Automotive - Aug-last month of tax holiday

HLInvest

Publish date: Fri, 21 Sep 2018, 04:36 PM

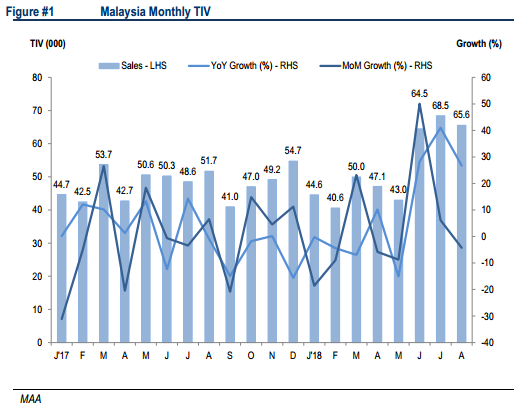

Aug 2018 TIV registered higher YoY by 26.8% but lower MoM by 4.3% to 65.6k units. YTD TIV registered strong growth of 10.1% YoY to 423.7k units, attributed to the strong demand during the recent 3-month GST zerorisation (Jun-Aug 2018). In Aug 2018, all OEMs registered strong YoY growth, with the only exception of Perodua (UMW and MBM), affected by supply disruption. We expect TIV to take a dip in Sep 2018 due end of tax holiday period. We maintain our 2018 TIV assumption at 588.1k units (+2.0% YoY) and NEUTRAL rating on the sector. Our top picks are PECCA (BUY; TP: RM1.35), DRB-HICOM (BUY; TP: RM2.80) and MBM Resources (BUY; TP: RM3.04).

As expected, MAA continued to report a strong Aug 2018 TIV at 65.6k units, a growth of 26.8% YoY on peaking demand during tax holiday period (GST zerorisation). The marginal 4.3% MoM drop was mainly attributed to supply constraints during the month. YTD sales increased by 10.1% YoY to 423.7k units, accounted for 72.0% of our forecast. We anticipate Sep 2018 sales to decline as consumer has brought forward their purchases before the end of the Aug GST holiday period. However, we still maintain our forecast of 588.1k units for 2018 in view of the slower sales post SST 2.0 implementation in Sep 2018.

We maintain NEUTRAL on the sector. The benefits from the spike in car sales in Jun Aug period (during 0% GST) will be partly offset by the sales slowdown in Sep-Dec period (implementation of 10% SST) as well as weakened RM/USD outlook.

Our top picks are PECCA (BUY; TP: RM1.35), DRB-HICOM (BUY; TP: RM2.80) and MBM Resources (BUY; TP: RM3.04).

Perodua (UMW and MBM) reported lower sales at 17.8k units (-4.4% YoY; -25.3% MoM) bringing its YTD sales to 158.7k units (+15.7% YoY), due to supply disruption for its Myvi dashboard mould, affected approximately 3.1k units. The supply issue has been resolved in Sep and production volume has normalised back. Perodua maintained its leading position with market share of 27.2% in Aug 2018. Despite that, we remained positive that Perodua is on track for its target of 209k sales for 2018, driven by its best-seller Myvi and newly launched Alza facelift (Aug 2018). The anticipated Perodua SUV launch which was initially scheduled to be launched in 4Q18 will be postponed to Feb 2019.

Proton (DRB) reported commendable sales at 9.5k units (+47.3% YoY; +17.3% MoM) in Aug 2018, strongest month for car sales over the last 36 months. However, YTD sales dropped 13.7% YoY to 44.7k units as Proton was already dragged by disappointing sales prior to tax holiday period. It was reported that Proton will absorb the SST charge for all Proton models in Sep 2018 to allow buyers to benefit from the tax-free prices (we expect limited cost absorption due to high level of local contents, which is tax-exempted under new SST 2.0). Proton is actively upgrading its outlets and dealerships with the addition of more 3S and 4S facilities as they targeting to reach 109 3S and 4S outlets by end of Oct 2018 in conjunction with the expected new launch SUV X70 model.

Honda (DRB) sales improved by 10.8% YoY to 10.8k units but dropped 15.8% MoM. YTD sales was at 75.0k units (+5.8% YoY) attributed to strong demand for its best seller models - City, Civic and Jazz. Honda retains its positions as market leader among non-national carmaker with 16.5% market share in Aug 2018. It is on track to achieve its sales target for 2018 of 109k units, supported by upcoming launch of new facelifted HR-V in Oct 2018.

Toyota (UMW) reported growth of 54.3% YoY but declined by 3.7% MoM to 8.8k units. YTD sales improved to 49.6k units (+10.4% YoY), driven by higher demand for Vios and Hilux during the tax holiday period. Toyota is banking on the new Harrier (Jan 2018), new C-HR (Mar 2018), updated Alphard and Vellfire (Mar 2018) as well as upcoming launches of upgraded Vios and new Camry in order to reach its target of more than 70k units sales in 2018.

Nissan (TCM) reported higher sales at 3.5k units (+37.2 YoY; +6.0% MoM) in Aug 2018, mainly driven by the new Serena S-Hybrid which was launched in mid-May 2018. YTD sales improved to 18.7k units (+0.7% YoY). We believe its all-new Nissan Serena S-Hybrid (May 2018) and Nissan Urvan NV350 (Mar 2018) will continue to sustain Nissan sales in 4Q18.

Others. Mazda (BAuto) sales jumped higher to 1.9k units (+142.9% YoY; +62.3% MoM). Mazda has launched the facelifted Mazda 6 and facelifted CX-3 in Aug 2018 in order to remain competitive in the market. Similarly, BMW (Sime) also registered improved sales at 1.5k units (+58.5% YoY; +22.8% MoM). Mercedes (DRB & C&C) registered higher YoY sales by 12.4% at 1.4k units but dropped 14.4% MoM.

Source: Hong Leong Investment Bank Research - 21 Sept 2018