Mplus Market Pulse - 27 Jan 2025

MalaccaSecurities

Publish date: Mon, 27 Jan 2025, 10:07 AM

Bargain Hunting May Be Seen In YTL Stocks

Market Review

Malaysia: While the regional sentiment improved, the FBMKLCI (-0.22%) closed lower, erasing gains in Telco & Media (+0.46%) as strong sell-offs in YTL-related counters, after the Group plans to issue 1-for-5 non-tradable warrants, dragged down sentiment on the local front.

Global markets: Wall Street closed lower as investors traded cautiously ahead of the FOMC meeting, which will dictate the rate cut path, as well as the major corporate earnings set to be released. Meanwhile, the European market closed lower while Asean market edged higher.

The Day Ahead

The local bourse closed lower, dragged down by sell-offs in YTL-related counters following the issuance of a 1-for-5 non-tradable warrant, which is seen as an inflexible corporate exercise. In the US, Wall Street closed lower ahead of the FOMC meeting, which is expected to provide clarity on the direction of future rate cuts. Traders will closely monitor key economic data, including (i) US economic growth, (ii) unemployment claims, and (iii) the core PCE index. In the commodities market, Brent crude oil remained below USD80, while gold prices closed higher, surpassing the USD2,750. CPO prices traded flat around RM4,200.

Sector Focus: With the proposition of issuing bonus warrants for YTL-related counters, where the exercise price is set at RM2.45 for YTLPOWR, we believe bargain-hunting opportunities will emerge if there is further retracement. Meanwhile, with the recent announcement from the Ministry of Communication, we believe that the 67 identified industrial areas set to be equipped with 5G facilities will benefit companies involved in underground utilities work, at least in the mid-term. Also, we are positive on the ongoing NETR and LSS projects, coupled with the data center boom, which are expected to drive higher electricity demand in the RE segment.

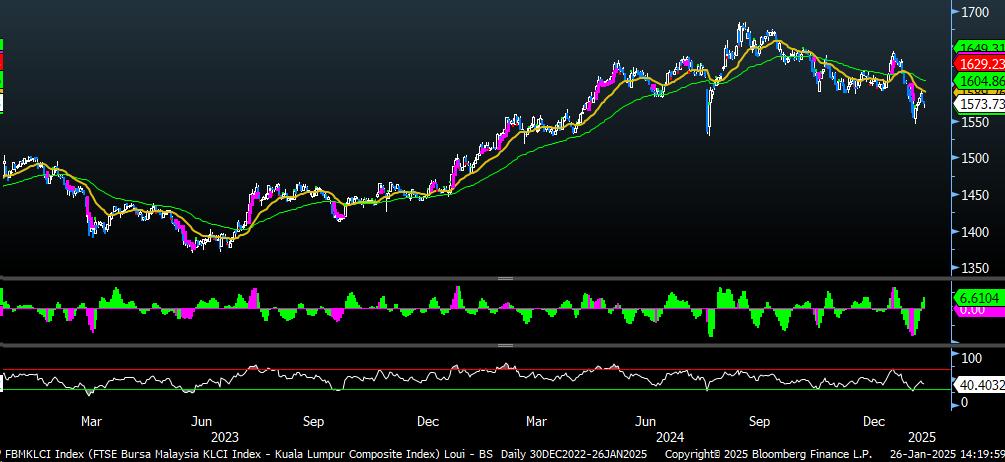

FBMKLCI Technical Outlook

The index retraced after hitting the MA20. However, the technical indicators are showing recovery signs, with RSI rebounded off the oversold zone, while MACD Histogram close expanded above the positive territory. Resistance is anticipated around 1,588-1,593, while support is set at 1,553-1,558.

Company Briefs

A consortium led by Khazanah Nasional Bhd has received valid acceptances of 1.548bn shares or 92.82% of the total number of issued shares in Malaysia Airports Holdings Bhd (AIRPORT) on its conditional voluntary offer for shares of the airport operator, better known as MAHB. The latest acceptance level was at 5pm on Jan 24. Besides Khazanah, the consortium, dubbed Gateway Development Alliance (GDA), also comprises the Employees Provident Fund, Abu Dhabi Investment Authority (ADIA) and Global Infrastructure Partners. Despite surpassing the acceptance level, GDA will only determine if the offer has become unconditional on Jan 28 after 5pm, AmInvestment Bank said on behalf of the consortium. The offer will remain open for acceptance until 5pm on Feb 4. The original deadline was on Jan 8, under the takeover launched in May last year. (The Edge)

