Traders Brief - Sideways Ahead of Long Merdeka Holidays

HLInvest

Publish date: Thu, 30 Aug 2018, 09:15 AM

MARKET REVIEW

Despite the easing fears on the trade front as well as the breakthrough in NAFTA negotiations, which led to the positive overnight Wall Street performance, the Asia’s key regional indices ended mixed. The Nikkei 225 and Hang Seng Index gained 0.15% and 0.23%, respectively, but Shanghai Composite Index declined 0.31%.

Ahead of the long Merdeka weekend holiday and awaiting the imminent US trade deal with Canada, KLCI slid as much as 11 pts on profit taking (rallied 10.3% or 170 pts from GE14 low of 1657 on 28 June to a high of 1827 on 28 Aug) before mitigating the losses to 6.3 pts. Trading volume increased 14.6% to RM2.63bn amid a resumption of foreign selling, reflected by a negative market breadth as losers 629 thumped 355 gainers.

Wall Street extended gains overnight as the S&P 500 and the Nasdaq closed at a record for a 4th session, while the Dow rose 60 pts to finish at its highest since Feb. Sentiment was boosted by better-than-expected US 2QGDP of 4.2% and optimism over the possibility of an imminent trade deal with Canada, following the US-Mexico’s progress towards a retooling of the trilateral NAFTA.

TECHNICAL OUTLOOK : KLCI

We are watchful on Bursa Malaysia as the benchmark KLCI had been enjoying a bullish rally of 163 pts from 1657 to 1820 closing yesterday, without any meaningful consolidations during this period. Given the formation of a small Doji and steeply overbought slow stochastic readings, we do not discount a possibility of seeing further mild pullback ahead of the Merdeka weekend. Immediate supports are 1800 and 1794 (200d SMA) while resistances are situated at 1827 and 1840 (76.4% FR).

On the local front, barring any decisive breakdown below support trendline near 1800, we remain optimistic that KLCI could still retest 1846 (pre GE14 close on 8 May) after a brief consolidation. Overall, potential earnings revisions post 2Q18 results given consensus view of a slowing local economy in 2H18 coupled with nagging external volatility in global capital and trade flows are likely to impede further KLCI gains beyond 1850 in the medium term.

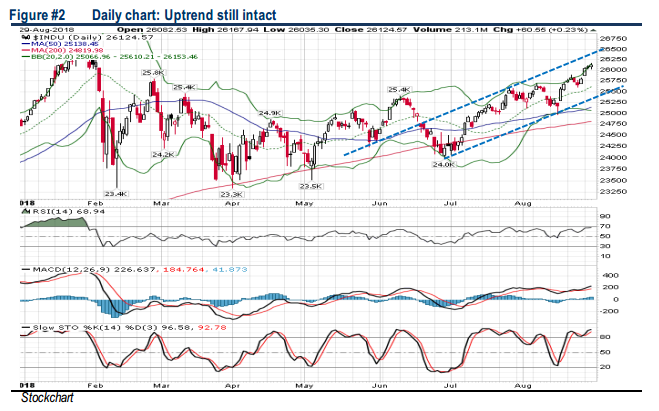

TECHNICAL OUTLOOK: DOW JONES

The Dow has closed above the 26000 psychological level in the last two sessions. The MACD Indicator is suggesting that the uptrend is intact as the MACD Line is hovering above the Signal Line. However, as the RSI and Stochastic readings are in the overbought region, resistance will be pegged around all-time high of 26616. Support will be anchored around 25500 (uptrend line from 24000).

The sense that the economy and corporate earnings remain on a solid footing has allowed Wall Street to shrug off all kinds of headwinds and negative headlines to close at 26124 (the highest since Feb), including uncertainty over trade policy, signs of weakness in the housing market, and the legal woes surrounding Trump. Nevertheless, readings from the slow stochastic and RSI indicators are starting to show toppish signals, warning that more weakness could creep in. A close below the mid Bollinger band near 25700 would see the index into consolidation mode.

Source: Hong Leong Investment Bank Research - 30 Aug 2018