Traders Brief - Market rebound in store

HLInvest

Publish date: Fri, 29 Jun 2018, 04:45 PM

MARKET REVIEW

Sentiments throughout the Asian stock markets remained cautious as trade issues between the US and China were refraining investors to further expose in equities as investors digested the trade developments with a pinch of salt. Most of the equities ended softer led by Shanghai Composite Index (-0.97%), but Hang Seng Index rose 0.50%. Meanwhile, Nikkei 225 traded flattish.

On the local front, the FBM KLCI traded in the negative territory after the opening bell and ended marginally lower at 1,665.68 pts (-0.02%) after hitting the intra-day high of 1,670.85 pts. Market breadth remained negative with 419 losers vs 365 gainers. Trading activities were lacklustre with less than 2.0bn shares traded for the day worth RM1.66bn. Nevertheless, we saw some positive trading tone within selected export-oriented stocks (Top Glove and Pentamaster) and ACE market.

Investors were still cautious on the inconsistency of White House’s trade policies and most of the major indices were in the negative zone after the opening bell. However, bargain hunting activities were noted and lifted the US equities to end higher led by technology and financial stocks, snapping the 13th declining streak. The Dow and S&P500 rose 0.5% and 0.6% respectively, while Nasdaq added 0.77%.

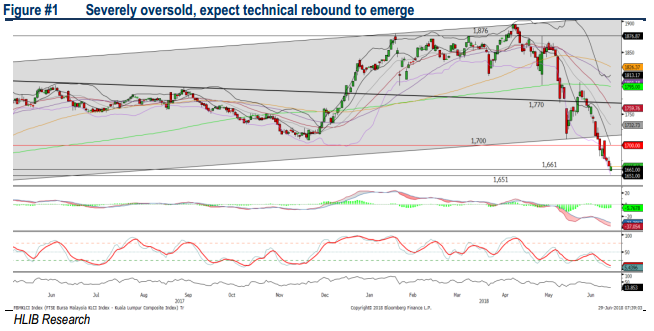

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended lower for 13 times out of the past 14 trading sessions. The MACD Line continues to trend below zero, but the MACD Histogram has recovered mildly. The RSI and Stochastic oscillators are severely oversold and we believe the key index could be due for a rebound with a potential retest of 1,670-1,700. Meanwhile, support will be pegged around 1,650, followed by 1,616

Tracking the positive performance on overnight Wall Street, we may anticipate bargain shopping to emerge on Malaysia’s stock market as most of the stocks are oversold, coupled with the final trading day of window dressing for 1H18.

TECHNICAL OUTLOOK: DOW JONES

Finally, threading slightly below the SMA200 and the upward trendline, the Dow revisited the psychological support of 24,000 and experience a technical rebound. The MACD Indicator is still hovering below zero, but the Stochastic oscillator is oversold. We may expect further rebound towards 24,500, with the support located around 24,000.

In the US, stocks remain volatile with the prolong trade concerns between US and its trading partners. Should there be any further negative developments on trade policies by the White House, it may dampen the market sentiment globally. Hence, the Dow may remain on a sideways consolidation phase over the near term.

Source: Hong Leong Investment Bank Research - 29 Jun 2018