Traders Brief - Downward Bias Amid Resumption of Selling Interest

HLInvest

Publish date: Mon, 09 Jul 2018, 09:42 AM

MARKET REVIEW

Asian stock markets turned positive at the end of the trading session, rebounding from the negative territory as investors continued to monitor the trade developments between the US and China as the tariffs took effect last Friday. The Nikkei 225 gained 1.12%, while Hang Seng Index and Shanghai Composite Index rose 0.49% and 0.47%, respectively.

Meanwhile, on the local front, the FBM KLCI bucked the regional trend and plummeted 1.58% to 1,663.86 pts led banking and telco heavyweights. Market traded volumes stood at 2.01bn, worth RM2.00bn in trading value. Market breadth was negative with 539 losers vs 286 gainers. However, selected construction stocks such as Gabungan AQRS (+3.0 sen) and Econpile (+1.0 sen) managed to recover mildly.

Despite the trade developments, Wall Street managed to stay positive with the US economy added 213k jobs in June (vs. consensus expectations of 195k), shrugging off the trade fears, at least for the near term. The Dow rose 0.41%, while S&P500 and Nasdaq increased 0.85% and 1.34%, respectively led by technology sectors.

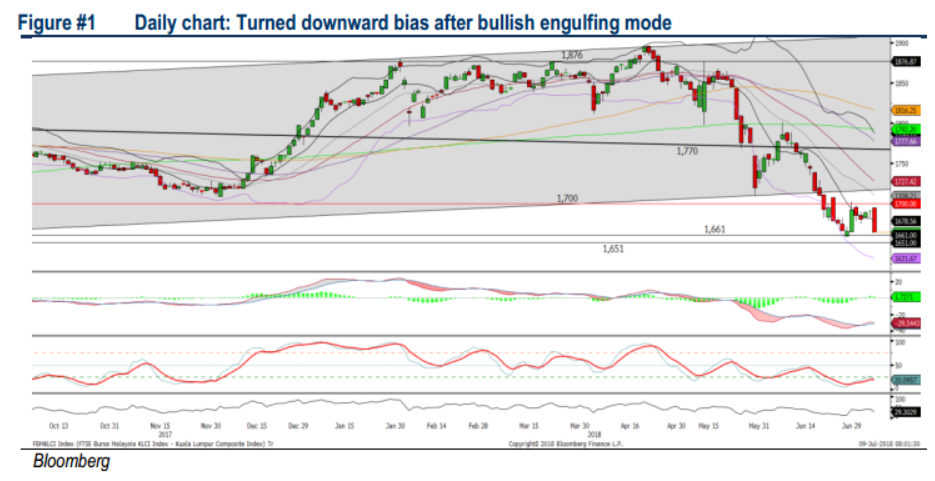

TECHNICAL OUTLOOK: KLCI

The FBM KLCI snapped the 2-day winning streak, forming a bearish engulfing candle last Friday. The MACD Indicator turned flattish, while the RSI and Stochastic oscillators are hovering below 50. We believe the key index is still on a mid-term downward bias mode as most of the technical indicators are weak at this juncture. The resistance will be set around 1,680-1,690. Support will be pegged around 1,640-1,650.

With China’s Foreign Ministry spokesman, Lu Kang mentioned earlier that China would fight back against the US and report to the World Trade Organisation, we think the FBM KLCI could see limited upside. However, tracking the rebound on the overseas markets, the FBM KLCI could be due for mild bargain hunting activities as it approaches the recent low near the 1,660 level.

TECHNICAL OUTLOOK: DOW JONES

The Dow managed to recover slightly above the SMA200 and hovering above the immediate trendline. The MACD Indicator is approaching zero, while the momentum oscillator such as Stochastic and RSI and turning positive. We believe the Dow may extend its rebound phase amid positive technicals. Resistance will envisaged around 25,000, while the support will be pegged around 24,000.

On Wall Street, despite the start of the trade war last Friday, the current trend remained positive after the rebound last week on the back of the stronger-than-expected jobs data. Nevertheless, should the retaliation measures by US’s trading partners set in in the near term, market volatility could increase, capping the potential upside.

Source: Hong Leong Investment Bank Research - 9 Jul 2018