Retail Strategy - Navigating through choppy waters

HLInvest

Publish date: Fri, 06 Jul 2018, 05:17 PM

We believe short term volatility may persist as prolong external uncertainties and concerns over trade spats between the US and its trading partners could paint a negative tone towards global and local markets, restricting the upside eventually. Meanwhile internally, PH reforms may take a while before any improvements on the economy will be noticed. Hence, we deploy a more defensive approach in 3Q18, targeting catalysts such as (i) stable growth, strong balance sheet and dividends (YSPSAH, PECCA), (ii) short term depreciation bias of ringgit (PIE, FRONTKEN), (iii) recovering crude oil prices (SERBADK, PANTECH) and (iv) thematic-driven stock picks (TALIWORKS).

Market Review

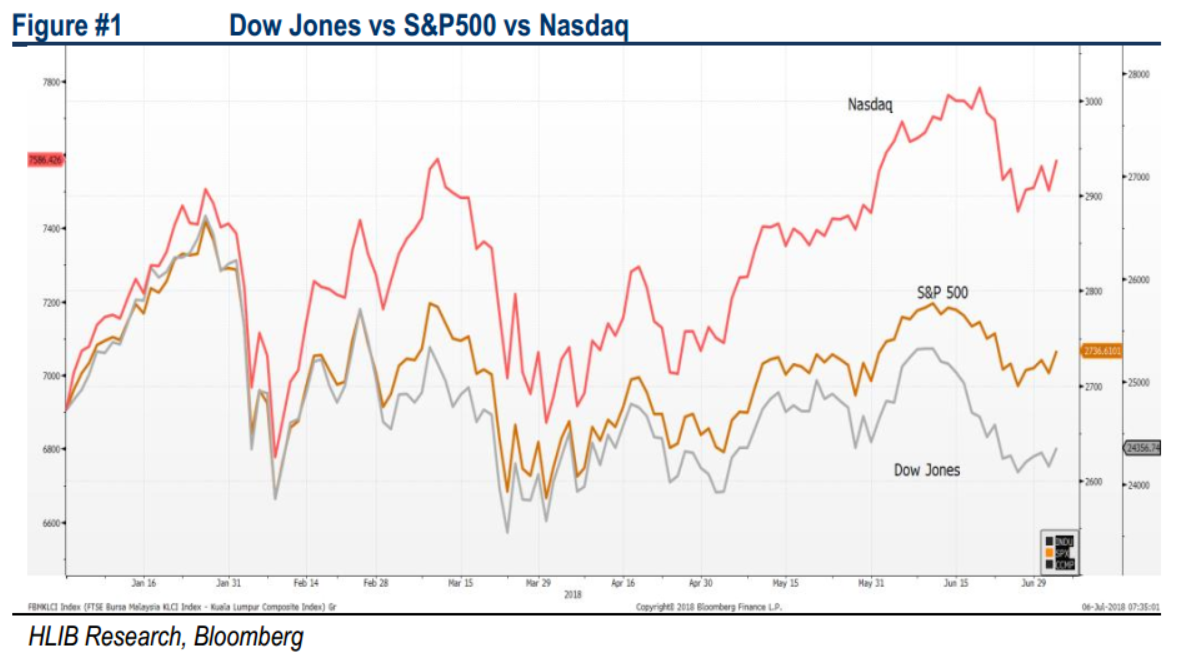

Trump’s trade, 10-year Treasury yields and the Feds. After the Wall Street ended lower in 1Q18 following 9 quarters of winning streak, the market volatility increased in 2Q18 on the back the interest rate up-cycle concerns, while the 10-year Treasury yield traded above the 3.0% psychological in May (signalling the potential tightening monetary policies by Federal Reserve). Also, the protectionist measures deployed by President Trump, imposing tariffs on its trading partners’ (China, Mexico, Canada and EU) goods, which most of them have retaliated with various tariffs on US products. These reciprocal actions have contributed to the fear that it may escalate into a full blown trade war, eventually dampening the global growth.

