Technical Tracker - Pecca 23 May 2018

HLInvest

Publish date: Wed, 23 May 2018, 09:22 AM

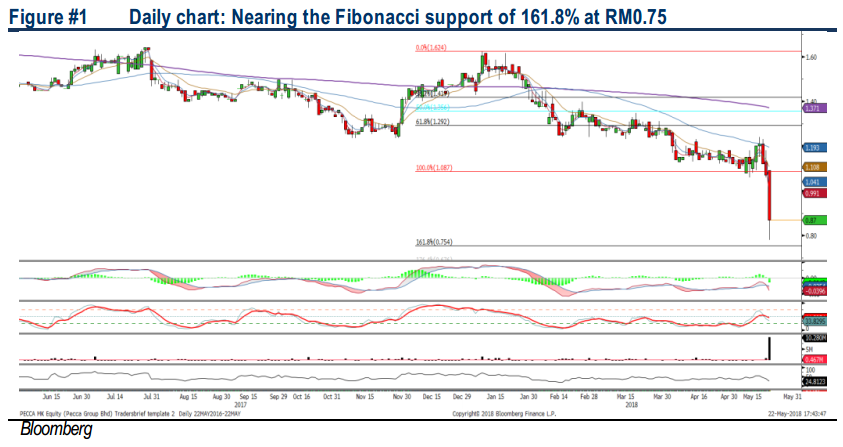

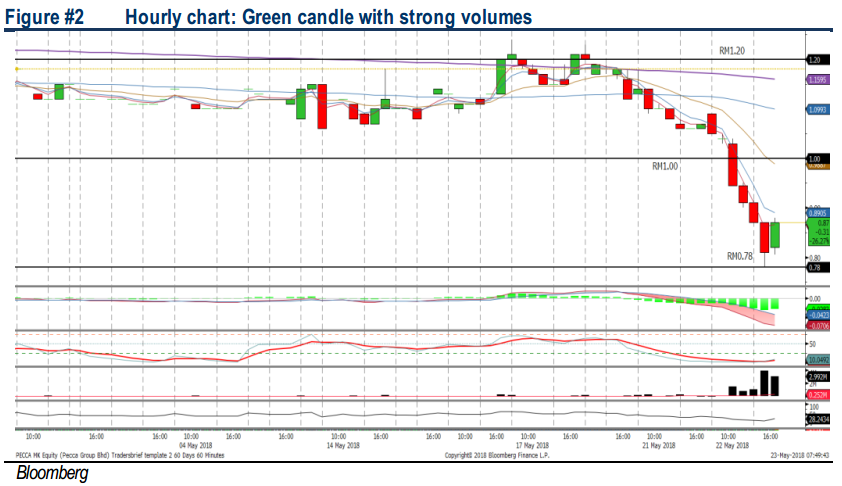

Overdone selldown; Auto stats remain encouraging

Pecca’s top client Perodua has shown monthly production units and monthly TIV sales growing steadily in 1Q18, which may benefit Pecca in the upcoming results. Also, Pecca is trading at 8.5x FY19 P/E (49% lower than average 16.6x P/E since listed), supported by net cash of 50 sen per share (ex -cash P/E of 3.6x). We think the recent selling pressure was overdone as investors perceived Pecca as BN-linked, anticipating a technical rebound towards RM0.92-1.00. Support at RM0.75-0.78, with a cut loss set at RM0.74.

The largest local player in automotive leather upholstery, with over 65% market share. PECCA is involved in the leather upholstery of passenger car seats covers (contribute ~70% to 1HFY18 revenue) for OEM, pre-delivery inspection (PDI) and replacement equipment manufacturing (REM) market segments, as well as the supply of leather cut pieces and others (contribute ~30% to revenue) to the automotive leather upholstery industry. Its main customer includes automotive seat manufacturers (Fuji Seats, Toyota Boshoku, Lear Automotive, Auto Part Manufacturers, etc.), which in turn supply car seats to automotive OEMs (Perodua, Toyota, Proton, Nissan, Honda etc.) and automotive distributors (Perodua Sales).

Fundamentals intact, overdone selling activities. We believe the selling pressure is overdone as investors may view this as BN-linked counter due to the Independent Non-Executive Chairman, Dato Mohamed Suffian bin Awang was previously the political secretary to Malaysia’s 6th Prime Minister (Dato Sri’ Najib Razak). However, from the business point of view, we believe it remains intact as the recent auto industry statistics by the Malaysian Automotive Association suggests there could be a healthy recovery in 1Q18 within the automotive industry.

Production units and monthly TIV sales have been growing steadily. Pecca’s top 5 clients (Perodua, Toyota, Nissan, Honda and Proton) cumulatively have shown a YoY and MoM growth of 10% and 31% for 1Q18 and Mar-18, respectively. Meanwhile, monthly TIV sales dropped 7% YoY for 1Q18, but Mar-18 grew at 23% MoM. We opine that Pecca may benefit from this encouraging statistics, resulting in stronger 1Q18.

HLIB maintains a BUY rating with RM1.72 TP (97.7% upside). We remain positive on Pecca amid its undemanding valuations at 8.5x FY19 P/E and 1.0x P/B (49% and 33% lower than average 16.6x P/E and 1.5x P/B since listed), supported by a commendable net cash of near to 50 sen per share (ex-cash P/E of 3.6x), and strong DY of 6.9%-11.5% for FY18-20.

Potential recovery after a sharp selldown. Although the daily chart is suggesting that the trend is down, but we think there could be a short term trading opportunities as the hourly candle has rebounded near the Fibo support of 161.8% (RM0.75). In the hourly chart, the RSI and Stochastics are in their oversold region. We think it could be due for a short term technical rebound that may retest the RM0.92-1.00, while the support will be located around RM0.75-0.78, with a cut loss set around RM0.74.

Source: Hong Leong Investment Bank Research - 23 May 2018