Traders Brief - Traders Remain Focused on Trade Developments

HLInvest

Publish date: Wed, 05 Sep 2018, 09:12 AM

MARKET REVIEW

Asia’s stock markets closed positively, despite the on-going concerns on the trade developments. The US and Canada officials are expected to resume the trade discussions after the two countries failed to reach a trade deal last week. Shanghai Composite Index and Hang Seng Index rebounded strongly into the positive territory, rising 1.10% and 0.94%, respectively, while Nikkei 225 (-0.05%) traded flattish. On the local front, the FBM KLCI managed to pare down earlier session’s losses to close only marginally lower by 0.05% to 1,812.76 pts. Market breadth turned positive with gainers leading losers by a ratio of 5-to-4, accompanied by traded volumes of 2.41bn worth RM2.01bn. Traders were also focusing on export-related segments (technology, gloves and wood-based) and oil & gas sector on the back of weaker ringgit and firmer crude oil prices respectively.

Wall Street trended broadly lower on the first trading day of September amid the escalating trade tensions between US and its trading partners (Canada and China). The Dow and S&P500 declined 0.05% and 0.17%, respectively while Nasdaq dropped 0.23%.

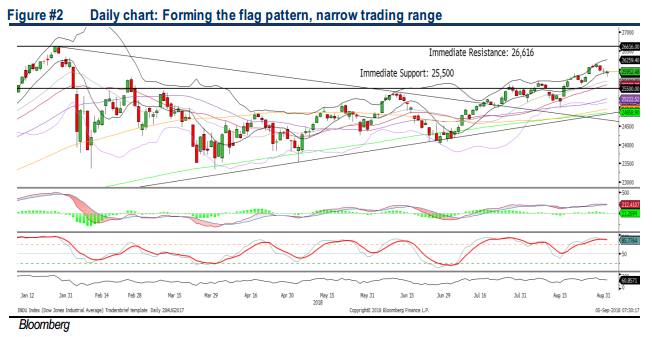

TECHNICAL OUTLOOK: KLCI

The FBM KLCI was supported around 1,810 yesterday, but the MACD indicator has issued a “sell” signal. Meanwhile, the Stochastic oscillator is dropping below the overbought region. With both the indicators weakening, we may anticipate a slower momentum on the key index and the upside may be capped around 1,825. Support will be set around 1,810, followed by 1,800.

Stocks on the local bourse are likely to trade on a lacklustre mode amid the ongoing trade worries, limiting the upside potential of the rebound yesterday. Nevertheless, export-oriented and oil & gas sectors are likely to stay under traders’ radar as ringgit is traded around RM4.13/USD, while Brent oil is hovering above USD78.

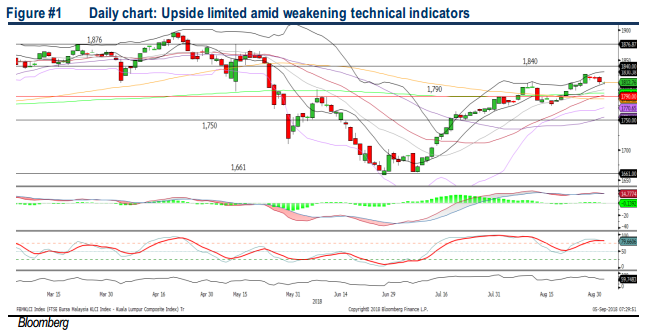

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its pullback phase for another session, but it is still hovering around 10D SMA and the MACD Indicator is trending positively above zero. However, the Stochastic oscillator is overbought. With the weakening bias on the momentum oscillator, we expect the Dow’s upside to be capped around 26,616, while the support will be located around 25,500

We believe the investors remain cautious over the trade developments between the US and its trading partners. Should there be any negative surprises on the current trade negotiations, we see downside risk to the stock markets globally. Hence, we see sideways trending mode on Wall Street.

Source: Hong Leong Investment Bank Research - 5 Sept 2018