Unisem (M) Bhd - Values Resurface; Potential Downtrend Reversal

HLInvest

Publish date: Tue, 08 May 2018, 08:56 AM

Unisem offers strong growth prospects (FY18-20 CAGR of 13%) at undemanding valuation of 10.6x (8.5x ex-cash) FY19 P/E (22% below its peers), supported by decent dividend yield of 3.6%-4.7% for FY18-19 and strong net cash of RM252m or RM0.34/share. Downside risk is limited, as sentiment is boosted by recent USD strength (vs RM), potential downtrend reversal from hammer candlestick pattern and company’s share buy-back exercise.

Fundamentals Remain Intact and Values Re-emerged After Recent Rout. After imputing a 48% slump in FY18 earnings (mainly due to high base in FY17, forex volatility, lower margins of its legacy packages and higher staff cost), FY18-20 earnings are expected to grow at 13% CAGR, driven by its strategic expansion towards 8-inch and 12-inch wafer bumping capacity in Ipoh and Chengdu that will allow it to gain better economies of scale coupled with narrowing losses in its Batam operation.

Overall, after a weak 1Q18, Unisem is guiding for 5-10% sequential US$ revenue growth in 2Q18, driven by robust recovery in industry demand. This is on the back of resilient demand for power management, automotive and internet-of-things applications. There is also a potential turnaround in smartphone industry for 2H18, given the blockbuster device launches towards end-2018.

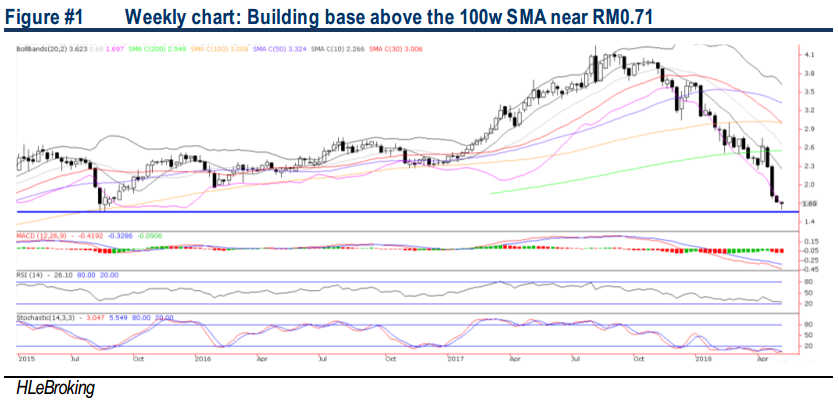

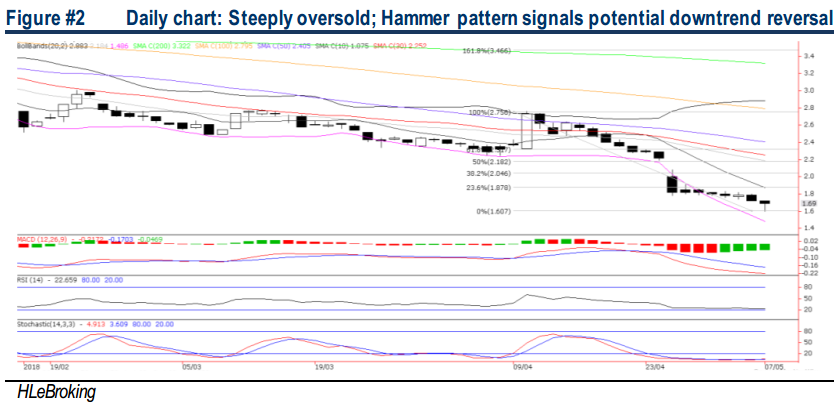

Potential Downtrend Reversal. In wake of a “risk off” selldown on Unisem amid the sluggish 1Q18 results and global technology stocks carnage after a disappointing sales outlook from TSMC coupled with a series of Trump’s protectionism measures, Unisem’s share prices nosedived 54% from YTD high of RM3.66 (2 Jan) to end at RM1.69 yesterday.

However, we see potential downtrend reversal owing to the hammer candlestick formation, supported by its steady earnings growth and undemanding valuations. Sentiment is also likely to improved following Apple’s positive outlook guidance and the US$ strength (FIG3) in anticipation of more aggressive interest rates hikes by Fed (RM weakened 2.5% against US$ at RM3.945 after hitting a low of 3.85 on 2 Apr).

A successful breakout above RM1.80 psychological barrier will spur prices higher towards RM1.88 (23.6% FR) before reaching our LT target at RM2.04 (38.2% FR). On the flip side, key supports are situated at RM1.60 (7 May low) and RM1.57 (18 Aug 2015 low). Cut loss at RM1.53.

Source: Hong Leong Investment Bank Research - 8 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-13

UNISEM2024-11-13

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM