Traders Brief - Downward Bias Mode Amid Turkey Crisis

HLInvest

Publish date: Tue, 14 Aug 2018, 09:43 AM

MARKET REVIEW

Asian key benchmark indices trended negatively following the heightened geopolitical tensions between the US and Turkey and investors flocked for safe haven asset such as Japanese yen. The Nikkei 225 and Hang Seng Index dropped 1.98% and 1.52%, respectively, while Shanghai Composite Index slipped 0.32%.

Meanwhile, the FBM KLCI slumped 1.24% led by selldown in Tenaga and IHH after the huge selloff in Turkish lira amid the ongoing turmoil in Turkey. On the broader market, there were 764 decliners vs 213 gainers. Market volumes stood at 2.07bn worth RM2.21bn. Nevertheless, selected steel stocks like Masteel and Lionind managed to trade actively higher.

Equities on Wall Street suffered another round of losses as fears over financial crisis in Turkey intensified. Also, energy stocks traded lower amid the slide in oil prices due to concerns about oil demand growth. The Dow and S&P500 slid 0.5% and 0.4%, respectively.

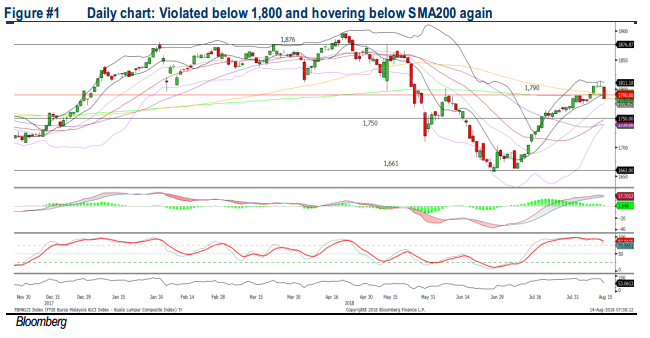

TECHNICAL OUTLOOK: KLCI

With the weakening indicators over the past few trading days, the FBM KLCI formed a bearish candle, violating below the SMA200 and 1,800. The MACD Histogram is approaching zero, while the RSI and Stochastic oscillators are hooking downwards, suggesting further downside could be seen over the near term. Hence, resistance will be envisaged around 1,800-1,810. Support will be set around 1,760-1,770.

We believe the retracement phase in the FBM KLCI may extend over the near term amid the economic turmoil in Turkey, coupled with the overly stretched indicators since the rebound rally has started 5-6 weeks ago. Sentiment for riskier assets like stocks could slowdown as profit taking activities persist.

TECHNICAL OUTLOOK: DOW JONES

The Dow ended lower for another session, contributing towards a 4-day losing streak. The MACD Indicator could be suggesting that the consolidation phase could persist over the near term. Also, both the RSI and Stochastic oscillators are pointing lower; indicating that the negative momentum is picking up. The Dow could retest the support at 25,000, while the resistance will be located around 25,500-26,000.

On Wall Street, investors are likely to stay on the sidelines as Turkey crisis mounts, stoking fears that a spill over into emerging markets, resulting in sell down on global banking stocks, where investors are having the view of this event could dampen global growth moving forward. Hence, upside of the Dow may be limited near the 25,500-26,000.

Source: Hong Leong Investment Bank Research - 14 Aug 2018