Cuscapi on the cusp of a strong upward momentum

zaclim

Publish date: Wed, 28 Aug 2024, 08:48 AM

Cuscapi on the cusp of a strong upward momentum

Share price performance of Cuscapi Bhd has been quite commendable, rising 50% year-to-date to close at 27 sen on Aug 27. Prices also broke out above the downtrend line from the 35 sen high seen in June, supported by a higher trading volume.

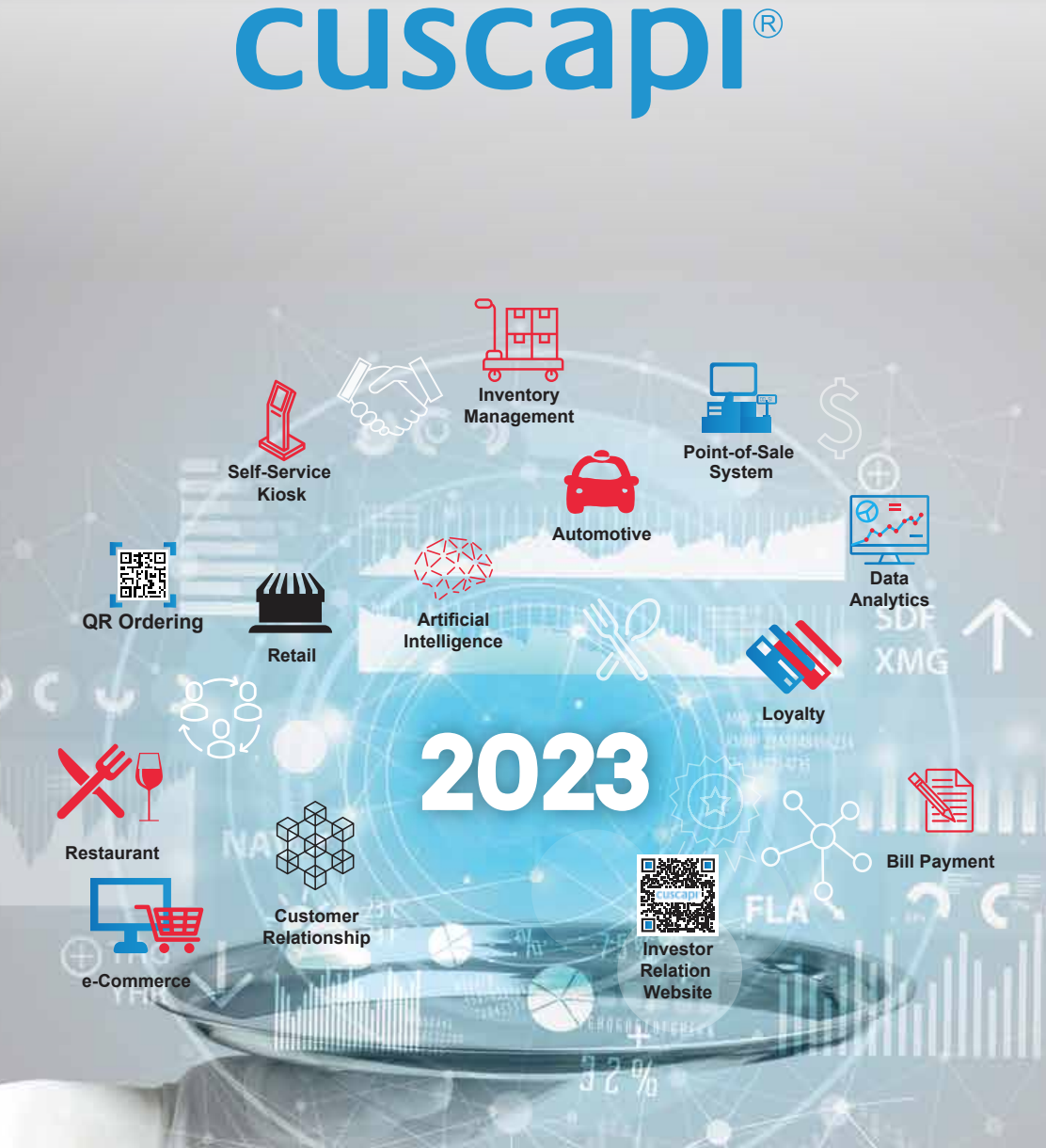

Cuscapi is a provider of point-of-sale systems and also owns the Electronic Dealer Management System (EDMS). EDMS is a web-based application which connects vehicle assemblers, distributors, and dealers with government agencies such as Customs and Road Transport Department.

