Retail Strategy 06 Jul 2018 - Navigating Through Choppy Waters

HLInvest

Publish date: Fri, 06 Jul 2018, 09:10 AM

We believe short term volatility may persist as prolong external uncertainties and concerns over trade spats between the US and its trading partners could paint a negative tone towards global and local markets, restricting the upside eventually. Meanwhile internally, PH reforms may take a while before any improvements on the economy will be noticed. Hence, we deploy a more defensive approach in 3Q18, targeting catalysts such as (i) stable growth, strong balance sheet and dividends (YSPSAH, PECCA), (ii) short term depreciation bias of ringgit (PIE, FRONTKEN), (iii) recovering crude oil prices (SERBADK, PANTECH) and (iv) thematic-driven stock picks (TALIWORKS).

Market Review

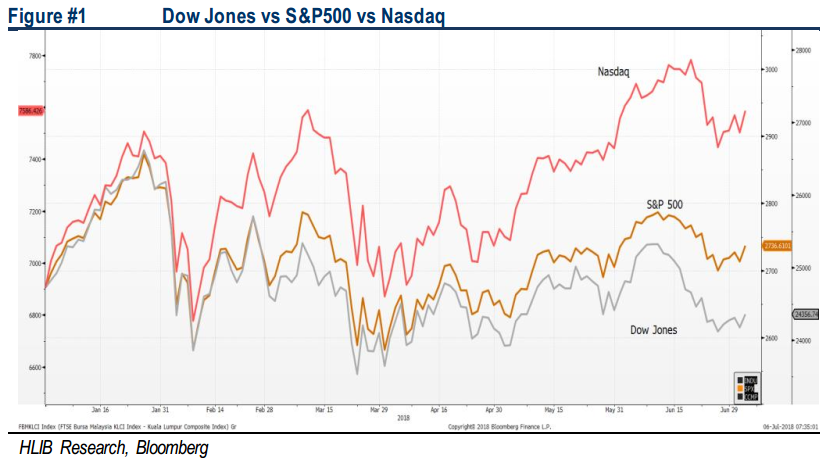

Trump’s trade, 10-year Treasury yields and the Feds. After the Wall Street ended lower in 1Q18 following 9 quarters of winning streak, the market volatility increased in 2Q18 on the back the interest rate up-cycle concerns, while the 10-year Treasury yield traded above the 3.0% psychological in May (signalling the potential tightening monetary policies by Federal Reserve). Also, the protectionist measures deployed by President Trump, imposing tariffs on its trading partners’ (China, Mexico, Canada and EU) goods, which most of them have retaliated with various tariffs on US products. These reciprocal actions have contributed to the fear that it may escalate into a full blown trade war, eventually dampening the global growth.

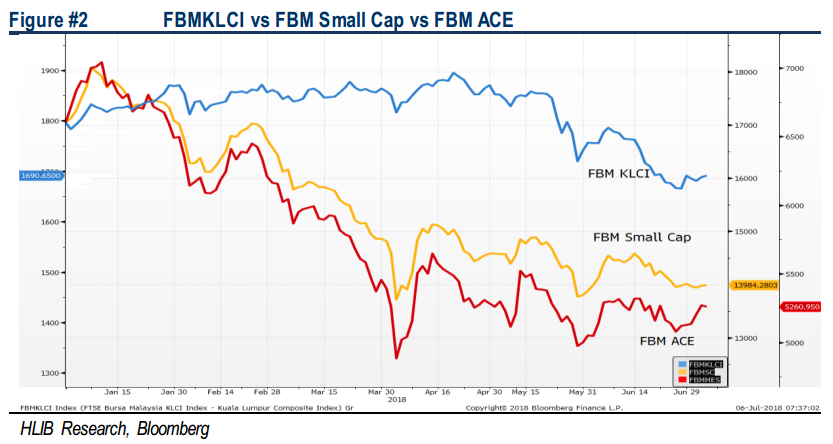

Historic win by Pakatan Harapan in GE14. At the start of 2Q18, market sentiment was generally tepid in the broader market ahead of the GE14 and the only trading interest was on the index heavyweights. However, the victory by PH came in by surprise and triggered the selling activities specifically by the foreigners post GE14. Some key risks which were affecting trading sentiment were (i) RM1trn national debt, (ii) negative news flow on the 1MDB, (iii) slowdown in construction sector after review of construction mega projects and (iv) lower revenue following GST “zerorisation”.

