Malayan Banking - Maybank Indonesia’s 2Q18 Results Below Expectations, Impacted By Weaker NIM And Non-interest Income

UOBKayHian

Publish date: Mon, 30 Jul 2018, 11:41 AM

COMMENT

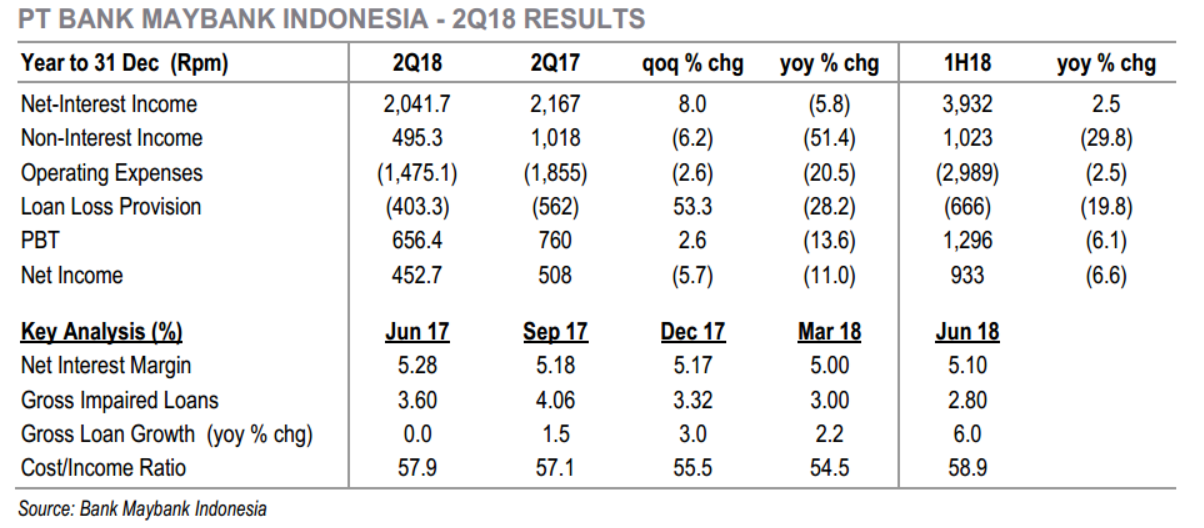

2Q18 earnings below expectations. Maybank’s Indonesian subsidiary, Maybank Indonesia, reported a 2Q18 net profit of Rpb (RM452m), down 11% yoy and 9% below our estimate due to a larger-than-expected NIM compression (-18bp yoy) on upward repricing of deposits and contraction in non-interest income (-51.4% yoy). On the flip side, provisions improved 28.2% yoy on the back of improving asset quality as reflected by gross NPL ratio of 2.8% compared with 3.60% in 2H17. We expect Maybank Indonesia’s 2018 earnings to contribute 6% of our 2018 earnings estimate for Maybank.

Commendable loans growth but consumer loans remains weak. Maybank Indonesia reported 2Q18 loans growth of 6.0% yoy, mainly due to weak consumer loan growth. Global banking loans grew 10.4% yoy, driven by loans from SOEs while Community Financial Services (CFS) non-retail loans, comprising micro, SME and business banking loans, grew 7.3% yoy. Meanwhile, consumer loans rose 1.6% yoy.

Maybank Bhd. Maintain HOLD with an unchanged target price of RM9.50 (10.1% ROE, 1.32x 2018F P/B). Current valuations at 1.20x and forecasted ROE of 10.0% are also generally in line with the sector’s. The attractive dividend yield of 6.2% should provide share price support but upside is limited by potential provision risk from the group’s exposure to project financing to Hyflux Ltd in Singapore. Entry level: RM9.00

Source: UOB Kay Hian Research - 30 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on UOB Kay Hian Research Articles

Created by UOBKayHian | Aug 26, 2022

Created by UOBKayHian | Feb 24, 2022

Created by UOBKayHian | Dec 13, 2021

Created by UOBKayHian | Jul 12, 2021

Created by UOBKayHian | Jan 29, 2020