Traders Brief - All Eyes on the Trade Episode

HLInvest

Publish date: Wed, 04 Jul 2018, 04:50 PM

MARKET REVIEW

Investors continue to remain cautious as market participants monitored closely on the trade developments between US and China and Asian stock markets closed mostly mixed; Nikkei 225 and Hang Seng Index declined 0.12% and 1.41%, while Shanghai Composite Index 0.39%.

On the local front, sentiment was negative with FBM KLCI traded mostly in the red territory and the key index ended lower by 0.28% to 1,680.37 pts. Market volumes were slightly higher at 2.13bn worth at RM1.66bn. However, we noticed some of the semiconductor-related (FoundPac and Aemulus) and water-related (KPS and Taliworks) stocks were traded actively higher on the back of weaker ringgit outlook and positive newsflow on the water sector.

On Wall Street, traders were focusing on the recent trade developments, which may turn into a full-blown trade war that is likely to dampen growth moving forward and Wall Street traded into the negative region; the Dow and S&P500 fell 0.54% and 0.49%, while Nasdaq declined 0.86%.

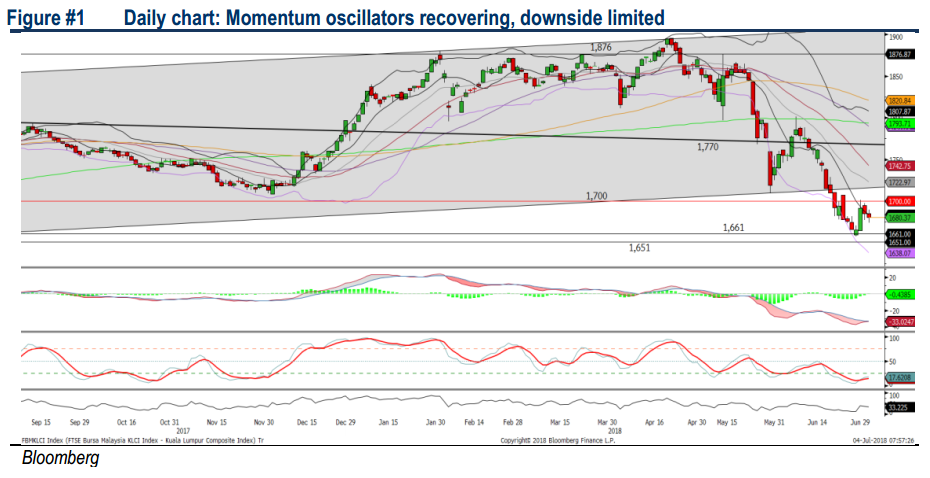

TECHNICAL OUTLOOK: KLCI

The FBM KLCI pulled back for another session, but maintained above the 1,670 level. The MACD Histogram is recovering towards zero, while the RSI and Stochastic are trending higher from the oversold position. With most of the momentum indicators turning towards a more positive position, we think the FBM KLCI’s downside could be limited. The resistance will be envisaged around 1,700-1,725, while the support will be pegged around 1,640-1,650.

We believe investors will remain prudent with the uncertain trade environment, coupled with the outflow of foreign funds without any recovering signs. Hence, the FBM KLCI could trend sideways over the near term with upside limited around 1,700-1,725. Nevertheless, oil and gas stocks are likely to trade actively on the back of recovering Brent oil prices.

TECHNICAL OUTLOOK: DOW JONES

Despite the lower closing yesterday, the Dow continues to hover within the symmetrical triangle and above the upward trendline. The MACD Line, however is below zero, suggesting that the trend is negative. Should the Dow breaches below the immediate support of 24,000, further downside should be expected around 23,500. On the flip side, the resistance will be located around 24,500.

In the US, market sentiment remains shaky ahead of Friday, where President Donald Trump’s administration will be imposing tariffs on US$34bn Chinese goods and it could attract further escalation of trade spats between US and China. Also, its trading partners may retaliate with similar measures that may dampen the global growth eventually. Hence, the Dow is likely to extend its consolidation phase.

TECHNICAL TRACKER: TALIWORKS CORPORATION

Nearer towards settling Selangor water saga; Positive downtrend line breakout. Despite a 6.5% gain yesterday, sentiment on the stock may improve after newly appointed Water, Land and Natural Resources Minister Xavier Jayakumar yesterday vowed that the long-standing Selangor water supply issue would be resolve soon. Valuation is still undemanding at 14.3x FY19 P/E (21% below 10Y average of 18x and supported by a 22% EPS CAGR from FY18-20, coupled with a huge trade receivables of c.RM638m (52sen/share; ~54% of its market cap). Positive downtrend line breakout could spur prices higher towards RM1.13-1.25.

Source: Hong Leong Investment Bank Research - 4 Jul 2018