Traders Brief - Technical Rebound May Extend as Tension Eased

HLInvest

Publish date: Fri, 13 Jul 2018, 05:14 PM

MARKET REVIEW

Despite the new list being released by the Trump administration to impose 10% tariffs on USD200bn worth of Chinese goods, Asian stock markets ended on a positive note as China and US officials signal for another round of trade discussions. Shanghai Composite Index (+2.18%) led the regional markets higher, while the Nikkei 225 and Hang Seng Index rose 1.17% and 0.60%, respectively.

Similarly, stocks on the local front were traded on a stronger tone in tandem with the regional indices amid fading trade tensions, coupled with positive news flows on LRT3 project to continue with a lower construction cost. The FBM KLCI increased 0.88% to 1,703.57 pts. Market breadth was positive with advancers led gainers by a ratio of 2-to-1. Meanwhile, market volumes were higher at 2.69bn vs 2.08bn on Wednesday.

Wall Street trended positively led by technology heavyweights (Facebook and Amazon hit new highs) as trade tensions eased and investors shifted their focus on earnings and data, while trade fears has taken a back seat for the moment. The Dow and S&P500 rose 0.91% and 0.87%, respectively, while the tech-heavy Nasdaq increased 1.39%.

TECHNICAL OUTLOOK: KLCI

After a 2-week sideways consolidation within the range of 1,657-1,700, the FBM KLCI has finally breached above the 1,700 psychological level. The convincing technical breakout came along after both the MACD and RSI indicators were on a recovering trend. We could expect the technical rebound to sustain towards 1,725-1,740. Meanwhile, support will be located around 1,650-1,660.

With the healthy recovery on the FBM KLCI above 1,700, coupled with the positive surge on the overnight Wall Street, sentiments on the local front are likely to be more favourable on the broader market. Also, we may see further buying interest into construction stocks following the LRT3 resumption news.

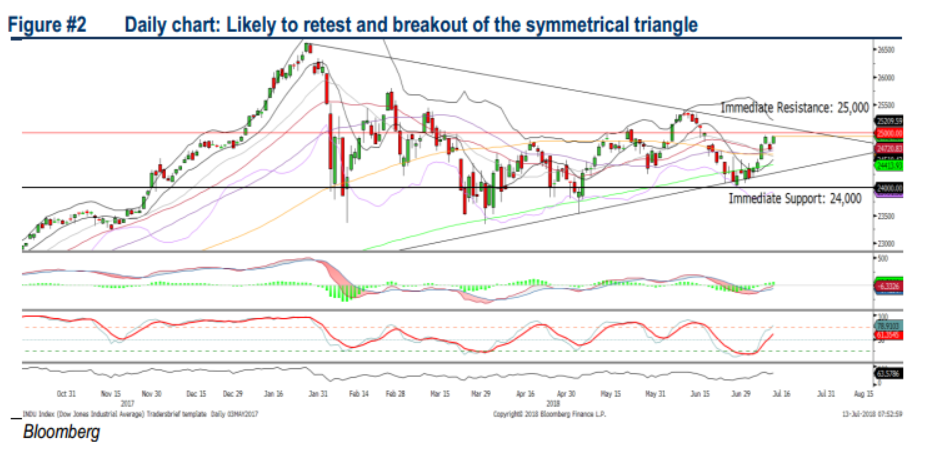

TECHNICAL OUTLOOK: DOW JONES

The Dow managed to reverse the one-day decline, sustaining its short term uptrend within the symmetrical triangle formation. Also, technical indicators are suggesting that the upward momentum is intact and could retest the 25,000 level. The support will be located around 24,000.

In the US, we opine that most of the negative trade developments have already priced in at this moment and investors will be focusing on the 2Q earnings over the near term. However, should China retaliate with a bigger quantum on the trades, it will dampen the trading tone, capping the upside on global markets.

Source: Hong Leong Investment Bank Research - 13 Jul 2018