HLBank Research Highlights

Trading Idea: GAMUDA – Opportunities amidst uncertainties; Potential technical rebound after sharp fall

HLInvest

Publish date: Wed, 08 Nov 2017, 09:30 AM

- Gamuda’s share price plunged 5% amid speculation of new MRT3 structure. Gamuda’s share price plunged as much as 34 sen to a low of RM4.73 yesterday before narrowing the losses to 26 sen or 5.1% at RM4.81. The rout was attributed to reports that MRT Corp is opening a tender to select a turnkey contractor to build and finance the upcoming MRT3 (estimated RM35-40bn), triggering speculation that the MRT3 will no longer employ the project delivery partner (PDP) model. This could dampen Gamuda management’s earlier guidance of RM10bn in project tenders each in 2018 and 2019, in the event that it falls short of prevailing quantities or project margins if the new structure is deployed. To recap, both the MRT1 (completed) and MRT2 (ongoing) applied the PDP concept with the MMC-Gamuda JV helming the role.

- Opportunity for risk-takers as negatives priced in? Despite the uncertainty, HLIB institutional research maintains a BUY rating for Gamuda with unchanged TP of RM6.36, as Management reassured that it will still bid for the underground works from the winning consortium, given its tunnelling track record with SMART, MRT1 and MRT2 which will render it in a prime position to secure such works for MRT3. Management also maintains its RM10bn orderbook replenishment guidance over the next 2 years which includes jobs such as the MRT3 and ECRL. Overall, we expect robust job flows for 2018, driven by the rollout of mega rail projects such as the ECRL, MRT3 and HSR. To illustrate, job wins hit a high of RM28bn in 2012 and RM56bn in 2016 when the MRT1 and MRT2 were rolled out.

- At RM4.81, Gamuda is trading at 14.7x FY18 P/E (18% below its average 10-year average P/E of 18x and 16% lower than its peers 17.6x). In terms of P/B, the stock is trading at 1.58x (17% below its average 10-year 1.9x and 37% lower than its peers 2.51x). We believe such valuations and yesterday’s unwarranted selldown could have priced in most of the negatives, providing sufficient margin of safety to cushion further slide in share prices.

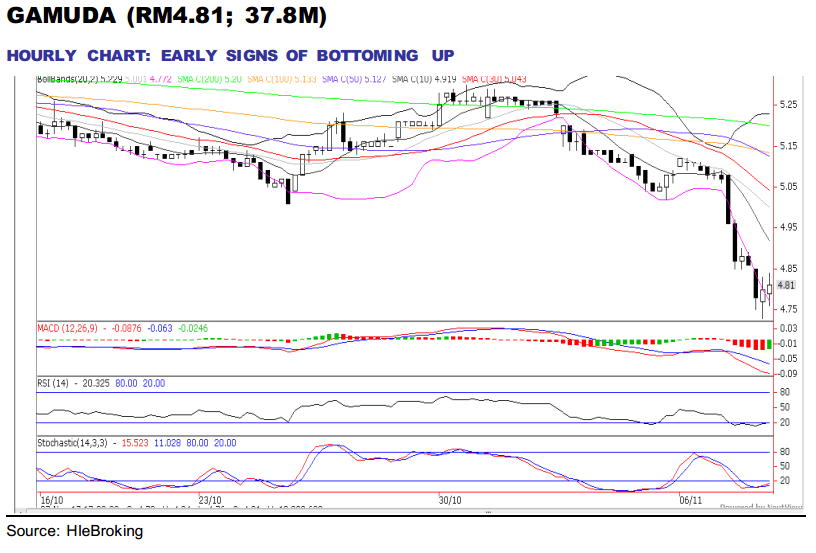

- Poised for a relief rally after recent selling climax. There are some signs of potential technical rebound soon as hourly technical indicators are bottoming up. Moreover, yesterday’s huge transaction of 37.8m shares, which was 5.6x higher than 1M average of 6.7m shares, could be selling climax since it happened near bottom.

- A decisive breakout above the immediate resistance of RM4.91 (10-h SMA) will likely lift share prices higher towards RM5.04 (30h SMA) and our LT objective at RM5.33 (100-d SMA). On the flip side, we believe the supports of RM4.73 and RM4.65 (50% FR), which are lower than the neckline bearish breakdown objective of RM4.80 should cushion further selling pressures. However, failure to hold near RM4.65 levels may weaken share prices lower towards RM 4.43 (61.8% FR). Cut loss at RM4.60.

Source: Hong Leong Investment Bank Research - 8 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-11

GAMUDA2024-11-11

GAMUDA2024-11-11

GAMUDA2024-11-11

GAMUDA2024-11-08

GAMUDA2024-11-08

GAMUDA2024-11-08

GAMUDA2024-11-08

GAMUDA2024-11-08

GAMUDA2024-11-08

GAMUDA2024-11-07

GAMUDA2024-11-07

GAMUDA2024-11-07

GAMUDA2024-11-07

GAMUDA2024-11-07

GAMUDA2024-11-07

GAMUDA2024-11-06

GAMUDA2024-11-06

GAMUDA2024-11-06

GAMUDA2024-11-06

GAMUDA2024-11-06

GAMUDA2024-11-06

GAMUDA2024-11-05

GAMUDA2024-11-05

GAMUDA2024-11-05

GAMUDA2024-11-05

GAMUDA2024-11-05

GAMUDAMore articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments