Why We Think This Construction Stock will FLY Next!!

Nixion585

Publish date: Sat, 08 Jun 2024, 01:40 PM

Since the beginning of the year, the Bursa Malaysia Construction Sector has been delivering stellar performance, with a total return of close to 30.0%, significantly outperforming many actively managed funds.

Now, what are the “invisible factors” driving this remarkable upside for the construction sector? To understand this, we need to take a deeper look at the development and construction outlook in Malaysia.

Here are some statistics for your reference:-

The property development and construction sectors in Malaysia showed significant resilience and growth in 2023. The real estate construction activities expanded by 0.8%, driven by higher demand for properties despite rising interest rates and global uncertainties. The total value of real estate construction activities reached RM24.45 billion, up from RM24.24 billion in 2022, with the residential building subsector performing notably well.

The construction industry also saw robust growth, expanding by 6.3% to RM56.69 billion in 2023. This growth was fueled by progress in multi-year civil engineering projects, special trade work, and a recovery in the residential building subsector.

The Malaysian government’s supportive policies, including significant development expenditure and housing project allocations in the 2nd Belanjawan MADANI, are set to drive further growth. The industry is projected to expand by 6.8% in 2024, reaching RM60.49 billion, with broad-based growth across all subsectors. The forecast for 2028 predicts a total value of RM73.68 billion, bolstered by ongoing and new infrastructure projects, improved housing demand, and the implementation of the New Industrial Master Plan 2030.

In summary, Malaysia’s property development and construction sectors are poised for continued growth, supported by favourable government policies, economic expansion, and strong private sector participation. The projected compound annual growth rates for real estate construction and the construction industry stand at 4.5% and 5.3% respectively from 2024 to 2028, signalling a positive outlook for the sectors.

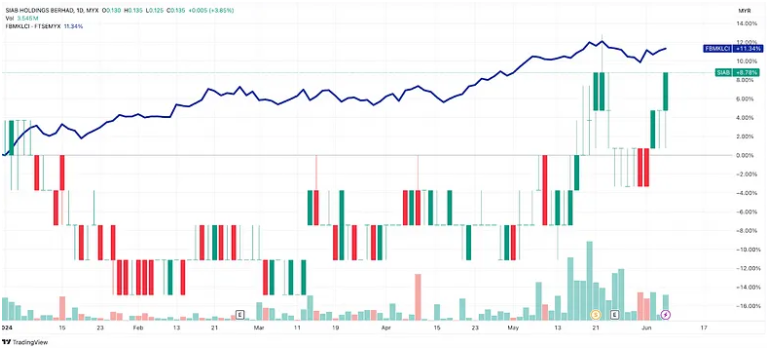

With all these prospects ahead, we see that most construction-related companies have already increased in share price. But one stock, in particular, is considered a huge laggard in the stock market, and that company is Siab Holdings Berhad.

Siab Holdings is a construction company with exposure to residential and non-residential projects, and the company is currently going through a major corporate exercise — a rights issue with free warrants.

For every 10 existing shares held, shareholders are entitled to 13 rights shares and 1 free warrant for every 2 rights shares subscribed. This means if you own 1,000 shares, you can subscribe to 1,300 rights shares and receive 650 free warrants.

Siab Holdings aims to raise approximately RM91.98 million through this rights issue. The funds will be utilised primarily for the acquisition of Taghill Projects Sdn. Bhd., which will cost RM84 million, with the remaining RM3.67 million allocated for working capital, and RM4.31 million for estimated expenses related to the proposals.

Why is Taghill important?

Taghill brings a significant advantage with its profit guarantee and robust order book. The acquisition includes a profit guarantee ensuring Siab Holdings a minimum profit of RM24 million over the next two years, which reduces investment risk. Taghill’s current order book stands at RM1.31 billion, providing strong revenue visibility for the coming years.

Over the years, Taghill has successfully completed several notable projects, including:

- Alaia @ Titiwangsa, Kuala Lumpur / Black Lotus Development Sdn. Bhd. (RM131.1 million)

- Fiddlewoodz P3 @ KL Metropolis / Ivory Interpoint Sdn. Bhd. (RM317.5 million)

- Macalisterz @ Georgetown, Penang / Exsim Macalisted Sdn. Bhd. (RM95.0 million)

- Skyline KL @ Jalan San Peng, Kuala Lumpur / LTS Skyline Sdn. Bhd. (RM425.0 million)

- D’Velada @ Bukit Jalil, Kuala Lumpur / Binastra Builders Sdn. Bhd. (RM150.0 million)

- The Cove @ Melaka / KEB Utama Sdn. Bhd. (RM317.5 million)

- The Stallionz P2 @ Ipoh White Times Square / Exsim Caldwell (Ipoh) Sdn. Bhd. (RM104.6 million)

- Noordinz Suites @ Georgetown / Exsim Noordin Sdn. Bhd. (RM19.4 million)

By investing and subscribing to Siab’s rights issue, investors are poised to benefit from the company’s strategic growth plans, robust project pipeline, and the synergy brought by the acquisition of Taghill. This positions Siab Holdings Berhad as an interesting investment opportunity in the thriving construction sector.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|