Traders Brief - Awaiting positive development from US-China deal

HLInvest

Publish date: Tue, 02 Oct 2018, 09:16 AM

Asia stock markets ended on a positive note after US and Canada had reached a deal to replace NAFTA. The Nikkei 225 rose 0.52%. China and Hong Kong stock exchanges were closed for public holiday.

Sentiment on the local bourse however was mixed as the FBM KLCI traded flattish for most of the session. Market breadth was slightly negative as decliners led advancers by 455-to-427 stocks. Market volumes rose to 2.40bn compared to 2.11bn a day ago, while traded value shrunk to RM1.63bn vs. RM2.58bn on last Friday. Nevertheless, oil and gas stocks were topping the active list yesterday amid up trending Brent crude oil prices.

Wall Street gained momentum on the first trading day of 4Q18 as US and Canada secured a deal to replaced NAFTA and it will be named USMCA (United States-Mexico-Canada). The deal is expected to be signed by the end of November. Hence, the Dow and S&P500 rose 0.73% and 0.36%, respectively, but Nasdaq slipped 0.11%.

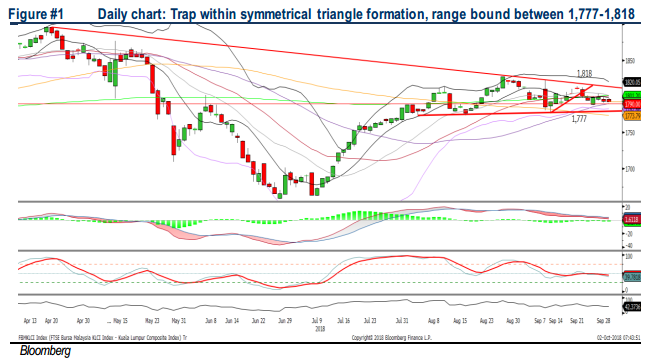

TECHNICAL OUTLOOK: KLCI

Still, the trading activities were subdued yesterday and the FBM KLCI is threading below the SMA200, trapped within the symmetrical triangle formation. The MACD indicator is flattish near the zero, while both the RSI and Stochastic oscillators are below 50. With the flattening indicators reading, we may expect the key index to stay sideways over the near term between the 1,777-1,818 zones.

With the solid overnight performance on Wall Street coupled with the positive agreement between US and Canada, we anticipate some spill over of buying interest towards stocks on the local front. Also, we extend our optimism on the trading activities amongs t oil and gas stocks due to the firm Brent oil prices.

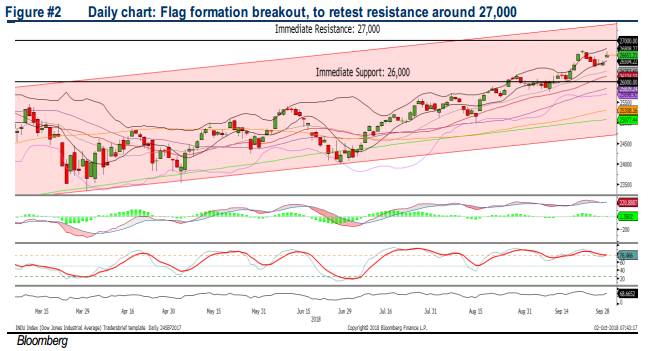

TECHNICAL OUTLOOK: DOW JONES

The Dow gapped up and experienced a flag formation breakout yesterday, the MACD Indicator has turned upwards. However, both the RSI and Stochastic oscillators are approaching overbought zone. Hence, the Dow could trade higher with the near term resistance located around 27,000 psychological level. Support will be set around 26,000.

The sentiment has turned fairly bullish following the replacement of NAFTA agreement, buying support should return and most of the major indexes should trend positively over the near term. Energy shares are likely to be focused as well with the Brent oil prices hovering steadily above USD80.

Source: Hong Leong Investment Bank Research - 2 Oct 2018