Traders Brief - Subdued sentiment to persist

HLInvest

Publish date: Thu, 04 Oct 2018, 04:26 PM

MARKET REVIEW

Asia’s stock markets ended mostly negative led by selloffs amongst automakers in Japan as September auto sales in the US were weaker-than-expected. The Nikkei 225 fell 0.66%, while Hang Seng index slipped 0.13% Market sentiment on the local bourse remained lacklustre without any new developments on the trade front; the FBM KLCI ended flat at 1,796.30 pts (-0.10%). Market breadth was still negative as decliners led advancers by 7-to-5. Meanwhile, market volumes declined 22% to 2.34bn worth RM1.99bn. Stocks in the US were mostly positive on the back of stronger-than-expected private payroll (increased 230k in September) and September ISM non-manufacturing (jumped to 61.6% from 58.5% in August) The positive bag of data has contributed towards higher 10-year treasury yield near the 3.14%, where investors avoided stocks with higher dividend within the consumer and utilities sector and focused on financials. The Dow and S&P500 gained 0.20% and 0.07%, respectively.

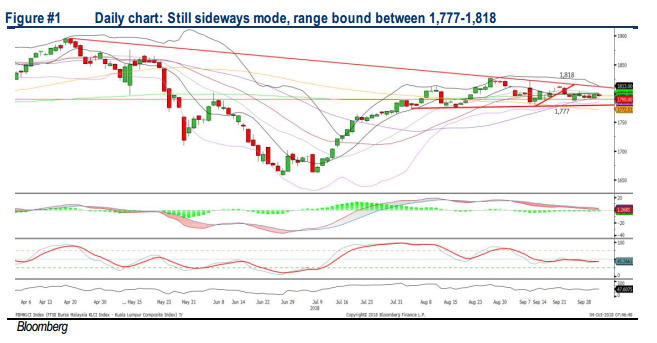

TECHNICAL OUTLOOK: KLCI

The FBM KLCI is still trapped within the symmetrical triangle and hovering near the SMA200. The MACD indicator remained flattish around the zero level. Meanwhile, RSI and Stochastic trended sideways over the past few days. Resistance will be pegged around 1,818 and the support will be set around 1,777.

Despite the positive trend on Wall Street, we believe sentiment on the local front would remain subdued ahead of the 11MP mid-term review, which will be tabled on the 18th of October. Meanwhile, trading themes that are available for traders in the near term would be on the O&G and export driven stocks on the back of firmer crude oil price and strengthening USD outlook.

TECHNICAL OUTLOOK: DOW JONES

The Dow continued to trend higher near the 27,000 psychological level. The MACD Indicator is surging higher, but both the RSI and Stochastic are hovering in the overbought region; the technical readings could be indicating that the Dow may trend higher above the 27,000 level after a healthy retracement phase. The support will be anchored around 26,500.

In the US, investors will be trading on a cautious note as the 10-year treasury yield is at 7-year high, is indicating that the underlying economic activity is growing positively and this could be suggesting that the Fed may continue to increase the interest rate. Hence, should there be any surprise on the tone of the interest rate hike, profit taking activities may emerge.

Source: Hong Leong Investment Bank Research - 4 Oct 2018