Traders Brief - Positive Sentiments to Prevail

HLInvest

Publish date: Thu, 17 May 2018, 04:48 PM

MARKET REVIEW

Asian equities closed mostly lower after 10-year US Treasury yield rose to near seven-year high at 3.07%. Investors were also focusing on the new geopolitics developments on Korea Peninsula as North Korea suddenly dropped plans for talks with South Korea yesterday. The Nikkei 225 and Shanghai Composite Index declined 0.44% and 0.70%, respectively. Meanwhile, Hang Seng Index shed 0.13%.

Bucking the regional trend, the FBM KLCI managed to recoup mild losses at the start of the session and advanced 0.54% to end at 1,858.26 pts. Overall, market breadth was slightly positive as advancers led decliners by 492-to-486 stocks. Market volumes dwindled to 3.00bn vs. 4.31bn on Tuesday. Consumer sector traded higher as investors were looking for stocks that will benefit from the abolishment of GST which was mentioned in Pakatan Harapan’s manifesto.

Wall Street ended on a higher note despite the resurfacing of geopolitical tension in the North Korea region. However, gains on the markets were limited as the 10-year Treasury yield was above the psychological mark of 3.00%. The Dow increased 0.25%.

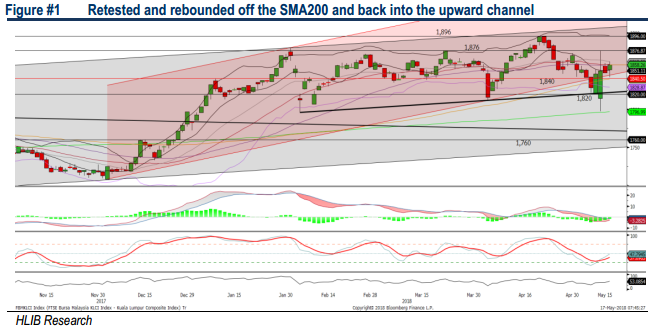

TECHNICAL OUTLOOK: KLCI

After retesting the SMA200 post-GE14, the FBM KLCI managed to climb back into the uptrend channel. The MACD Indicator is recovering back to zero, the RSI and Stochastics are hooking upwards. We think the FBM KLCI may rebound higher to revisit the immediate resistance at 1,876, followed by 1,896. Support will be located around 1,840.

With the Confirmation of GST to be Removed With Effect From 1st of June by the Ministry of Finance, We Anticipate Consumer Stocks to Benefit Out of This Policy as the Rakyat Generally Will Have Higher Disposable Income to Spend in the Economy. Meanwhile, We Think Trading Focus May Emerge Further on the Export-oriented Stocks as Ringgit Trended on a Weaker Note Yesterday.

TECHNICAL OUTLOOK: DOW JONES

The Dow stayed slightly below the SMA100 level as the Stochastics oscillator is suggesting that the Dow is overbought. Nevertheless, the MACD Indicator is hovering in the positive region. We think the Dow may retest the 25,000 level after a short consolidation. Support will be pegged around 24,500.

We Believe the Near Term Outlook on Wall Street Could Trade on a Cautious Tone With Limited Upside as the 10-year Treasury Yield Is Hovering Around the 7-year High Area. Meanwhile, Market Participants May Focus on Small Caps as the Russell 2000 (small Cap Index) Was Traded Towards the All-time-high Zone as Analysts in the US Viewed Them as Lower Risk Towards the Recent Trade War Episode.

Source: Hong Leong Investment Bank Research - 17 May 2018