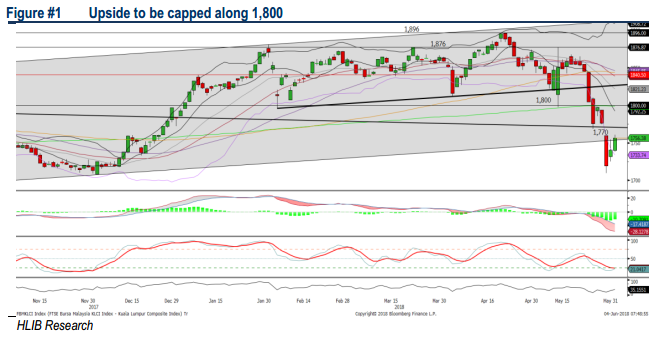

Traders Brief - Upside Capped Along 1,800

HLInvest

Publish date: Mon, 04 Jun 2018, 10:22 AM

MARKET REVIEW

Asian stocks ended on a mixed note as trade war concerns resurfaced after the US imposed import tariffs on steel and aluminium tariffs on its trading partner such as Mexico, Canada and the European union. The Nikkei 225 and Shanghai Composite Index fell 0.14% and 0.65% respectively, while Hang Seng Index rose 0.08%.

On the local bourse, despite the softer performance on the overnight Wall Street, the FBM KLCI rebounded higher led by banking heavyweights such as CIMB (+20.0 sen) and Maybank (+38.0 sen). Market breadth turned positive with 560 gainers vs 377 decliners, accompanied by 2.88bn shares (worth RM2.79bn) traded for the day. Also, brewery stocks such as Carlsberg and Heineken traded actively higher.

Wall Street ended higher as jobs report came in stronger-than-expected; the US economy added 223,000 jobs in May (vs consensus of 188,000). The Dow and S&P500 gained 0.90% and 1.08%, respectively, while Nasdaq advanced 1.51%.

TECHNICAL OUTLOOK: KLCI

Despite the rebound of the FBM KLCI above the 1,706 level last week, the key index is still hovering below the SMA200 level. The MACD Histogram has recovered mildly, while the RSI and Stochastics oscillators are oversold. Hence, we may expect that the key index may be due for further rebound towards 1,770-1,780. However, upside could be limited around the next resistance of 1,800, while the support will be located around 1,706.

With the trade war concerns continue to cloud the market environment, coupled with the resurfacing of the 1MDB-related news as well as any new policies and potential review of the toll concessions by Pakatan Harapan, it may heightened the market volatility and the upside may be limited over the near term.

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trade above the SMA200 level and the MACD Indicator is hovering above the zero level. The RSI and Stochastics are hooking above 50. With the positive technicals, the Dow may retest the 25,000 psychological. The next resistance will be pegged around 25,400. Support will be anchored around 24,000.

Although Wall Street traded mildly higher last week, we expect investors to stay cautious with the renewed concerns over trade war developments between US and its trading partners. Should there be any further surprise move by the US, it may send jittery tone to the markets. However, with the better-than-expected jobs data, Wall Street could sustain its upward movement towards the 25,000 level.

TECHNICAL TRACKER: GENTING MALAYSIA

Expect a robust growth; Poised for sideways breakout. Downside risk is limited amid undemanding 15.2x FY19 P/E (vs 10Y average of 17x) and the oversold positions coupled with the optimism from multiyear fruit yielding (from FY18 onwards) for its GITP investment. The high visitation rate will continue to provide the springboard for growth amid the progressive rollouts of new amenities, followed by 20th Century Fox theme park by year end. Meanwhile, the worry on the erosion of margin will be offset by the upside provided by the zerorisation of GST.

Source: Hong Leong Investment Bank Research - 4 Jun 2018