Will Asia File see a turnaround to trend higher?

zaclim

Publish date: Mon, 02 Dec 2024, 08:41 AM

Asia File Corporation Bhd is poised for a rebound in share price having closed at RM1.80 on Nov 28.

After posting a 65% surge in net earnings to RM52.1 million in FY Mar 2024, its bottom line declined 36% to RM10.3 million in 1QFY25. According to consensus estimates, Asiafile is expected to report a net profit of RM41.2 million in FY25 and RM43 million in FY26. This translates to prospective PERs of 8.3x and 7.9x, respectively.

The group maintains a debt-free balance sheet and is in a strong financial position. It has cash & investments holdings totalling RM353.2 million or RM1.86 per share, which exceeds its current share price as of end-Jun 2024.

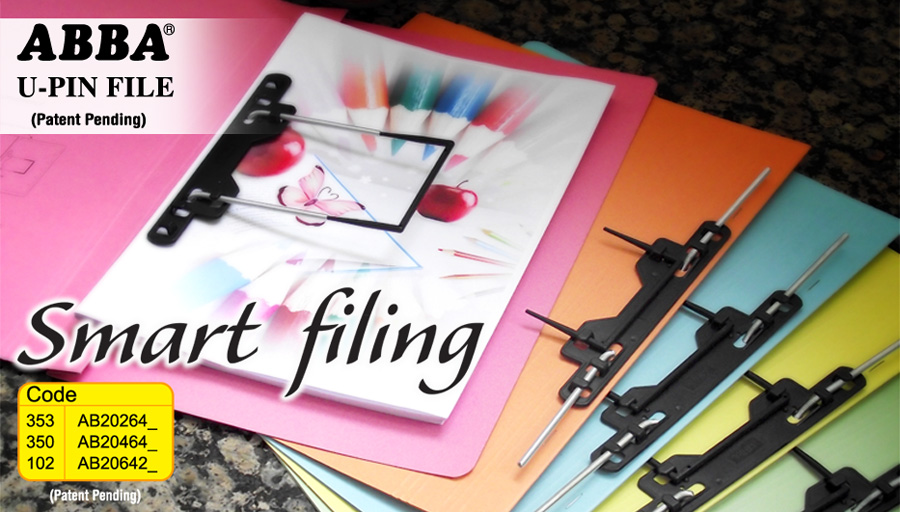

However, things do not look so positive for the company as it plunged into the red with a net loss of RM10.6 million from a net profit of RM6.9 million a year ago. This was on the back of lower revenue of RM68.5 million versus RM79 million. The company saw lower demand for it filing products

Its Consumer & Food Ware division saw an 8% increase in revenue. It reached RM11.82 million, up from RM10.94 million last year driven by strong sales performance on online platforms.

For the six months' period ended 30 September 2024, the company reported total revenue of RM145.68 million as compared to RM154.69 million for the same period last year.

This represents a 5.8% drop in overall revenue. The decline was mainly attributed by weaker sales in the Filing division which saw its revenue decreased from RM133.56 million to RM121.74 million.

The above drop was partially mitigated by improvement in Consumer & Food Ware division where sales rose from RM21.11 million to RM23.93 million during the period.

Profit before tax for the six-month period dropped to RM5.81 million as compared to RM29.23 million recorded in the corresponding period last year.

In addition to lower revenue, Asia File bottom line was negatively impacted by an unfavorable foreign exchange loss of RM16.48 million as compared to foreign exchange gain of RM5.33 million recorded in the corresponding period last year.

The operating margin was further hit by the escalation in costs in sea freight and a higher share of loss from associate company of RM5.82 million, as opposed to RM3.25 million losses shared during the same period last year.

The company had been consistently profitable in the past 5 financial years. Net profit decreased from RM36.9mil in FYMar20 to RM31.6 million in FYMar23, but rebounded to a high of RM52.1 million in FYMar24.

The increase in net profit from FYMar23 was driven by improved margin. Investors can only hope that the company can recover and generate better profits in subsequent quarters.

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Dec 04, 2024

Sealink International Bhd has seen a positive run in its share price after retracing from a high of 42 sen in Aug. With better prospects expected, the counter is likely to move higher.

Created by zaclim | Dec 03, 2024

Ranhill Utilities Bhd has seen its share price trending higher after touching a low of RM1.30 some two weeks ago. WIth higher demand for utilities, will the counter see sustained upside?

Created by zaclim | Dec 02, 2024

Leong Hup International Bhd rose to a high of 77.5 sen recently. There are signs of the counter rising further after enjoying improved margins.

Created by zaclim | Nov 26, 2024

Toyo Ventures Holdings Bhd may not be performing well in the past year, falling some 64%. Can investors look beyond the company’s terminated power plant project?

Created by zaclim | Nov 26, 2024

Infoline Tec Group Bhd has beein gaining momentum, climbing from a low of 79 sen about 3 months ago. With better performance expected, the share price will likely see further upside.

Created by zaclim | Nov 21, 2024

Moving forward, investors are excited on prospects of retailers such as Aeon as it stands to gain from renewed sentiment following the announcement of Budget 2025.

Created by zaclim | Nov 19, 2024

Analysts are also optimistic on Kelington’s margin improvement bolstered by a significant increase in higher-margin UHP projects

Created by zaclim | Nov 18, 2024

PGF Capital Bhd is starting to show a sustained upside after closing at RM2.24 recently. Will the counter be able to surpass its 52-week high of RM2.24?

Created by zaclim | Nov 18, 2024

Unique Fire Holdings Bhd appears to be moving upwards on the back of strong buying signals. How high can it go?