Traders Brief - Further Negative Bias Mode Following Tech Selloffs

HLInvest

Publish date: Thu, 06 Sep 2018, 08:53 AM

MARKET REVIEW

Key regional benchmark indices splashed in the red prior to the resumption of the US-Canada trade discussions. Also, most of the emerging currencies experienced another round of selling pressure. Hang Seng Index and Shanghai Composite Index closed sharply lower by 2.61% and 1.68%, respectively, while Nikkei 225 declined 0.51%.

In tandem with the regional market rout, the FBM KLCI faced with heightened selling pressure, falling 0.95% to 1,795.90 pts. Market breadth was bearish with 703 decliners vs. 270 advancers, accompanied by higher traded volumes (2.91bn) and values (RM2.92bn). Despite the huge selling on the broader market, selected technology counters such as MI Equipment, Pentamaster and Vitrox trades actively higher.

US stocks traded lower led by a significant drop in technology shares such as Netflix and Amazon amid concerns over tightening of regulations in the tech industry and investors were staying cautious as the US-Canada trade talks resumed. The S&P500 and Nasdaq fell 0.28% and 1.19%, respectively. Meanwhile, the Dow rose marginally by 0.09%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI breached below the psychological level of 1,800 and hovers near the SMA200; indicating that the key index is on a negative bias mode. Also, indicators such as MACD, RSI and Stochastic continue to weaken further yesterday. Hence, we opine that the upside will be limited around 1,800-1,810, while support will be pegged around 1,760-1,774.

After facing with huge selling pressure yesterday in tandem with the regional markets, the FBM KLCI could be due for a short technical rebound with the upside capped along 1,800. However, should there be any negative surprises from the trade talks; we see further volatility with downward bias trade moving forward.

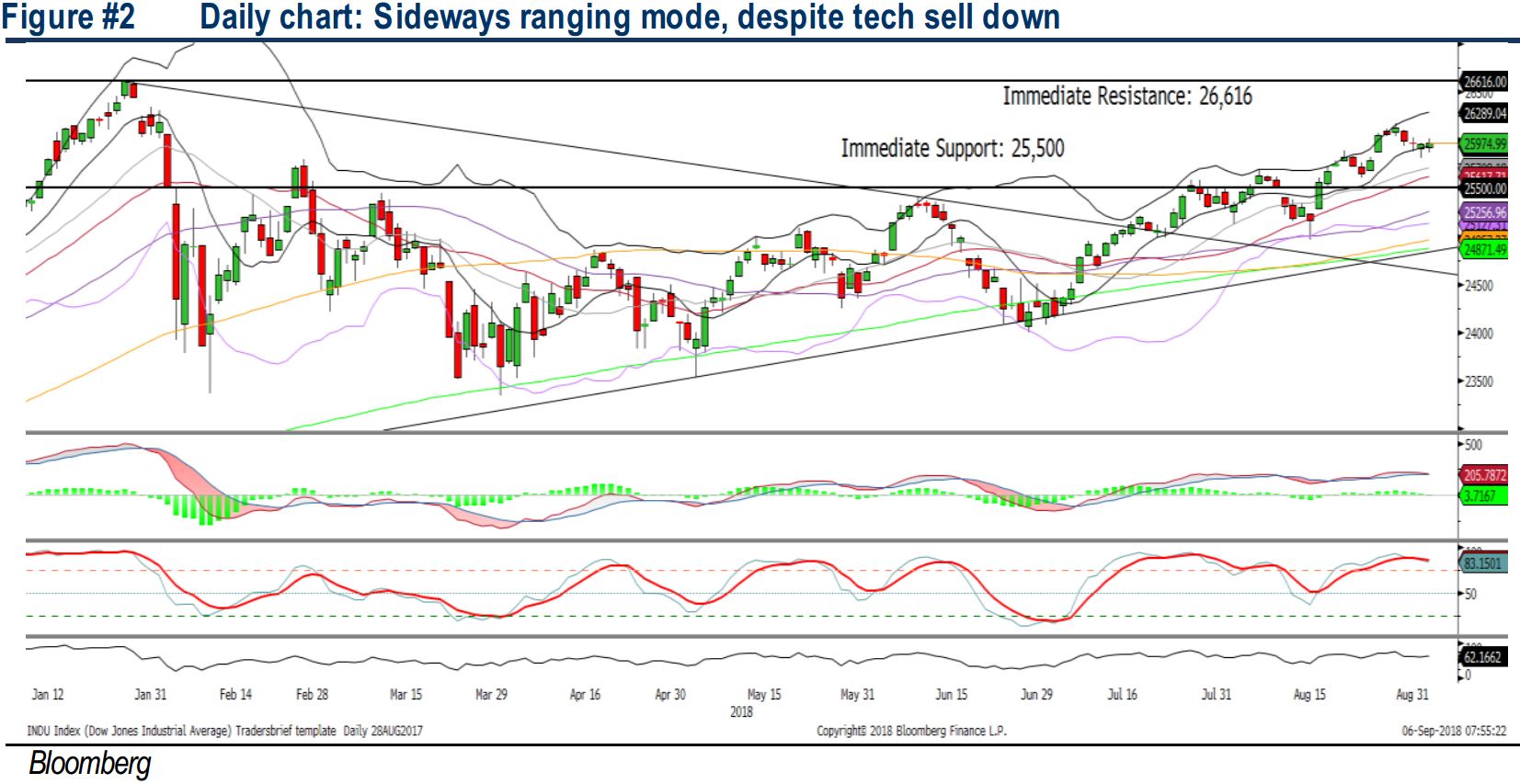

TECHNICAL OUTLOOK: DOW JONES

The Dow turned sideways after forming the flag formation; the uptrend is still intact as it is hovering above short and long term moving averages. However, MACD indicator is approaching the Signal Line, could be forming a “sell” signal. The Stochastic also is weakening in the overbought region. With the technical readings on most of the indicators are softening, we expect the upside to be limited around 26,000. The support will be anchored around 25,700.

With the ongoing investigations on tech giants over claims by President Trump of political bias and censorship by major social media firms, we see the trading sentiment could remain shaky over the near term. Also, uncertain trade developments may dampen the optimism on stock markets.

Source: Hong Leong Investment Bank Research - 6 Sept 2018