Short term pain, long term gain. Market participants could be pricing in the abovementioned risks and we believe the current knee-jerk reaction on the market may be extended at least for the near term. Nevertheless, the long term outlook could be looking positive after clearing some inefficient usage of government’s resources in the past, resulting in better governance. PH is likely to be crafting more effective policies for “New Malaysia”, contributing towards a healthy growth in the upcoming years.

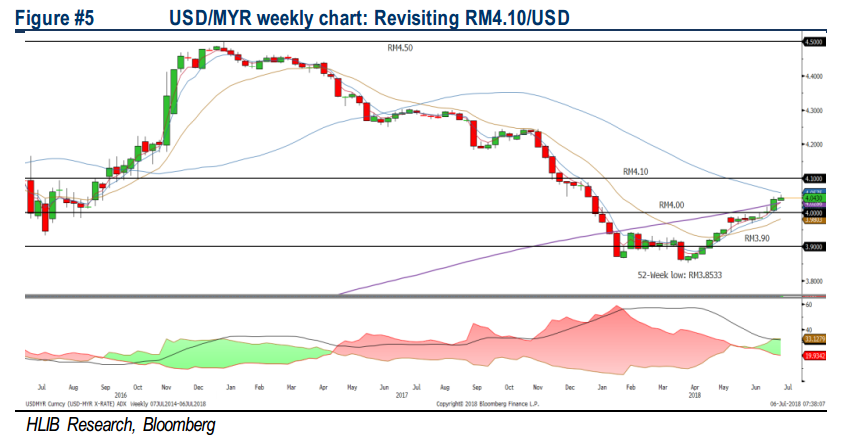

Ramping up in foreign outflow after GE14. Pre-GE14, foreign participation remained positive, but post-GE14, the rampant selling pressure was noted by foreigners, contributing towards an outflow of RM9.0bn in 2Q18 (1Q18: inflow of RM2.2bn) and the FBM KLCI was flushed down below two major psychological levels of 1,800 and 1,700 within the period of 1 month. We believe should there be any extended foreign selling activities, the KLCI’s upside shall be limited. In tandem with the foreign outflow, the ringgit has weakened towards RM4.0385/US$ (-4.33% QoQ, - 1.45% MoM) in end-1H18.

Market Outlook and Retail Strategy for 3Q18

Hitting some road bumps at the start… Foreign funds may be discounting the near term uncertainties as they are fleeing the local stock market on the back of the scrapping of KL-SG High Speed Rail (HSR) and MRT3 mega projects, which were supposedly to contribute higher domestic growth in FY18-19. Also, the heightened fear on the huge national debt might be a hindrance for now to buy Malaysia’s equities. Meanwhile, PH-led government has materialised the zerorisation of the GST will be migrating to SST in Sept, reducing the tax collection for the country.

…but a reform is on the way. However, the on-going LRT3, MRT2 and Pan Borneo Sarawak projects, coupled with the potential review and continuation of the ECRL may cushion the downside risk in the construction sector. Meanwhile, despite the reduction in GST revenue for Malaysia, we anticipate that the implementation of SST and the higher crude oil revenue, as well as the GLC restructuring and other tax avenues (better excise duty collection on sin products) to sustain Malaysia’s revenue moving forward. Moreover, the appointment of the noteworthy full Cabinet members and Council of Eminent Persons (CEP) post-GE14 will be able to assist the new government in crafting policies and boosting confidence amongst investors, reforming from the fundamental position.

