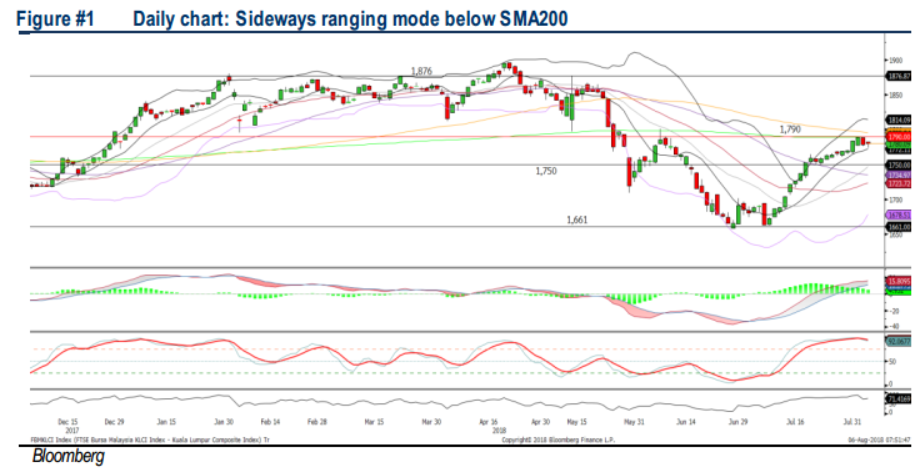

Traders Brief - Remain Range Bound Mode Below SMA200

HLInvest

Publish date: Mon, 06 Aug 2018, 11:34 AM

MARKET REVIEW

Asian stock markets were mostly lower amid escalated trade tensions after Trump’s administration proposed to impose a 25% tariffs (vs. 10% in earlier announcement) on USD200bn Chinese goods. In return, China commented that will slap tariffs on USD60bn of US goods, ranging from 5% to 25%. The Shanghai Composite Index and Hang Seng Index declined 0.97% and 0.14%, respectively, while Nikkei 225 (+0.06%) ended flat.

Meanwhile, on the local bourse, the FBM KLCI (+0.11%) eked our marginal gains after fluctuating between the negative and positive territories throughout Friday’s trading session. Market breadth was positive with 481 gainers vs. 326 losers, while market volumes were lower at 1.85bn (vs. 2.09bn on Thursday). Water-related stocks such as YLI and Engtex were gaining momentum throughout the session with the conclusion of Selangor’s water sector restructuring.

Despite the reciprocal action announced by China related to the trade issues, market sentiment remained resilient and Wall Street traded higher led by Apple and IBM. The Dow and S&P500 rose 0.54% and 0.46%, respectively. Meanwhile, the US economy added 157k jobs last month.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI inched marginally higher on Friday, but it is still below the SMA200. The MACD Histogram continues to weaken further over the past few weeks. Meanwhile, both the RSI and Stochastic are still in the overbought region. Hence, we opine that the KLCI’s upside will be limited around 1,790-1,800, while the support is located around 1,750-1,760.

Tracking the positive performance on Wall Street, we think there could be spill over buying interest towards Malaysia’s equities, but upside could be limited as technicals are overbought. Nevertheless, with the conclusion of the Selangor water saga with the acquisition of SPLASH for RM2.55bn, water-related stocks may gain tractions, at least for the near term.

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded off the SMA200 last Thursday forming a hammer candle and followed by a bullish candle on Friday and could be retesting 25,500 over the near term. The MACD Line is hovering above zero, while both the RSI and Stochastic oscillators are recovering. The Dow could poise for a flag pattern breakout, targeting 25,700-26,000. Support will be pegged around 25,000, followed by 24,

On Wall Street, we think the market volatility would depend on the trade developments between the US and China. However, the recent positive earnings registered by selected tech giants such as Apple are likely to cushion the downside risk over the near term.

Source: Hong Leong Investment Bank Research - 6 Aug 2018