Evergreen Fibreboard BHD (5010)

Jameschng

Publish date: Sun, 22 Nov 2015, 12:54 PM

Evergreen ( 5101)

Company overview

Evergreen Fibreboard Berhad (5101) is a leading worldwide producer of quality engineered wood-based products consisting of Medium Density Fibreboard (MDF) and Particleboard with an annual production exceeding 1.3 million cubic meters. In response to worldwide market demands, Evergreen adopted a vertical integration strategy and expanded beyond its core Medium Density Fibreboard and Particleboard into value-added downstream products such as Paper, Veneer, Printed, Melamine Board Laminations, RTA Furniture, Sawn Rubberwood Timber, Biomass Wood Pallets and move up stream producing Resin and having our own Rubber Trees Plantation. Evergreen's comprehensive range of upstream & downstream products has set the trend around the world.

Why Evergreen ?

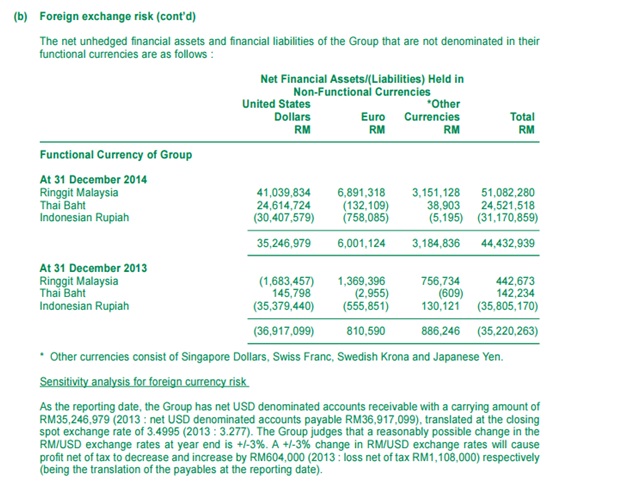

- The continued appreciate in US dollar (US$) is positive for Evergreen’s earnings, as 70% of its total revenue is denominated in US$ whilst only 25-30% of its production cost is denominated in US$. Currency movement aside, we understand the prices of key inputs (including rubber log wood, urea and methanol) are moving in favour of Evergreen’s earnings.

- Management remains committed to further enhance its earnings performance by improving its overall production efficiency and diversifying its product range to the downstream segment (which has better profit margin and less susceptible to price competition).

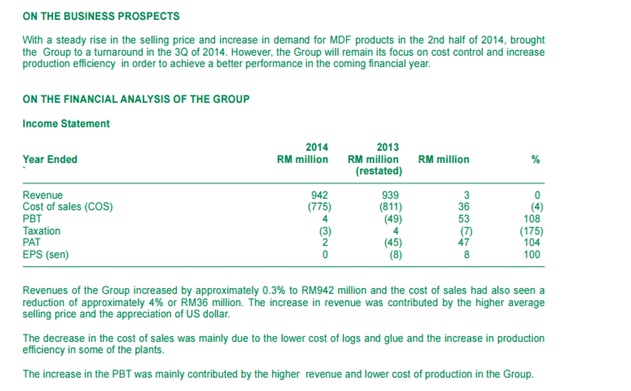

Prospects in Annual Report 2014

The sentivisty USD to evergreen’s profit after tax

Benefit from appreciation of USD dollar

As the company’s revenue is denominated in US$, hence the company will benefit from appreciation of ringgit.

Rate on 30/9/2015 USD1=RM4.3955

Rate on 30/9/2014 USD1=RM3.2805

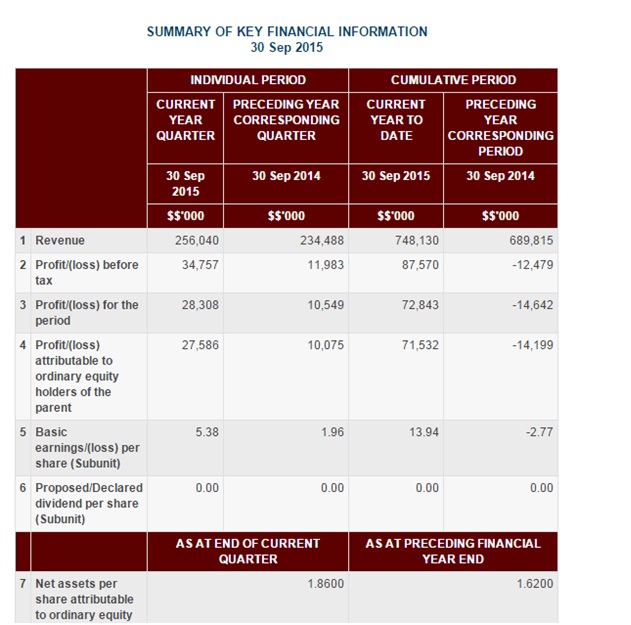

Improvement in recent 3 quarter

For the recent 3 quarter, the company have constantly improvement in earning compare to previous year

|

Date |

EPS (sen) |

Date |

EPS (sen) |

|

31/3/2014 |

-0.50 |

31/3/2015 |

3.91 |

|

30/6/2014 |

-4.23 |

30/6/2015 |

4.66 |

|

30/9/2014 |

1.96 |

30/9/2015 |

5.38 |

The company just annouced the recent 3rd quarter result. The company acheieved Profit before tax for the current quarter increased by 190.2% or RM22.78 million to RM34.76 million compared to a profit before tax of RM11.98 million recorded in the corresponding quarter of the preceding year. The increase in profit was mainly contributed by the lower cost of glue, higher operational efficiency and synergistic cost savings derived from the group's recent restructuring of certain operational facilities.

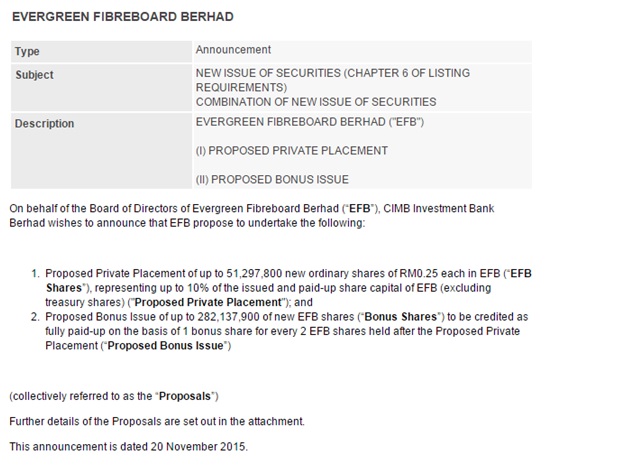

After annouced the recent 3rd quarter report, company decide to proposed private placement and bonus issue.

Conclusion

- Company is benefit from strong US$ and low oil price

- Healthy balance sheet

- Gradual global recovery in the demand for MDF products in a more stablized global market conditions

- The company announced the company through its wholly owned subsidiary Siam Fibreboard Co., Ltd. had on the 07th July 2015 obtained an Operating License for the Incorporation of its wholly-owned subsidiary, Siam Furniture Company Limited (Shanghai) (“SFS”) in Shanghai, Republic Of China.

- Proposed Private Placement & bonus issue.

Short term TP : RM 2.80

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

BearbearDrop

Need to open a new account to make this blog?

How to trust a guy who has zero post counts

2015-11-22 13:58