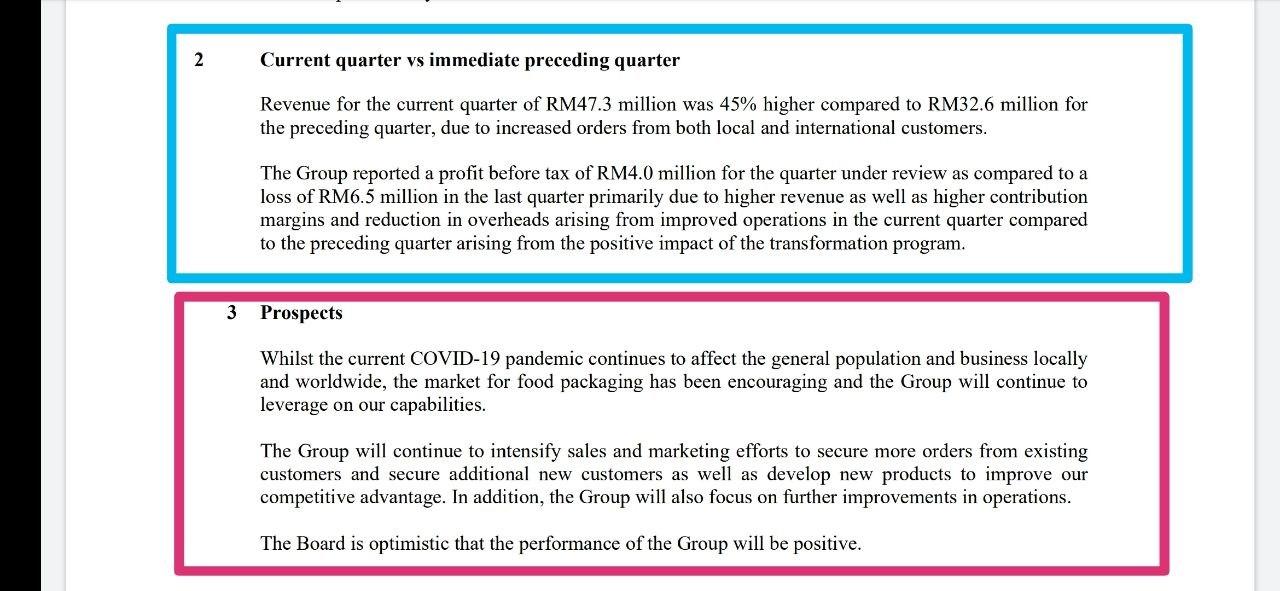

- In Q2, the Group achieved a revenue of RM47.8 mil and a profit before tax of RM4.02 mil compared to Q1 revenue of RM32.6 mil with a loss of RM6.54 mil respectively. The 1H FY 2020 revenue was RM80.4 mil with a loss before tax of RM2.51 mil compared to 1H FY 2019 turnover of RM75.4 mil with a loss before tax of RM7 mil.

- Group revenue for FY 2019 was RM158.061 million as compared to RM168.382 million achieved in FY 2018. The decrease in sales was primarily due to a reduction in sales to some local customers. However, the decrease of sales to these customers were partially mitigated by increase in sales to some existing and new international customers. Almost all of Tomypak Group customers are from the food and beverage industry, both multinational and local.

![]() Company is expected to be profitable due to:

Company is expected to be profitable due to:

The Group expects overseas customers demand to be stronger.Increasing export sales in regaining Nestle Philippines and securing other overseas MNC and achieving higher export sales of more than 70% contributing to higher margin turning Q2 profitable.

- In Q2, the export sales of RM33.8 mil amounted to 70.7 % of the Q2 Revenue of RM47.8 mil compared to Q1 RM19.1 mil which amounted to 58.6% of the Q1 sales of RM32.6 mil. For the 1H the export sales of RM52.9 mil amounted to 65.8% (FY 2019 54.2%).

- Export sales in FY 2019 accounted for 55.5% or RM87.72 million as compared to 39.9% or RM67.19 million in FY 2018.

- Harvesting from transformation program implemented in FY 2018 through to FY 2019 improving operating and cost efficiencies. Implementation of the various transformation programs had resulted in positive effects in FY 2019 with lower production overheads and higher contribution margins. This operational efficiency is expected to be further enhanced which will result in improved operational performance in FY 2020 and reflected in Q2 reporting profit compared to last 8 qtrs of losses.

Countries where Tomypak Group products are exported to include Singapore, Thailand, Indonesia, the Philippines, Vietnam, Myanmar, Sri Lanka, Russia, Ukraine, Australia, New Zealand, Papua New Guinea, Brazil, Nigeria, Peru, and South Africa.

Most of the major customers have been partners of Tomypak Group for some time, with some for as long as over 10 years, as Tomypak Group continues to consistently meet clients’ key criterion of consistent quality, timely delivery and competitive commercial terms.

Q2 Report ended June 2020

![]() Financial Strength

Financial Strength

Shareholder's Equity -The Shareholders’ Equity of Tomypak Group as at 30 June 2020 was RM178.8 mil. The net asset per share is about 43 Sen.

Gearing - Total short term and long-term borrowings decreased from RM78.21 million as at the end of FY 2019 to RM71.2 mil as at the end June FY 2020. The Group still has a very low debt equity ratio of only 0.35 times as at 30 Jun FY 2020. The Group continues to generate positive cash flow from operations. For FY 2019, there was a total of RM16.28 million net cash generated from operating activities.

![]() PROSPECTS

PROSPECTS

Whilst the current COVID-19 pandemic continues to affect the general population and business locally and worldwide, the market for food packaging has been encouraging and the Group will continue to leverage on our capabilities.

The Group will continue to intensify sales and marketing efforts to secure more orders from existing customers and secure additional new customers as well as develop new products to improve our competitive advantage. In addition, the Group will also focus on further improvements in operations. The Board is optimistic that the performance of the Group will be positive.

- Operation becomes more efficient with consolidated operation at Senai factory

- Having a long-term relationship with its customers. • higher demand for packed food and beverage due to covid-19 - shift in the food and beverage consumption patterns. Packed food is more hygienic.

- F&B producers,clients of Tomypak, were concerned of the need to ramp up supply and have placed more orders for packaging, up to 6 months order.

- Sufficient capacity to meet the demand, since utilization is 30% plus in 2019.

- Benefit from low oil price and strengthening of MYR

- Intensifying efforts to secure more orders and customers (existing customers).

- Increase of customer base with acquisition of a 51% stake in Melaka-based printing company SP Plastic & Packaging Sdn Bhd. The acquisition is expected to complete by July 2020. Hence, additional revenue might be recognized in coming Q3 result.

Thank you

BursaGemAnalysis Team

Please Join us at Telegram channel - https://t.me/BursaGemAnalysis

Disclaimers:

The views are my own as of this date and subject to change, for educational and informational purposes only. No further distribution is allowed without prior written consent. I make no recommendation, offer or invitation to transact in any securities, futures contracts or other instruments. Please make your independent evaluation, consider your own investment objectives and financial situation, and consult your own professional advisers before participating in any transaction. Shall Anyone here try soliciting business like buy call, mutual fund forex, will be kick out by admin.

Thank you and enjoy investing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|