Defensive-stance to sail through the volatile period. Given the risky external environment (trade spats between US-China, rising 10-year Treasury yield and interest rates upcycle), coupled with the process of internal reform could take longer term to materialise, we opine that the negatives may outweigh the positives and market volatility may still persist, at least for the near term. Hence, we will be deploying a more defensive approach in sailing these choppy waters throughout 3Q18.

We have formulated the table above using several moving averages to flag us with potential trading opportunities. At a glance, market participants are focusing on Technology, Consumer and REITs. Hence, we have stated the following 4 strategies to drill down into potential stock picks within our local stock exchange.

Strategy 1: Stable growth, balance sheet and dividends. To endure the potential downside risk in 3Q18, investors may focus on defensive stocks with solid fundamental, especially the strong net cash and potential steady dividends being paid out over the years. Should there be any wild cards revealed by President Trump that may heighten the market volatility, defensive sectors such as pharmaceutical or healthcare may cushion the downside risk. Under this solid fundamental segment, we would favour YSPSAH and PECCA.

Strategy 2: Depreciation bias of ringgit. In view of the uncertain external environment, coupled with internal factors, the USD may strengthen against the ringgit at least for the near term. Hence, with the near depreciation outlook in 3Q18, we may look for entry within export-driven sectors (semiconductors and gloves) as stronger USD will likely translate towards higher potential revenue and earnings for companies such as FRONTKEN and PIE.

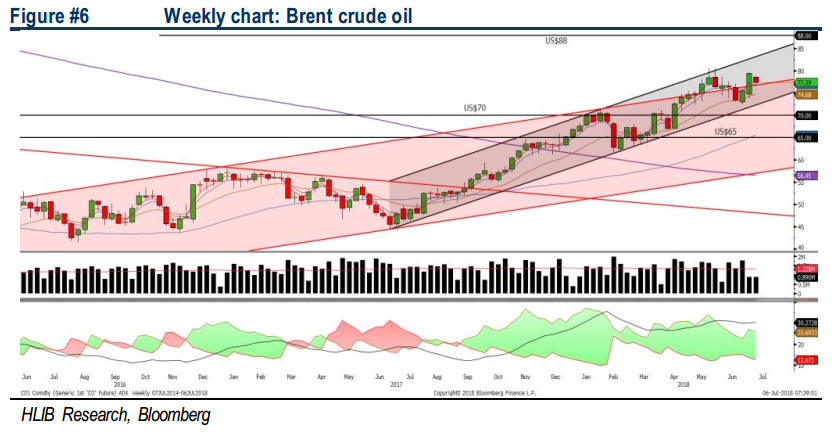

Strategy 3: Decent recovery in crude oil. To recap, in our previous retail strategy based on technical analysis, we projected the Brent crude oil may retest US$70 and may sustain its trend towards US$88 (inverted Head and Shoulders’ projection target) in the mid- to long-term. Although OPEC increased their production by 1m bpd in July, this potential upward cycle could be due to prolong Iran sanction and production drag from Venezuela. With this steady recovery, it is likely to attract traders’ attention on O&G stocks (SERBADK and PANTECH) and may surprise on the upside.

Strategy 4: Thematic-driven stocks. With the full formation of Cabinet members being released earlier this week by PH-led government, we anticipate new changes in policies and resolving certain dead-lock issues such as the Selangor water saga. In this regard, we think it may benefit water-related stocks like TALIWORK, following the positive remarks from the new Minister of Water, Land and Natural Resources, Dr A Xavier Jayakumar, assuring the Selangor water supply issue would be settled soon.

Nevertheless, should there be any negative events under this cautious external environment, we are able to use KLCI futures to hedge against any unfavourable downside risk, providing a safety net towards our portfolio.

Source: Hong Leong Investment Bank Research - 6 Jul 2018