Uchi hooks investors with strong brew of consistent growth

zaclim

Publish date: Wed, 03 Jan 2024, 11:09 AM

Uchi Technologies Bhd is one of the rare companies which has seen its EBITDA margins going up for the past 10 years or so. Its EBITDA margin was 46% in 2013 and recorded a high of 59% in 2022.

The counter has also been on a rise, up 13.8% year-to-date to close at RM3.71 on Dec 29. It touched a 52-week high of RM3.78 recently versus a low of RM3.14 in January.

Investors are probably happy that the counter has not only appreciated but received good dividend yield of 6.3%, which is expected to increase to 7.6% in the next two years. These positive returns are possible as the company saw good revenue growth fuelled by multiple reasons.

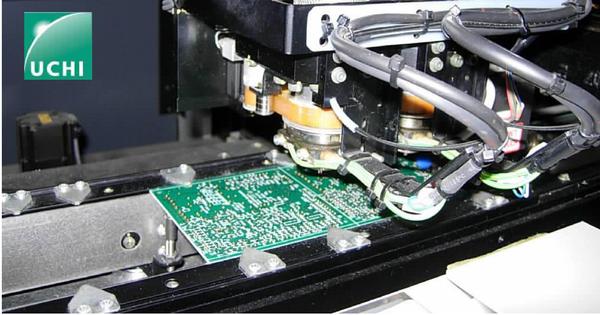

Uchi holds the advantage being a supplier of its coffee module product to its key customer and the strong alliance created has helped build a partnership that allows both parties to grow.

The Penang-based company constantly invests in research & development to improve its design. It is also able to increase its efficiencies having achieved economies of scale via using more common parts.

The margin enhancement is also driven by favourable product mix changes especially with higher end models which see most of the enhancement in product features. The above are mostly within its control - enhance efficiencies through improved processes while better margins via cost efficiencies and product mix. The uncontrollable factor would be the currency movements, which have worked in Uchi’s favour.

It is to be noted that the weakening of the ringgit against the US dollar has resulted in its USD-denominated sales rising by 63%. As long as there is no share appreciation of the ringgit, Uchi margins are expected to stay intact.

Not only that, the company enjoys tax exemption for new products and this will incentivise Uchi to step up the production of new models in order to enjoy its pioneer tax status. It is estimated that only 14% of its products are qualified for tax exemption. It would therefore make sense for Uchi to gradually increase the introduction of new products as older ones reach end of life.

Overall, management maintains its 2023 revenue growth guidance of high single digits in USD terms, implying a relatively firm 4Q23.

Affin Hwang research believes the fully automated coffee machine market is underpenetrated, while its major European customer continues to gain traction in the high end segment. Therefore, investors can clearly see what’s in store for Uchi, which will continue to drive higher market share and growth.

Here are some of the setup based on Weekly Chart:

1. Price moving in uptrend with several healthy pullback

2. Breakout resistance with higher volume. Potential retest to support again

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Apr 29, 2024

The stock price is riding above all EMA lines which are arranged in rosing order and also riding above rounding bottom SMA200 line

Created by zaclim | Apr 29, 2024

Spring Art Holdings Bhd has jumped to a year high of 27 sen recently and succumbed to profit taking. However, it is looking to rise again.

Created by zaclim | Apr 29, 2024

Radiant Globaltech Bhd has been moving higher in recent days, pushing it closer to its year high of 40 sen. Can the counter surpass this level?

Created by zaclim | Apr 25, 2024

The stock price is riding above all EMA lines. This indicates that the stock price is in transiting from accumulation phase into the initial stage of markup phase

Created by zaclim | Apr 25, 2024

RGB International Bhd share price is on an upward movement as investors take note of its latest deal involving product leasing. Can the good run last?

Created by zaclim | Apr 24, 2024

GDB’s stock price has been in an expanding wedge at the last count of 5-wave-pattern rebounded from last week low at RM0.255 where it was supported at EMA30 line

Created by zaclim | Apr 24, 2024

Kimlun Corp Bhd has been trending higher after it bagged projects, pushing its total outstanding orderbook to RM2.4 bil. With more projects in the pipeline, will the counter be able to rise further?

Created by zaclim | Apr 23, 2024

LEESK’s stock price has been on pullback consolidation from previous high at RM1.11 down to as low as RM0.890 in 1 month

Created by zaclim | Apr 23, 2024

PEKAT’s stock price has gone through past 8 months of pullback consolidation stage along the sideway SMA200 line

Created by zaclim | Apr 23, 2024

Malaysia Smelting Corporation Bhd is back on investors’ radar as tin prices continued their upward movement. Will the good run continue?