KPJ Healthcare - Robust outlook and sustained momentum; Uptrend intact

HLInvest

Publish date: Thu, 16 Aug 2018, 09:10 AM

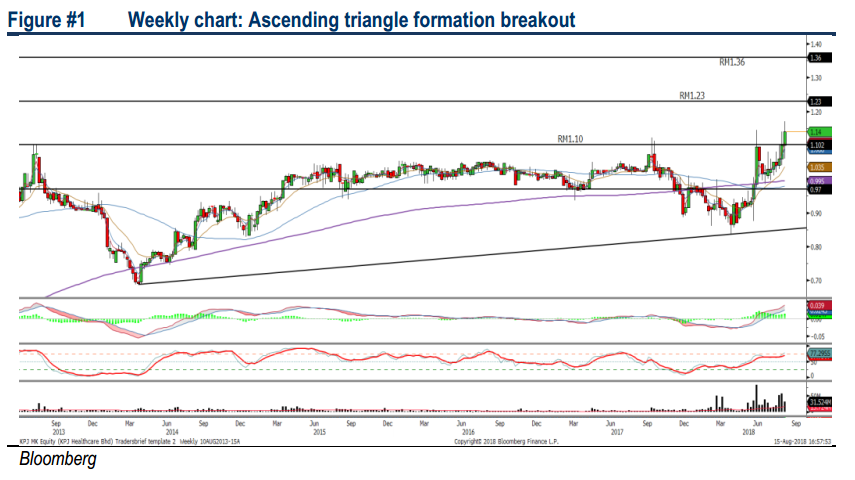

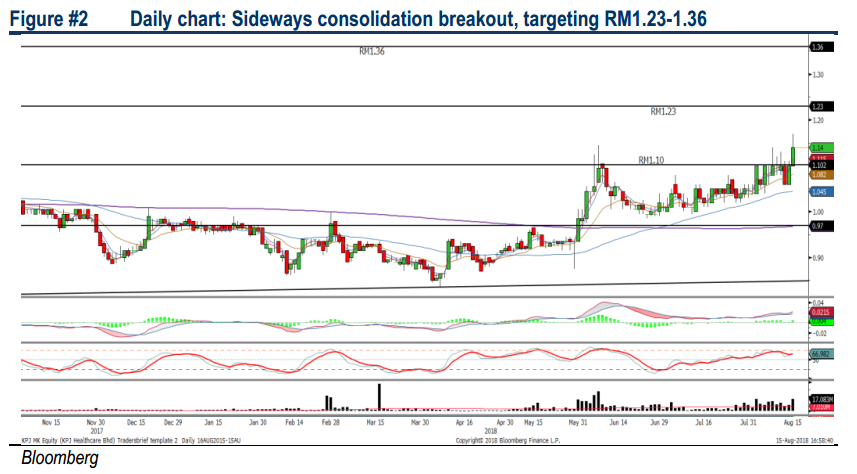

As 30% of KPJ’s cost is drugs, it could benefit from the stronger 1HFY18 ringgit average of RM3.94/USD (1HFY17: RM4.39/USD), which may reflect in the upcoming quarterly results. Also, KPJ may benefit under the tax holiday period as KPJ no longer absorbing cost related to services that were not exempted under the GST-regime. Besides, we think there may be switching of trade flows from IHH to KPJ given the heightened volatility in Turkish lira, which may affect IHH’s earnings. KPJ has experienced a breakout above RM1.10, accompanied by increased volumes, next target will be located around RM1.23-RM1.36, support will be located around RM0.98 and cut loss will be at RM0.97.

A pure domestic Malaysian hospital play. With 26 private hospitals in Malaysia, KPJ is the leading domestic player with c.23% of the market share and KPJ has expanded into less densely populated tier-2 cities (Manjung, Muar, etc). KPJ’s presence is felt nationwide, except in Melaka and Terengganu.

Stronger 1HFY18 ringgit average YoY. 30% of their cost is drugs, which are denominated in USD and EUR. With the 1HFY18 ringgit average at RM3.94/USD vs.1HFY17 ringgit average of RM4.39/USD, it could bode well for KPJ as it will reduce the cost of drugs and we assume it will result in higher profitability in the upcoming 2Q18 results.

Migration of GST to SST. Under the previous GST-regime, KPJ had to absorb some of the GST cost related to services that were not GST exempt. We can thus assume that with the 0% GST environment, KPJ is no longer absorbing the cost, margins will be improved, eventually.

Undemanding valuations. At this current price, KPJ is undemanding 24.8x FY19 P/E, which is 36% lower against IHH, which is trading at 38.7x FY19 P/E. Meanwhile, KPJ’s dividend yield stood at 1.7% vis-à-vis 0.6% of IHH. Moreover, given the recent volatility in the Turkish lira, there could be a potential switch of trade flows from IHH towards KPJ under the healthcare services provider segment.

Sideways consolidation breakout with higher volumes. After consolidating within the range between RM0.985-RM1.10, KPJ advanced further above RM1.11, accompanied by higher volumes. The MACD Indicator is trending positively above zero, while RSI and Stochastic oscillators are improving above 50. All the indicators are suggesting that the uptrend is intact. Next resistance will be pegged around RM1.23 and RM1.36, followed by a LT target of RM1.68. Support will be located around RM0.98-1.00 and cut loss will be set below the RM0.97.

Source: Hong Leong Investment Bank Research - 16 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

KPJ2024-11-15

KPJ2024-11-15

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-13

KPJ2024-11-13

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-11

KPJ2024-11-11

KPJ2024-11-11

KPJ2024-11-08

KPJ2024-11-08

KPJ2024-11-07

KPJ2024-11-07

KPJ2024-11-07

KPJ2024-11-06

KPJ2024-11-06

KPJ2024-11-06

KPJ2024-11-06

KPJ2024-11-05

KPJ2024-11-05

KPJ