Traders Brief - Extended Consolidation Mode Unless Swiftly Reclaims Above SMA200 Near 1797

HLInvest

Publish date: Wed, 19 Sep 2018, 04:38 PM

MARKET REVIEW

Asia markets wobbled in early trades after the White House slapped 10% tariffs (and will upgrade to 25% effective 1 Jan 2019) on USD200bn worth of Chinese imports effective 24 Sep, drawing a sharp rebuke and warning from Beijing that it will be forced to retaliate. Trump further warned that he will put tariffs on another USD267bn of Chinese goods if China retaliates. However, investors shrugged off the negative news with most of the markets rebounded to end higher as the 10% duties slapped were smaller than consensus’ 25% expectation coupled with speculation that China will step up more measures to stimulate economy fallout from the latest tariff salvo from US. On the positive note, Trump’s plan to defer the 25% levies to 1 Jan 2019 could mean there’s still room for further negotiation conciliatory.

Despite Morgan Stanley’s upgrade on Malaysia to equal weight last week and the recovery in regional markets, KLCI lost 10.8 pts as investors continue to adopt a ‘risk-off’ mode amid external headwinds and the lack of domestic rerating catalysts amid the prospects of slowdown in Malaysia’s economy and expectations of further “belt-tightening budget 2019”. Compared to last Friday, trading volume and value tumbled 33% and 20% to 1.79bn worth RM1.98bn, respectively. Market breadth was negative with 272 gainers against 611 losers.

The Dow rebounded 185 pts to 26247 as investors judged the latest US-China tit-for-tat tariffs are less damaging than expected after China’s retaliation only included 5-10% duties on USD60bn worth of U.S. goods, convincing some that Beijing was running out of options to hit back. Trade has been a headline risk for months, and while it has increased day-to-day volatility, the Dow continued to grind higher and is only 353 pts or 1.3% off all-time high at 26600, supported by strong growth in corporate earnings and improving economic data.

TECHNICAL OUTLOOK: KLCI

After staging a decisive breakdown below the support-turned-resistance trend line (near 1810) in early Sep, the KLCI has derailed below the key SMA 200 (near 1797) yesterday, suggests that the bears are in the driving seat for the immediate term. Hence, unless KLCI can reclaim above 1810 successfully, it is likely to drift sideways with immediate supports at 1770 (SMA 50) and 1763 (38.2% FR).

Although the overnight strong rebound in Wall St could spur some excitement on our market today, we reiterate that sentiment to remain cautious due the lack of domestic rerating catalysts amid the prospects of slowdown in Malaysia’s economy and expectations of further “belt-tightening budget 2019” to be tabled on 2 Nov. Unless KLCI can reclaim above congested resistances near 1797-1810 strongly, the index is likely to engage in extended consolidation mode.

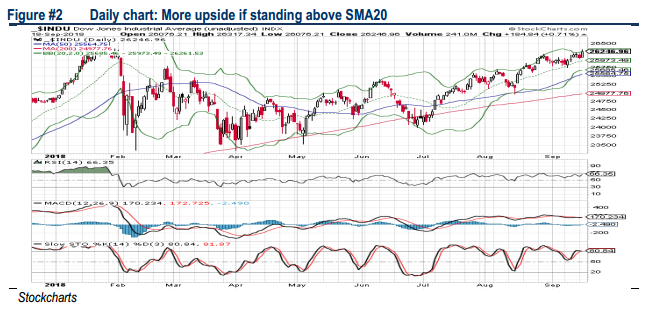

TECHNICAL OUTLOOK: DOW JONES

The Dow regained its upward momentum following the overnight 185 pts gain with a strong white candlestick pattern and trending above the SMA20 of 25973. The MACD Indicator is still positive, while the RSI and Stochastic oscillators are on the mends. As long as the SMA20 support is not violated, the Dow could retest the all-time high of 26600 over the near term. On the flip side, a decisive fall below SMA20 will trigger further retracement towards 25500-25600 territory.

As US-China remains stern and bold on their statements on the trade issues, the prospects for significant progress towards de-escalation in the short term are low. Unless it can strike a favourable deal with China, the US is likely to prolong this matter until its mid-term elections in November is over as any attempt to rush through a deal that appears unfavourable for the US could backfire on the Republican Party. Hence, we anticipate that the Dow to engage in rangebound mode with increased day-to-day volatility, supported by strong growth in corporate earnings and improving economic data.

Source: Hong Leong Investment Bank Research - 19 Sept 2018