Traders Brief - Near Term Upside Bias Towards 1740-1750

HLInvest

Publish date: Mon, 16 Jul 2018, 09:40 AM

MARKET REVIEW

Asian shares closed higher on Friday, extending gains after Wall Street rebounded as technology stocks spurred Nasdaq to end at all-time-high. Sentiment was also boosted following the relatively calmer tone on the trade front overnight, with the U.S. Treasury Secretary Steven Mnuchin said that bilateral talks on trade could resume on the condition that China was open to making “serious efforts” to change.

In line with higher Dow and regional markets, KLCI spiked 18.4 pts to 1721.9 last Friday, posting its 5th straight gains as market environment was also boosted by the positive news flows on the resumption of LRT3 project (albeit at a lower price tag) as well as tapering foreign selling (-24% wow to average RM106m/day for the week ending 13 July). WoW, the key index surged 58.1 pts to register its first weekly gain after falling in the previous four weeks. Market breadth was positive with 605 gainers as compared to 315 losers, supported by increased volume and value by 22% and 13% to 3.27bn shares worth RM2.83bn, respectively.

The Dow soared 94 pts to 25019 (+563 pts or 2.3% wow) led by industrials, offsetting a decline in financials after results from three of the big banks were mostly disappointed. Meanwhile, the tech-heavy Nasdaq also ended at a fresh high of 7826, underlining an uptrend that has been driven by signs of economic strength and solid quarterly earnings, shaking off the uncertain trade policy environment in recent months.

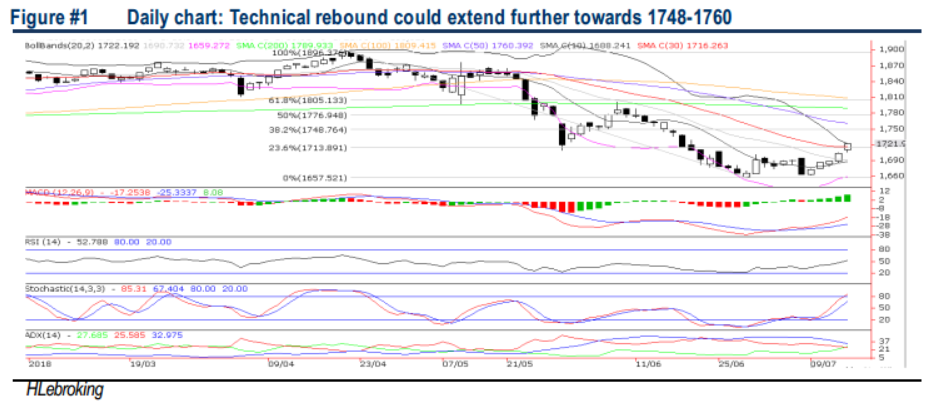

TECHNICAL OUTLOOK: KLCI

After trending sideways within 1657-1700 range, KLCI has finally closed above the 1700 psychological level on 12 & 13 July. The convincing breakout came along with higher volumes and strong recovery modes in MACD/RSI/Stochastic indicators are likely to spur the index to retest 1748 (38.2% FR) to 1760 (50d SMA) levels in short term. Nevertheless, further upside could be capped as daily stochastic indicator will become grossly overbought. On the flip side, key supports are 1700 and 1690 (20d SMA). A decisive violation below 1690 will witness further retracement towards 52-week low of 1657 (28 June).

Taking cues from a successful recovery above 1700 and multiple key SMAs, coupled with the easing net outflows post GE14, sentiment on the local bourse is likely improve further this week with key resistance at 1740-1750 zones. Notable risk remains on the potential escalation of US/China tariffs overtures following a relatively softer tone last week.

TECHNICAL OUTLOOK: DOW JONES

The Dow is poised for a downtrend line breakout after posted its 2nd consecutive gains and closed above 25000 last Friday, sustaining its short term uptrend within the symmetrical triangle formation. Also, technical indicators are suggesting that the upward momentum is stronger and could retest the 25300 level. The support will be located around 24,000-24,300.

In US, we opine that most of the negative trade developments have already priced in at this moment and investors will be focusing on the ongoing 2Q18 earnings reporting season, which is forecasted to jump over 20% YoY. Sentiment is also likely to be cushioned by the latest developments that the U.S. and China are open to resume negotiations after days of exchanging retaliatory threats.

Source: Hong Leong Investment Bank Research - 16 Jul 2018