Traders Brief - Mild profit taking activities may emerge

HLInvest

Publish date: Wed, 03 Oct 2018, 04:25 PM

MARKET REVIEW

Asia equities ended mostly in the negative territory amid escalating trade tensions as a planned visit by Defence Secretary James Mattis to China in October has been cancelled. Also, White House economic advisor Larry Kudlow commented that the trade deal between US-China is far from being reached. Hang Seng Index plunged 2.38%, while Nikkei 225 inched higher by 0.10%.

Meanwhile, the FBM KLCI bucked the regional trend and ended slightly higher at 1,798.15 pts (+0.3%). However, market breadth was negative (376 advancers vs. 556 decliners) accompanied by 3.01bn shares traded for the day, while volumes declined to RM2.15bn. Also, trading interest amongst O&G increased on the back of firm Brent crude oil prices.

Wall Street closed mixed despite a mid-day rebound as Facebook dragged S&P500 and Nasdaq into the negative territory. The mixed sentiment was also due to the resurfacing trade worries between the US and China, coupled with the Italy budget episode. Meanwhile, the Dow charged towards a new all-time high at 26,773.94 pts (+0.46%).

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended sideways within the symmetrical triangle formation and the MACD Indicator is turning flattish near the zero level. Meanwhile, the RSI and Stochastic oscillators are hovering near the 50. We opine that the FBM KLCI could persist within the range of 1,777- 1,818 over the near term. However, should there be a breakout above 1,818, next resistance will be pegged around 1,830.

On the back of the escalating worries over the trade developments between US and China, coupled with the sideways move on Wall Street, it is likely for traders to lock in profits at least for the near term. Nevertheless, we expect trading interest to sustain within oil and gas stocks as Brent crude oil is hovering near the USD85 level.

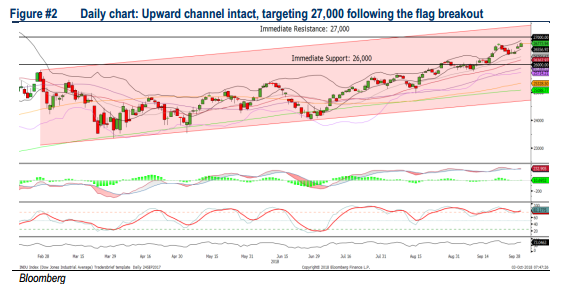

TECHNICAL OUTLOOK: DOW JONES

The Dow has trended positively after breaking above the 26,000 level last month, followed by a flag formation breakout this week. The MACD indicator is suggesting that the overall trend is positive. However, the RSI and Stochastic oscillators are in the overbought region. We believe the upside could be capped along the 27,000 psychological level for the time being, while the support will be envisaged around 26,300.

In the US, despite the positive development on the USMCA agreement over the weekend, sentiments were affected by the growing fears over political instability in Italy (3rd largest EU member) as well as the uncertain outlook on US-China deal, traders may look for stability in stock markets such as blue chips and high dividend yield stocks within the utility sector.

Source: Hong Leong Investment Bank Research - 3 Oct 2018