FCPO - Rangebound mode amid rising stockpiles concerns in 2H

HLInvest

Publish date: Tue, 14 Aug 2018, 09:41 AM

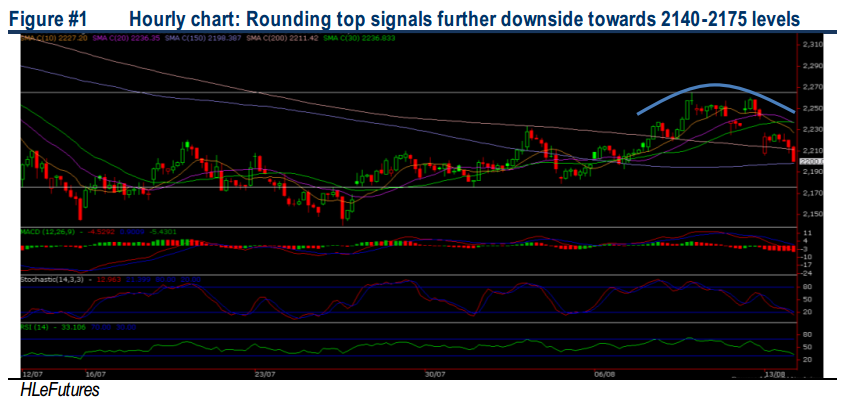

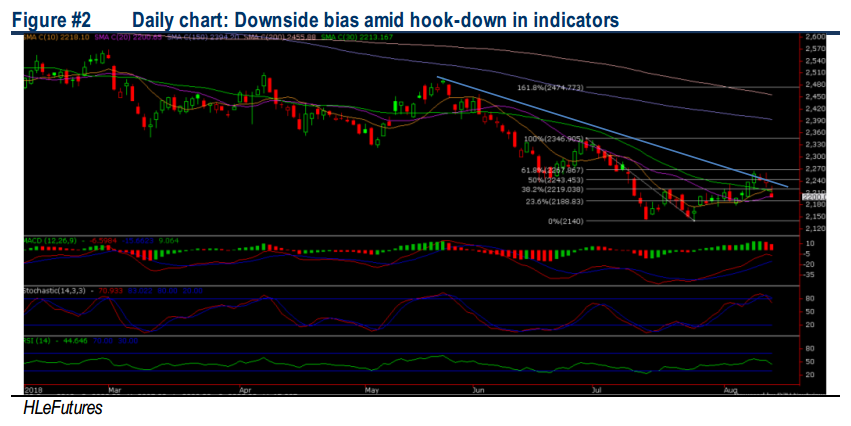

In the near term, FCPO outlook remains negative in anticipation of higher stockpiles in 2H and weakness in related edible oils. However, severe downside could be limited following a slide of 11.9% from 3M high of RM2498 (24 May), cushioned by RM weakness (vs USD), a 0% CPO export tax in Sep 2018, Indian government’s recent move to raise import duties on other soft oils and potential re-emergence of El Nino. Stiff resistances are set at RM2268-2300 levels.

FCPO slipped RM38 to end at RM2204, sliding 11.9% YTD. Tracking rising stockpile to 7M high and weaker soybean and crude oil prices, FCPO dropped RM38 to RM2204, despite favourable 1-10 Aug export shipments, stronger USD and positive expectations of wooing more demand from China during PM’s visit this week. Overall, near term outlook remain tepid as a confluence of negative headwinds amid nagging concerns of rising inventory amid production surplus in a seasonally strong 2H and the weakness in rival oil related prices.

FCPO needs to stay above RM2250 to arrest current downtrend. Following a 14.3% or RM358 slump from RM2498 to a low of RM2140 (25 July), FCPO staged a 5.8% rebound to a high of RM2265 (8 Aug) before retreating again to RM2204 yesterday. We expect FCPO to engage in rangebound consolidation unless staging a decisive breakout above RM2250 (downtrend line), which will lift prices higher towards RM2268 (61.8% FR) and RM2300 psychological barrier. On the flip side, a breakdown below RM2200 could see more retracements towards RM2188/2175/2140 territory.

Source: Hong Leong Investment Bank Research - 14 Aug 2018