HLBank Research Highlights

Momentum Idea: Steeply oversold - PLABS (RM0.255/Vol:350k)

HLInvest

Publish date: Mon, 15 Feb 2016, 12:15 PM

- Listed in July 2011, PLABS is one of the leading specialists in manufacturing, distribution and trading of animal health and nutrition products. Its products include animal feed additives, environment maintenance products, veterinary pharmaceuticals, biologicals, anthelmintic, antimicrobial, disinfectant, injectable products, mold inhibitor and toxin binder, multi -nutrient and supplement, complete feed premix, pre-probiotic / enzyme / acidifier, topical dressings and cleansing agents. The group is Good Manufacturing Practices (GMP) compliant for its premises and manufacturing facilities.

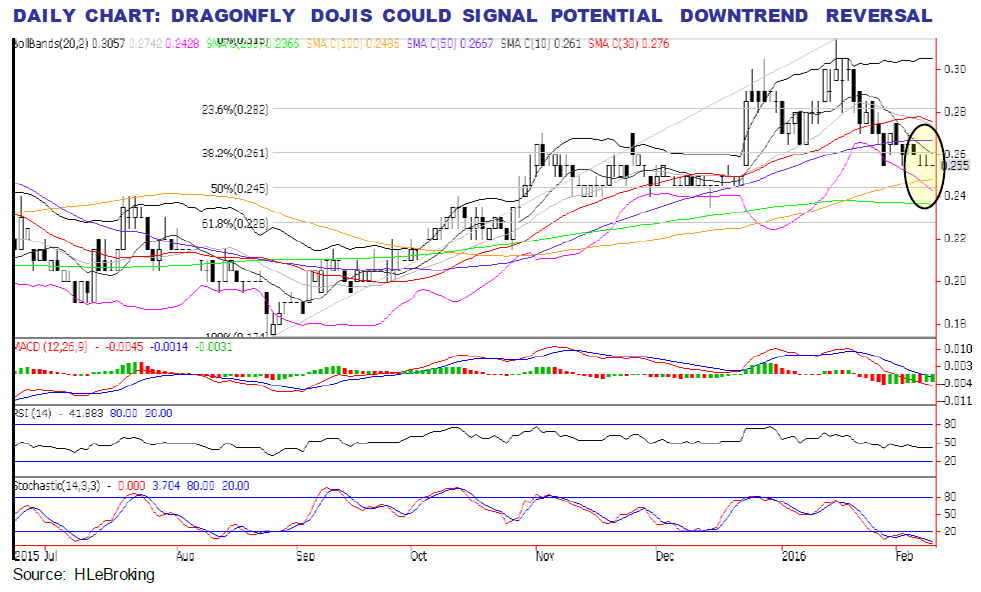

- Likely to bottom up. PLABS share prices had retreated 19% from YTD high of RM0.315 on 15 Jan to end at RM0.255 on 12 Feb. We see limited downside risks and potential reversal to upside, underpinned by the form ation of ‘Dragon Fly’ dojis and steeply oversold slow stochastic indicator.

- A decisive breach above immediate resistance of RM0.265 (50-d SMA) is likely to spur prices higher towards RM0.28 (23.6% FR) before reaching our long term objective of RM0.315. Key supports are situated at RM0.245 (50% FR) and RM0.235 (200-d SMA). Cut loss at RM0.225.

- Positives risk to reward ratio with 23.5% upside against 11.5% downside. All in, we see a favourable risk to reward ratio for investor with a theoretical entry price of RM0.255 given that the downside to the cut loss zone of RM0.225 is 3 sen (- 11.5%) while the upside to the LT target of RM0.315 is 6 sen (+23.5%).

Source: Hong Leong Investment Bank Research - 15 Feb 2016

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments