Traders Brief - Cautiously Optimistic Ahead of GE14

HLInvest

Publish date: Wed, 02 May 2018, 09:41 AM

MARKET REVIEW

Asian stock markets traded lightly higher despite a weaker close on Wall Street and most of the bourses were closed for the Labour day public holiday. Meanwhile, Australia ASX and Japan Nikkei 225 gained 0.54% and 0.18%, respectively led by financials and energy stocks.

Monday’s trading activities were tepid amid the shortened trading week. The FBM KLCI rose 0.37%, accompanied by softer overall trading volumes of 1.71bn (below 100-day average volumes of 2.88bn). On the broader market, market breadth was rather neutral with decliners led advancers by a ratio of 411-to-401. Selected construction stocks such as George Kent and Sunway Construction were actively traded higher.

Wall Street started on a negative trade, but managed to recoup part of their losses amid positive comments by Trump’s administration on trade with China and Mexican economy minister on the renegotiation on the North America Free Trade Agreement. The S&P500 and Nasdaq rose 0.25% and 0.91%, while the Dow slipped 0.27%.

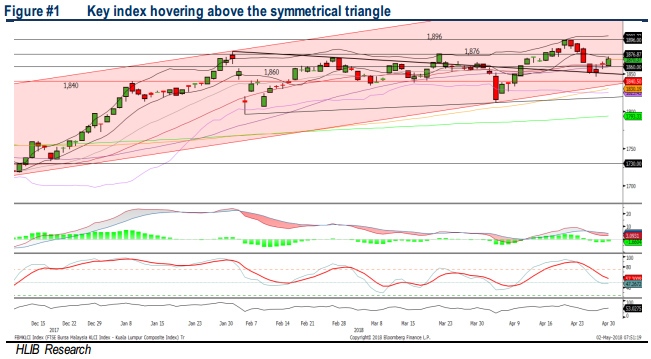

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded off the SMA50 level, forming a bullish engulfing bar. The MACD Histogram has turned green, while the RSI and Stochastics are hovering above 50; suggesting that the upward movement is intact. The key index may retest the resistance near 1,880-1,890 amid positive technicals. Meanwhile, support will be located around 1,840-1,850.

Despite the Positive KLCI Technicals, We Think Sentiment on the Local Bourse Could Stay Cautious Ahead of the Long Anticipated GE14, Which the Outcome of the Event May Provide Volatility to the Stock Markets. At This Current Juncture, We Think Investors May Look Into Defensive (consumer and REITs) as Well as Severely Oversold Stocks for Short Term Trading Purposes.

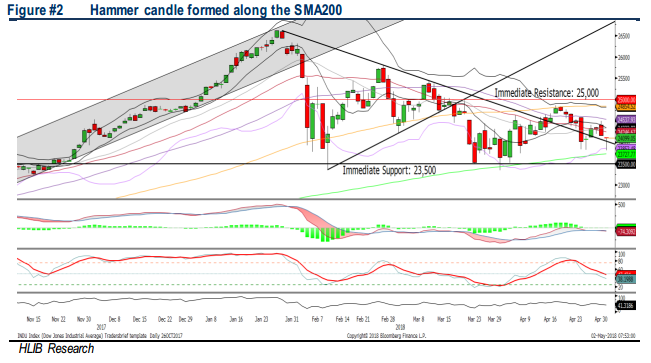

TECHNICAL OUTLOOK: DOW JONES

The Dow revisited the downward trendline, forming a hammer candle along the SMA200 level near the 23,727 level. The MACD Indicator is hovering below zero, while both the momentum oscillators are pointing lower. We think the Dow may stay sideways over the near term with the resistance envisaged around 24,500 and the support will be pegged around 23,500.

In the US, With the Easing Korean Peninsular Tension, Coupled With the Firmer-than-expected Earnings Season, It May Provide Stability for the Near Term. Nevertheless, Should There be Any Trade Talks Between the US-China, It May Extend the Near Term Weakness of the Dow Towards 23,000-23,500.

Strong Earnings Growth; Pending a Downtrend Line Breakout. BIOHLDG’s one-stop business model continues to give a competitive edge over its peers. Strong earnings growth of 49% CAGR for FY17-20 with cheap FY19 P/E at 7.9x and sound balance sheet (2.6sen netcash or 12% of share price). Pending a downtrend line breakout.

Source: Hong Leong Investment Bank Research - 2 May 2018