Traders Brief - Downward bias mode on FBM KLCI

HLInvest

Publish date: Fri, 05 Oct 2018, 04:19 PM

MARKET REVIEW

Asia’s stock markets ended lower amid increased concerns over the rising US 10-year treasury yield and Jerome Powell commented that the US central bank has “a long way” from neutral on interest rate amid the strong underlying economic data. The Nikkei 225 and Hang Seng Index declined 0.56% and 1.73%, respectively.

Similarly, on the local front, stocks succumbed to selling pressure, in tandem with the regionals’ sentiment and the FBM KLCI was sent lower at 1,790.11 pts (-0.34%). On the broader market, losers beat gainers by a ratio of 5-to-3, while market traded volumes stood at 2.06bn, worth RM2.45bn. Profit taking activities were noted within oil and gas stocks despite the Brent crude oil is hovering around the USD85 level.

Wall Street

Wall Street closed in the negative zone as the 10-year yield has increased more than 10 basis points, hovering around the 3.2% level after positive bag of data was released earlier two days ago. The Dow and S&P500 fell 0.75% and 0.82%, respectively, while Nasdaq plunged 1.81%.

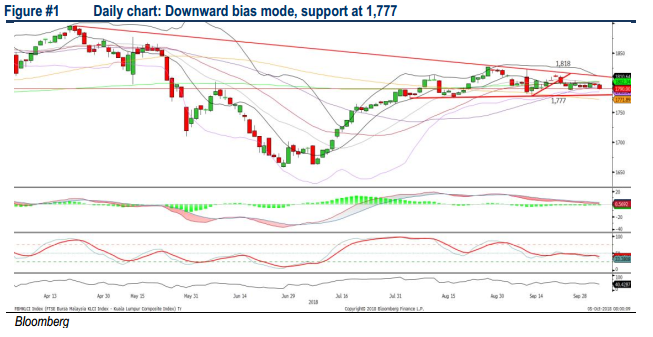

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to hover below the SMA200 (long term moving average), indicating that the key index could be having downward bias view at this juncture. Should there be any violation below the lower band of the symmetrical triangle, next support will be located around 1,730. Meanwhile, the resistance will be envisaged around 1,800-1,818.

On the local bourse, we believe further selling pressure would be seen, tracking the negative performance on Wall Street. Moreover, investors may stay side-lines until further clarity is being addressed in the upcoming 11MP midterm review and Budget 2019. In view of the weakness in sentiment, we expect the FBM KLCI to stay tepid at least for the near term.

TECHNICAL OUTLOOK: DOW JONES

The Dow pulled back after trending near the 27,000 psychological level. Also, the MACD Indicator has turned flattish and the MACD Histogram stayed flattish. Both the RSI and Stochastic oscillators are weakening after hitting the overbought region. Hence, we think further retracement phase could be expected on the Dow towards the 26,350 level. Meanwhile, resistance will be set around 27,000.

With the 10-year yield climbing at a fast-moving pace, we opine investors would stay alert and likely to take further profits over the near term. Hence, we opine the Dow’s upside will be capped along 27,000 psychological, in view of the overbought situation noticed on the momentum oscillators.

Source: Hong Leong Investment Bank Research - 5 Oct 2018