Investors’ interest in Cuscapi could stem from its blockchain business. The digital business solutions provider said in May that the Securities Commission Malaysia has approved its associate company MX Global Sdn Bhd to facilitate the trading of the Worldcoin (WLD) token on digital asset exchanges.

WLD will now be included on the list of permitted digital assets to be traded along with bitcoin (BTC), bitcoin cash (BCH), Cardano (ADA), among others. In March 2022, MX Global said it had secured an undisclosed equity investment from cryptocurrency exchange Binance, while Cuscapi invested RM9 million to subscribe for its redeemable convertible preference shares.

WLD is an iris biometric cryptocurrency project developed by Tools of Humanity. It encourages people to have their irises scanned by its "orb" devices, in exchange for a digital ID and free WLD tokens.

WLD provide a reliable way to authenticate humans online using World ID, to counter bots and fake virtual identities facilitated by artificial intelligence. More than five million people in 120 countries have signed up, according to WLD's website.

Cuscapi posted revenue of RM 28.4 mil and pre-tax profit of RM 2.16 mil during the current financial period 2023. Higher revenue during the financial period is mainly from the trading of digital assets. The company registered a revenue of RM24.59 million and a profit before taxation of RM8.92 million in current year-to-date.

For the current year quarter, the revenue is recorded at RM17.21 million with a profit before taxation of RM4.83 million. The revenue contribution for the current year to date and the current financial quarter mainly arose from the software sales.

No comparative financial information will be available for the previous year due to the Group changing its financial year-end from 30 June to 31 December

In February, Cuscapi saw the emergence of two new substantial shareholders, after they each acquired over 7% stakes in the point-of-sale systems provider. Datin Seri Lee Lan Moi bought 67.5 million shares, or a 7.14% stake. The block of shares was transacted at 2.5 sen per share, according to Bloomberg, for RM1.69 million. Meanwhile, Jessie Lim also bought 68.2 million shares or a 7.22% stake.

Coincidentally, Hillcove Sdn Bhd sold some 65.7 million shares, or a 6.95% stake, having bought into Cuscapi less than three months back in December 2023.

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jan 21, 2025

It was the boost the energy industry was hoping for as the enhancements to the Corporate Renewable Energy Supply Scheme (CRESS) framework will encourage adoption.

Created by zaclim | Jan 20, 2025

Oil & gas companies are expected to benefit as crude oil prices will increase further following heightened geopolitical tensions

Created by zaclim | Jan 16, 2025

Bursa Malaysia couldn’t have asked for a more terrible start of the week, having turned red in the past 3 days. Is there light at the end of the tunnel?

Created by zaclim | Jan 15, 2025

The new export restrictions on artificial intelligence (AI) chips under a three-tiered system by country have sparked concerns in Malaysia

Created by zaclim | Jan 13, 2025

Supercomnet Technologies Bhd is likely to trend higher having moved sideways recently. The impetus will probably come from its expansion and M&A plans.

Created by zaclim | Jan 13, 2025

It has not been a good year for Swift Haulage having to deal with trade disruptions in 2024. But things are looking brighter for the company as it accelerates its entry in cold-chain segment.

Created by zaclim | Jan 13, 2025

HSS Engineers Bhd has been climbing after some pullback having touched a year high of RM1.38. It appears that now could be a good time to accumulate

Created by zaclim | Jan 09, 2025

Wasco Bhd has been trending upwards in recent days after succumbing to a low of 97 sen in November. The counter touched a high of RM1.60 in June. Could it sustain its climb this time around?

Created by zaclim | Jan 07, 2025

MBM Resources Bhd is on the rise again having touched a high of RM6.84 in December. Is the rally sustainable?

Created by zaclim | Jan 06, 2025

MR DIY Group (M) Bhd is seen to be trading at an undemanding FY26 P/E of 25x, versus 99 Speed Mart Retail Holdings Bhd’s FY25 P/E of 37x. This suggests room for MR DIY to trend higher