FCPO Updates

12 Dec - FCPO followed Head & Shoulder Bearish Signal

InvestorsDoctor

Publish date: Tue, 12 Dec 2017, 10:14 AM

12/12/2017

FCPO Feb 18

Previous Close: 2459 -18

FCPO Feb 18 contract near active month change, traders may choose to trade Mar 18. FCPO recorded a 6 straight day of losses as market expect bearish inventory & export data, despite that Sppoma data show decrease in production. Today watch out for MPOB result by noon. Dalian palm olein +0.48% this morning, while US soyoil rebound to around 33.50, FCPO later may test rebound 1st.

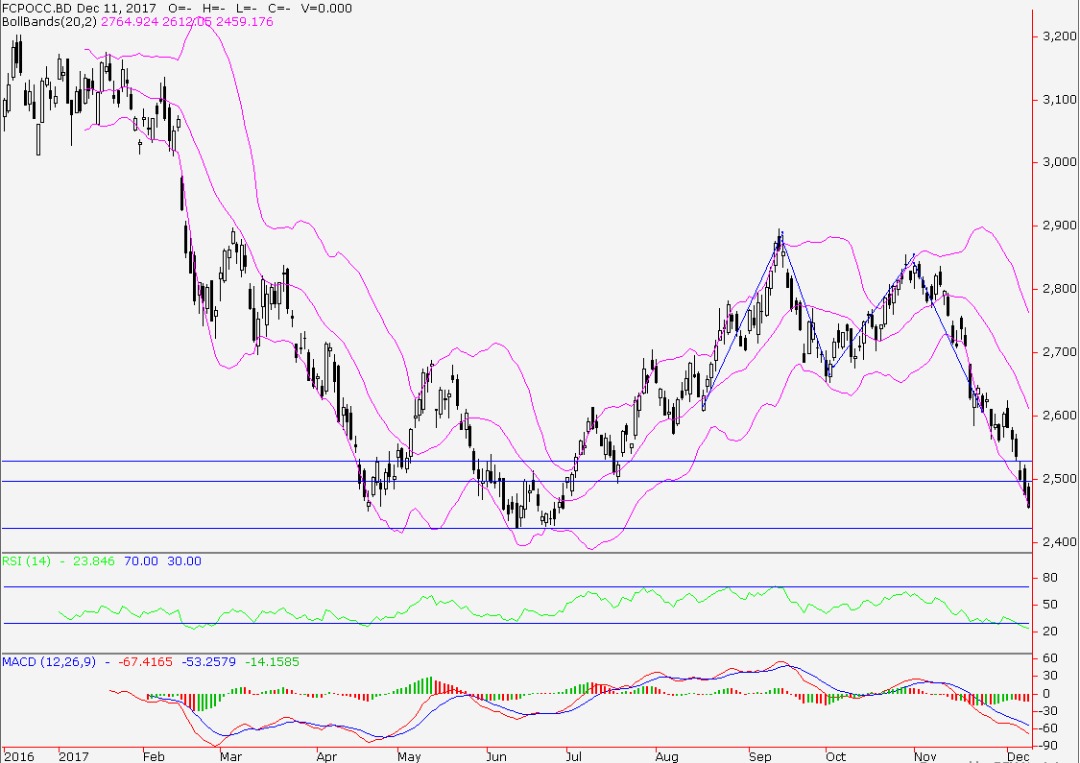

Daily chart show another lower low & high, extend its downside since triggered double top follow by hourly chart head & shoulder bearish signal. Be cautious of potential technical rebound as daily RSI in oversold and uncertainty over MPOB result.

Price Level to monitor today:

Resistance: 2497 2530

Support: 2424 2400

Recommend Trading Plan for the day:

1. Buy 2464 or below for a rebound, stop 2454, profit 10pts or above.

2. Sell lower low 2454, stop 2464, profit 10pts or above.

FCPO Margin Requirement

Intraday MYR 2250

Overnight MYR 4500

Spread MYR 1000

Disclaimer: Idea for sharing purpose, trade at your own risk.

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments