Traders Brief - Near Term Calmer Tone to be Expected

HLInvest

Publish date: Wed, 15 Aug 2018, 09:28 AM

MARKET REVIEW

Despite the ongoing concerns over economic turmoil in Turkey, Asian stocks traded on a calmer note with the Nikkei 225 rising 2.28%, while Shanghai Composite Index and Hang Seng Index slipped 0.17% and 0.66%, respectively after digesting barrage of data (July retail sales grew 8.8% YoY, industrial output expanded 6.0% YoY).

Sentiment on the local front was slightly negative at the start of the session. The FBM KLCI fluctuated between the negative and positive territories before closing marginally higher by 0.02% at 1,783.78 pts. Overall market breadth (520 gainers vs 374 losers) was positive, lifted by export-related stocks amid a weaker ringgit tone. Meanwhile, selected oil and gas stock (Sapura Energy) were under the limelight as crude oil edged higher after Saudi output cut and Iran sanctions.

Wall Street snapped a 4-day losing streak as bargain hunting activities emerged with investors focusing on corporate earnings, coupled with fading Turkey turmoil as Turkish lira took a breather. The Dow and S&P500 rebounded 0.45% and 0.64, respectively.

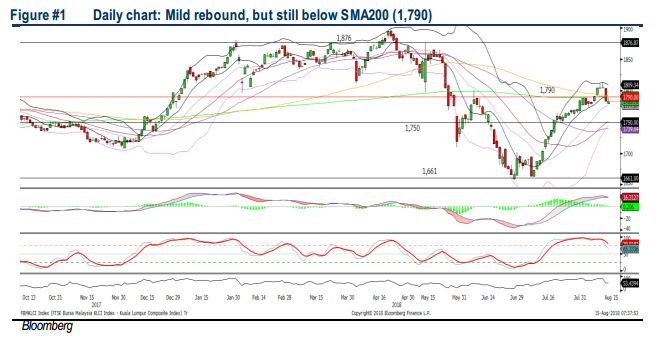

TECHNICAL OUTLOOK: KLCI

Despite the mild rebound yesterday on KLCI, the immediate resistance is located around 1,790. Also, the MACD Indicator continued to turn flattish over the past few days, potentially forming a “sell” signal soon. Meanwhile, the RSI and Stochastic oscillators are turning lower, suggesting that the negative momentum may prevail over the near term. Hence, upside resistance will be pegged around 1,800-1,810. Support will be anchored around 1,760-1,770.

With the slight recovery in overseas stock markets amid the ongoing Turkey concerns, we expect spill over buying support to lift sentiment on Bursa exchange. The FBM KLCI may turn positive bias over the near term, but upside could be capped near 1,800-1,810 amid the uncertain August reporting month.

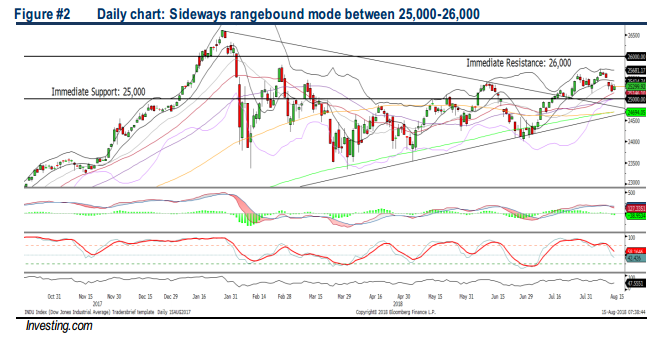

TECHNICAL OUTLOOK: DOW JONES

The Dow snapped a 4-day losing streak amid the relief rebound yesterday. The MACD Line is hovering below the Signal Line, suggesting that the sideways range bound mode may persist. Also, both the RSI and Stochastic oscillators have crossed below 50; flashing a weakening momentum in the near term. The Dow’s resistance will be set around 25,500, followed by 26,000. Meanwhile, immediate support will be located around 25,000.

With investors looked beyond the economic crisis in Turkey, at least for the near term and focused into corporate earnings and economic growth in the US, we opine that the Dow may stay neutral and trend sideways between the 25,000-26,000 levels. Should there be any resurfacing of trade news flows within this month, we believe it will soften the underlying tone of the stock markets.

TECHNICAL TRACKER: CLOSED POSITION

We took profit on our 3Q18 Quarterly Retail Strategy stock pick, PECCA (+25.7% return) after hitting our R2 upside target.

Source: Hong Leong Investment Bank Research - 15 Aug 2018