Traders Brief - 20180829 - Upward Bias, But Approaching Overbought Zone

HLInvest

Publish date: Wed, 29 Aug 2018, 04:40 PM

MARKET REVIEW

Shrugging off concerns over the US and China trade issues, investors took the new US Mexico trade deal positively and most of the key regional indices were traded broadly higher. The Nikkei 225 and Hang Seng Index rose 0.06% and 0.28%, respectively, but Shanghai Composite Index fell 0.10%.

Meanwhile, taking cues from the bullish overnight Wall Street performance, the FBM KLCI gained 0.84% to 1,826.90 pts led by banking heavyweights. Also, export-related sectors such as semiconductor and gloves were under investors’ radar as the ringgit is still hovering near the RM4.10/USD range. However, market breadth was negative with 534 decliners vs 408 gainers.

Stocks on Wall Street were traded on a positive tone and the S&P500 hit the 2,900 level for the first time amid fading trade fears. The positive move came after the US and Mexico announced that they have struck a deal that would replace NAFTA. The Dow (+0.06%) and S&P500 (+0.03%) were marginally positive for the session, while Nasdaq inched higher by 0.15%.

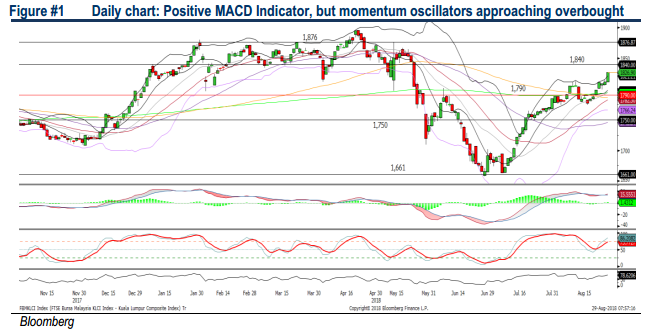

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has surged above the immediate resistance of 1,813 and traded positively. The MACD Indicator remains positive; suggesting that the uptrend is intact. However, as both the momentum oscillators are approaching the overbought zones, we believe the upside resistance could be located around 1,840. Meanwhile, support will be pegged around 1,800, followed by 1,790.

On the local front, the decent stretched of rally on the FBM KLCI could extend as it has breached above the 1,813 resistance. Also, the upward bias tone could lift the FBM KLCI towards the pre-GE14 level around 1,830-1,840. Nevertheless, as the momentum oscillators are approaching overbought zone, we could anticipate a mild retracement over the near term. The recent up trending export-related stocks could face with some profit taking activities.

TECHNICAL OUTLOOK: DOW JONES

The Dow has secured the territory above the 26,000 psychological level. The MACD Indicator is suggesting that the uptrend is intact as the MACD Line is hovering above the Signal Line. However, both the Stochastic and RSI oscillators are in the overbought region. Resistance will be pegged around 26,616. Support will be anchored around 25,500.

Despite the positive all-time-high closing in S&P500 and Nasdaq, we see limited upside amid overbought technicals. Also, we believe the trade developments between the US and China would be under the radar when it comes nearer to the conclusion of public hearing which will end on 5th September.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our Technical Tracker stock pick, TALIWORK (10.5% gain) after hitting our R1 upside target.

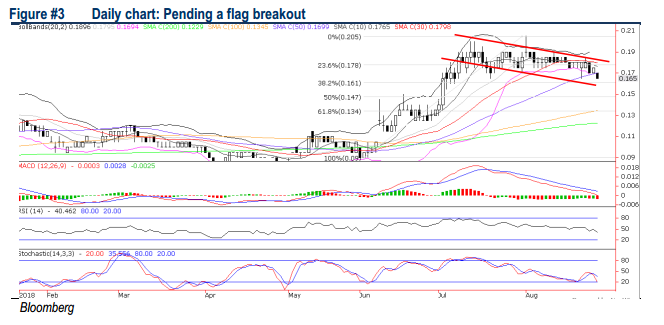

TECHNICAL TRACKER: NOVA MSC

Beneficiary of digitisation of government and healthcare applications. Nova MSC focuses on developing and providing smart e-solution systems in smart healthcare and digital government and is cautiously optimistic that the worst is over and following the disposal of Primustech in July 2018, Nova MSC can now fully focus on better prospect and higher growth potential of the Application Solution segment (with RM129m orderbook as at 30 June 2018). Valuation is not expensive based on 2.63x P/B (37% discount to peers 4.16x). Technically, it is poised for a flag breakout after a brief sideways consolidation.

Source: Hong Leong Investment Bank Research - 29 Aug 2018