Separately, MAHB managing director Datuk Mohd Izani Ghani told reporters that the automated people mover system (aerotrain) at the Kuala Lumpur International Airport (KLIA) is now targeted to resume operations by the second quarter of 2025, subject to the testing and commission progress. The RM456m project has faced several delays, with the previous targeted operational date being Jan 31 this year. (The Edge)

A joint venture between Gamuda Bhd (GAMUDA) and Ferrovial (GFJV) has inked an early contractor involvement (ECI) agreement with Capricornia Energy Hub (CEH) for a hydroelectric storage project in Queensland, Australia. CEH is backed by Copenhagen Infrastructure Partners, one of the world's largest clean energy investors. Under the five-month ECI deal, whose contract value was not disclosed, Gamuda said that its JV will develop an engineering, procurement and construction framework for delivering the project, named Capricornia Pumped Hydroelectric Storage. (The Edge)

Malaysian Resources Corp Bhd (MRCB) is partnering with Melaka Corp to develop a hospital on a parcel of land in Melaka Tengah that will have an estimated gross development cost of RM520m. Its wholly owned unit MRCB Land Sdn Bhd has entered into a joint venture (JV) and shareholders' agreement with Melaka Corp's subsidiary PM Multilink Sdn Bhd to form a JV company to undertake the project. MRCB Land and PM Multilink's JV company - Majestic Quest Sdn Bhd - will be formed on a 70:30 basis. The project, which is located in the Bukit Baru district in Melaka, will later be leased to Putra Specialist Hospital (Melaka) Sdn Bhd. (The Edge)

Packaging manufacturer and developer Scientex Bhd (SCIENTX) is acquiring 528.49 acres of land in Paya Rumput, Melaka for RM333.8m cash (RM14.50 per sq ft) from Genting Plantations Bhd (GENP). Scientex via its indirect wholly owned subsidiary Scientex Heights Sdn Bhd entered into two conditional sale and purchase agreements with Genting Plantations' subsidiaries, namely Genting Plantations (WM) Sdn Bhd (GPWM) and Genting Property Sdn Bhd (GPSB) to purchase the land. Scientex said the acquisition will boost its existing landbank, which aligns with the company's goal to build more affordable homes. The company is targeting to complete 50,000 affordable homes nationwide by 2028. (The Edge)

TMC Life Sciences Bhd (TMCLIFE) warned that it expects to report a loss for the second quarter ended Dec 31, 2024 (2QFY2025), compared to the net profit recorded in the same period last year. The company attributed the anticipated loss primarily to "termination and discount of customer contracts. In light of this, TMC Life Sciences advised shareholders and potential investors to exercise caution when trading in the company's shares. (The Edge)

After spending RM719.4m to acquire eight new assets in 2024, Axis Real Estate Investment Trust (Axis REIT) (AXREIT) said it will continue to aggressively source potential acquisition targets, particularly industrial properties. During an investors' briefing, Axis REIT Managers Bhd chief executive officer and executive director Leong Kit May shared that the REIT is currently in closed talks with potential acquisition targets valued at RM300m with heavy inclination towards industrial. Those deals are likely to be finalised in the next two months. (The Edge)

AmanahRaya Real Estate Investment Trust (AmanahRaya REIT) has terminated its plan to sell the Contraves building in Cyberjaya due to a failed condition precedent, but is simultaneously pursuing the acquisition of a sustainable asset to boost its distribution per unit (DPU). The purchaser, 4X Software Sdn Bhd, was unable to fulfill the stipulated condition precedent within the agreed timeline, which ended on Dec 26, 2024, according to AmanahRaya Kenedix REIT Manager Sdn Bhd, the REIT's manager. While it did not stipulate what the condition was, the REIT had previously said the sale of the property, for RM42.5m cash, had to obtain the approval of the Economic Planning Unit. (The Edge)

Taghill Holdings Bhd (TAGHILL), formerly known as Siab Holdings Bhd, has secured a RM152m construction job in Kuantan, Pahang. Its wholly owned subsidiary, Taghill Projects Sdn Bhd (TPSB), accepted the letter of award (LOA) from Kuantan Waterfront Resort City Sdn Bhd (KWR) for the proposed development of a commercial strata scheme. The project includes four business blocks, one serviced apartment block, and a six-level podium parking structure with residential facilities. (The Edge)

