Stock Analysis – PEKAT (0233) – RM0.520:

zaclim

Publish date: Tue, 23 Apr 2024, 09:19 AM

PEKAT’s stock price has gone through past 8 months of pullback consolidation stage along the sideway SMA200 line and the latest additional 1 month of gradual rebound and finally today the candlestick manages to breakout and stay above previous high above RM0.510 and close at RM0.520.

The stock price finally manages to stay above all short and medium terms’ EMA lines which riding above rising SMA200 line. This indicates that the stock price is finally taking off from its initial stage of markup phase;

If the stock price could stay above RM0.510 for higher high with trending momentum and increasing volume, then let’s monitor for the next possible short-term targets around RM0.550, 0.580, 0.600, 0.620, 0.650, 0.680, and 0.700.

Long term investors may prospect for possible long-term targets to challenge around RM0.720, 0.745, 0.775, 0.800, 0.820, 0.850, 0.880, 0.900, 0.920, 0.950, 0.980, and 1.00;

Should the new higher high beyond RM0.510 be successful, trailing stop with EMA20 or EMA30 line, or if the stock price were to pullback unexpectedly, put the short-term stop loss below RM0.480 or worst case below RM0.460;

The secondary indicators like MACD, DMI and RSI are at good junctures that may biased to lead the stock price for further upside and take off from its initial stage of markup phase;

“XChart’s Trade Signal” has been triggering 4 real times today afternoon as shown above indicating the stock on “CB06: Uptrend Intact and MD01: MACD (>0) crossing up signal line”;

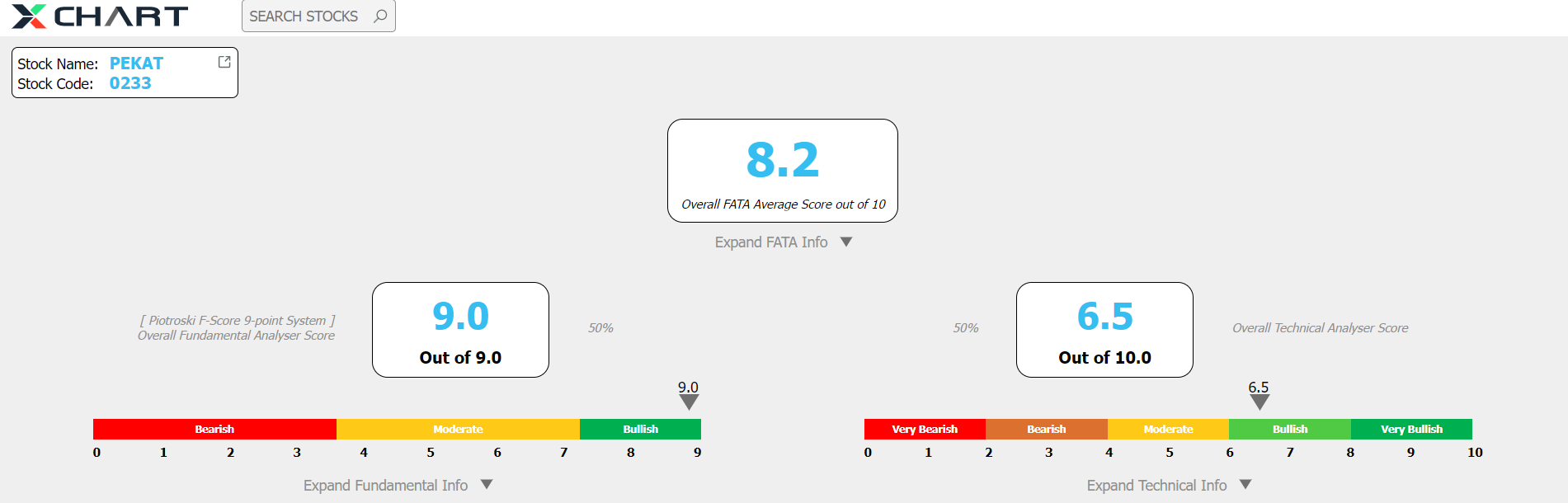

“XChart’s Stock Analyser” as shown above is fundamentally PFS9=9 indicates FA is extremely good, and technically TAS20>55% indicates that the stock price may biased for further upside after taking off the initial stage of its markup phase;

Fundamental:

PEKAT GROUP BERHAD (PEKAT, 0233) is listed under ACE market’s Industrial Products & Services Sector.

Principal Products / Services:

Solar Photovoltaic (PV) systems and power plants, Earthing and Lightning Protection systems, Electrical products and accessories.

Financial ratios:

TTM Q4-Dec-2023: DY%=1.92%, EPSG=9.28%, PER=24.53, ROE=10.02%, NGR=NetCash, DER-ST=0.01, TLER=0.30;

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Dec 18, 2024

RHB Bank Bhd has been inching higher after declining from a high in November. How high can it go?

Created by zaclim | Dec 17, 2024

Aemulus Holdings Bhd has been dragged by news of its loss-making associate in China. Can the company salvage the situation?

Created by zaclim | Dec 16, 2024

Muhibbah Engineering (M) Bhd has not fared well in the just concluded 3Q. However, investors are banking on the counter to rise further.

Created by zaclim | Dec 16, 2024

Karex Bhd has been rapidly expanding its synthetic condom production, with first shipments already dispatched to Europe and plans underway to significantly scale up capacity.

Created by zaclim | Dec 13, 2024

Samaiden Group Bhd has been trending higher after falling to a low of 99.5 sen last month. It is expected to register better earnings supported by solid jobs in hand.

Created by zaclim | Dec 13, 2024

IOI Corporation Bhd is on upward trajectory, albeit a minor one. Things are likely to look positive but its performance hinges an many things

Created by zaclim | Dec 04, 2024

Sealink International Bhd has seen a positive run in its share price after retracing from a high of 42 sen in Aug. With better prospects expected, the counter is likely to move higher.

Created by zaclim | Dec 03, 2024

Ranhill Utilities Bhd has seen its share price trending higher after touching a low of RM1.30 some two weeks ago. WIth higher demand for utilities, will the counter see sustained upside?

Created by zaclim | Dec 02, 2024

Asia File Corporation Bhd has seen better financial numbers in recent years but its main filing products have experienced slower sales.

Created by zaclim | Dec 02, 2024

Leong Hup International Bhd rose to a high of 77.5 sen recently. There are signs of the counter rising further after enjoying improved margins.