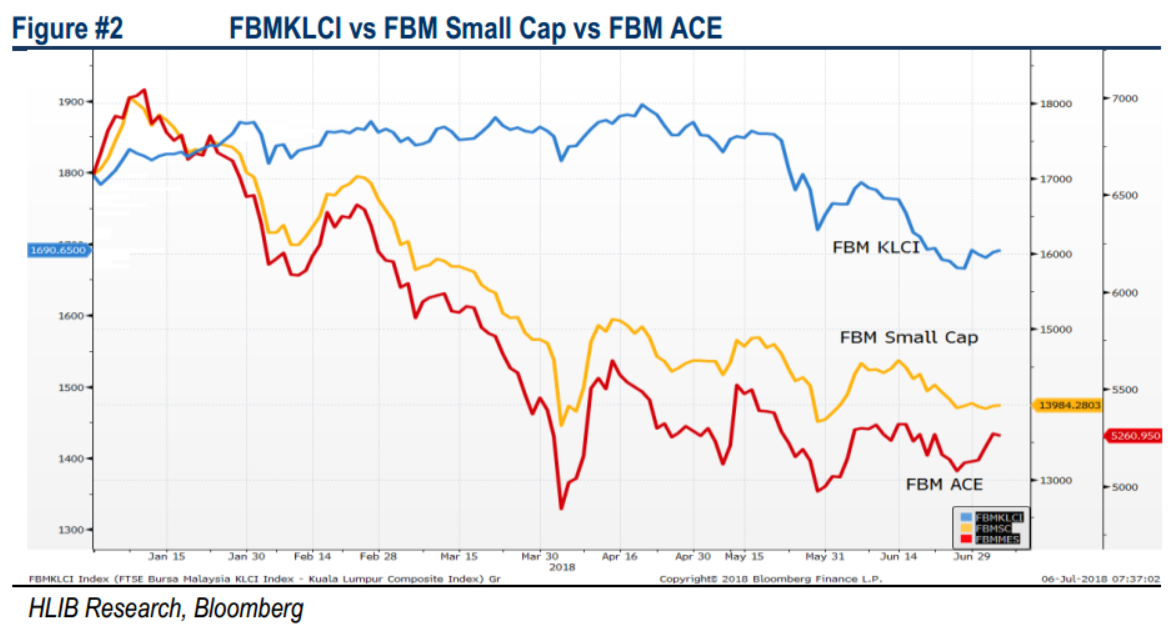

Historic win by Pakatan Harapan in GE14. At the start of 2Q18, market sentiment was generally tepid in the broader market ahead of the GE14 and the only trading interest was on the index heavyweights. However, the victory by PH came in by surprise and triggered the selling activities specifically by the foreigners post GE14. Some key risks which were affecting trading sentiment were (i) RM1trn national debt, (ii) negative news flow on the 1MDB, (iii) slowdown in construction sector after review of construction mega projects and (iv) lower revenue following GST “zerorisation”.

Short term pain, long term gain. Market participants could be pricing in the abovementioned risks and we believe the current knee-jerk reaction on the market may be extended at least for the near term. Nevertheless, the long term outlook could be looking positive after clearing some inefficient usage of government’s resources in the past, resulting in better governance. PH is likely to be crafting more effective policies for “New Malaysia”, contributing towards a healthy growth in the upcoming years.

Ramping up in foreign outflow after GE14. Pre-GE14, foreign participation remained positive, but post-GE14, the rampant selling pressure was noted by foreigners, contributing towards an outflow of RM9.0bn in 2Q18 (1Q18: inflow of RM2.2bn) and the FBM KLCI was flushed down below two major psychological levels of 1,800 and 1,700 within the period of 1 month. We believe should there be any extended foreign selling activities, the KLCI’s upside shall be limited. In tandem with the foreign outflow, the ringgit has weakened towards RM4.0385/US$ (-4.33% QoQ, - 1.45% MoM) in end-1H18.

Source: Hong Leong Investment Bank Research - 6 Jul 2018