Building materials and construction engineering firm Chin Hin Group Bhd (CHINHIN) has proposed to acquire an additional 37.38m shares or a 12.27% stake in metal roofing and safety glass maker Ajiya Bhd (AJIYA) for RM54.2m or RM1.45 per share. Upon completion, the shares purchase will effectively raise Chin Hin's stake in Ajiya to 66.36% from 54.09%. The purchase price of RM1.45 was agreed upon on a willing- buyer, willing-seller basis, which is 9.9% lower than Ajiya's closing price of RM1.61 on Friday. (The Edge)

Building and infrastructure construction services provider TCS Group Holdings Bhd (TCS) saw the emergence of a new substantial shareholder. James Liew Vun Tak acquired an 11.9% stake, equivalent to 71.5m shares, through a direct business transaction on Friday. The shares were purchased from TCS' managing director and largest shareholder, Datuk Tee Chai Seng, at 16 sen per share, amounting to RM11.44m. Following the sale, Tee's direct stake in TCS was reduced to 36.31%. He also has an indirect stake of 8.47% in the company, held via his spouse, Datin Koh Ah Nee. (The Edge)

Source: PublicInvest Research - 27 Jan 2025

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-28

YTLPOWR2025-01-27

AIRPORT2025-01-27

AIRPORT2025-01-27

AIRPORT2025-01-27

AIRPORT2025-01-27

AIRPORT2025-01-27

AJIYA2025-01-27

AJIYA2025-01-27

ARREIT2025-01-27

ARREIT2025-01-27

ARREIT2025-01-27

ARREIT2025-01-27

AXREIT2025-01-27

CHINHIN2025-01-27

CHINHIN2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GENP2025-01-27

GENP2025-01-27

GENP2025-01-27

GENP2025-01-27

GENP2025-01-27

GENP2025-01-27

MRCB2025-01-27

MRCB2025-01-27

MRCB2025-01-27

SCIENTX2025-01-27

SCIENTX2025-01-27

SCIENTX2025-01-27

SCIENTX2025-01-27

TAGHILL2025-01-27

TAGHILL2025-01-27

TAGHILL2025-01-27

TCS2025-01-27

TCS2025-01-27

TMCLIFE2025-01-27

TMCLIFE2025-01-27

YTL2025-01-27

YTL2025-01-27

YTL2025-01-27

YTL2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-24

AIRPORT2025-01-24

AIRPORT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

AXREIT2025-01-24

GAMUDA2025-01-24

GAMUDA2025-01-24

GAMUDA2025-01-24

GAMUDA2025-01-24

MRCB2025-01-24

MRCB2025-01-24

MRCB2025-01-24

MRCB2025-01-24

MRCB2025-01-24

MRCB2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

SCIENTX2025-01-24

TCS2025-01-24

TCS2025-01-24

TCS2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-23

AXREIT2025-01-23

GAMUDA2025-01-23

GAMUDA2025-01-23

GAMUDA2025-01-23

GAMUDA2025-01-23

GAMUDA2025-01-23

MRCB2025-01-23

YTL2025-01-23

YTLPOWR2025-01-22

AIRPORT2025-01-22

AIRPORT2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

GAMUDA2025-01-22

MRCB2025-01-22

MRCB2025-01-22

MRCB2025-01-22

MRCB2025-01-22

TAGHILL2025-01-22

TAGHILL2025-01-22

TAGHILL2025-01-22

YTL2025-01-22

YTL2025-01-22

YTL2025-01-22

YTL2025-01-22

YTLPOWR2025-01-22

YTLPOWR2025-01-22

YTLPOWR2025-01-21

AIRPORT2025-01-21

AIRPORT2025-01-21

AIRPORT2025-01-21

AIRPORT2025-01-21

CHINHIN2025-01-21

CHINHIN2025-01-21

CHINHIN2025-01-21

CHINHIN2025-01-21

CHINHIN2025-01-21

CHINHIN2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GAMUDA2025-01-21

GENP2025-01-21

MRCB2025-01-21

MRCB2025-01-21

MRCB2025-01-21

YTLPOWR2025-01-21

YTLPOWR2025-01-20

AIRPORT2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

GAMUDA2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

YTL2025-01-20

YTL2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GAMUDA2025-01-17

GENP2025-01-17

TCS2025-01-17

YTL2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWRMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 24, 2025