Retail Strategy - Stalemate Tone Unless Positive Budget 2019

HLInvest

Publish date: Mon, 08 Oct 2018, 09:47 AM

Unsettled trade developments will continue to weigh on the regional stock markets, while FBM KLCI could remain on a stalemate tone ahead of both the 11MP mid-term review and Budget 2019. We opine that the trading tone may be muted without any major re-rating catalyst for Malaysia’s corporates at least for the near term. While we think there should be minimal “goodies” in the Budget 2019 but any positive surprises should trigger buying interest into local market. We reckon retailers to deploy a defensive approach in 4Q18. Sectors to monitor: (i) defensive (PHARMA), (ii) export-oriented (SALUTE, SUPERMAX, POHUAT), (iii) O&G (DAYANG, UZMA) and (iv) thematic - water sector (DANCO, HSSEB).

Market Review

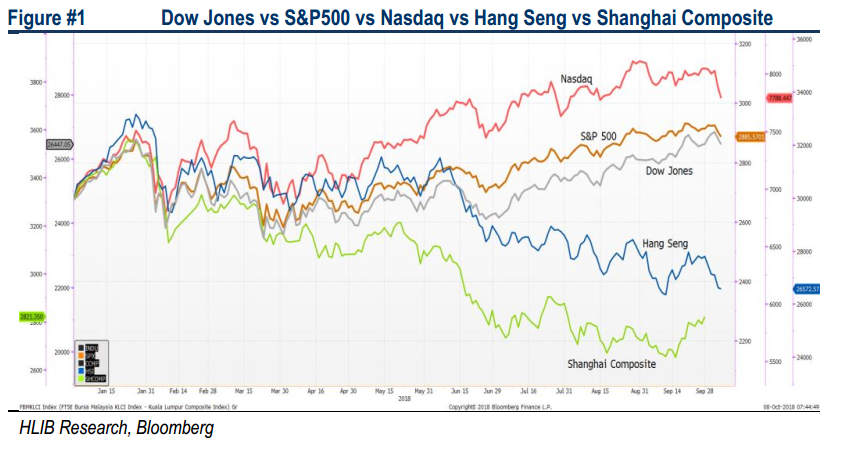

Trade tensions are piling up amid stern Trump’s protectionist actions. The trade war officially started in July 2018 soon after Trump administration imposed tariffs (25% on USD50bn and 10% on USD200bn) on China products. China has also retaliated with certain measures (25% on USD50bn and 5-10% on USD60bn). These reciprocal actions have contributed to the heightened market volatility in 3Q18, which we noticed a huge sell down in China (SHCCOMP) and Hong Kong (HSI) stock exchanges, declining from the peak by 26.3% and 21.7% towards the recent lowest point of 2,644.30 pts and 26,219.56 pts, respectively. Should there be an extended trade war, it could crimp into corporate earnings and eventually dampen global growth moving forward.

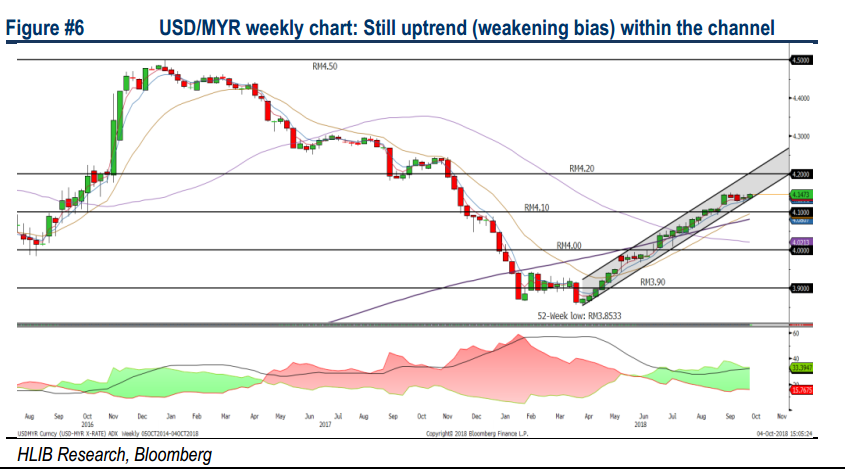

Trade battle turned ugly for EM. In the recent news flow, we observed that President Trump has forced higher tariffs on Turkish metals, which causes the Turkish lira into a downward spiral, losing 57.6% YTD. As collateral damage, most of the EM currencies were under pressure; our MYR has weakened against USD by 2.6% and 1.9% in 3Q18 and YTD, respectively. Nevertheless, our MYR was amongst the stronger currencies relative to its regional peers (Figure #2)

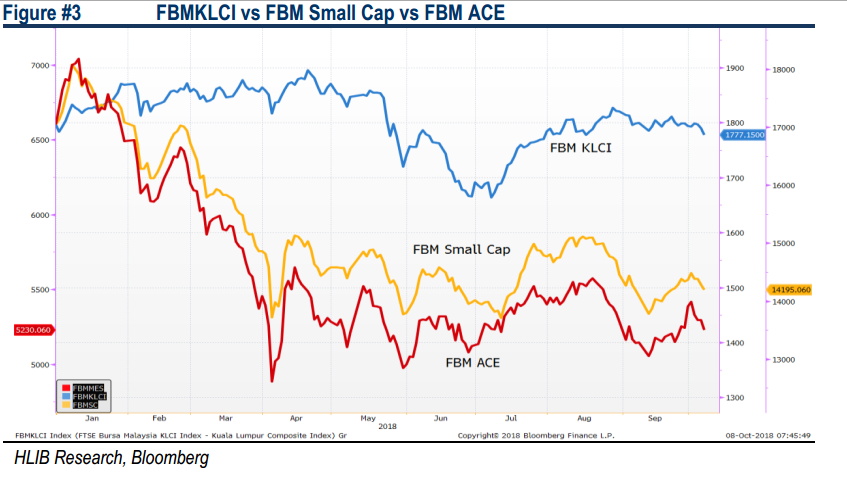

No rerating catalyst at this moment... Post-GE14’s overhaul on Malaysia’s fiscal situation were one of the main factors that led towards a lacklustre market and investors were uncertain on the corporate outlook following the axing in several construction mega projects and there were not many upward rerating catalysts on most of the sectors amid a potential slowdown in economic activities. Although we saw a decent recovery in share prices during 3Q18, we believe investors were turning on the bargain hunting mode as stocks were looking oversold with decent valuations.

Fleeing of foreign funds has stabilised. Foreigners were still fleeing the local bourse, with an outflow of RM1.7bn in 3Q18, but at a smaller quantum compared to 2Q18 of RM9.0bn. Meanwhile, September statistics show that the foreign trade flows turned positive at RM66.3m.

Market Outlook and Retail Strategy for 4Q18

Slower progress overall post-GE14... We noticed a significant slowdown in terms of construction contracts flows following the postponement/ cancellation of most of the mega projects (HSR, ECRL and MRT3) in Malaysia. We also expect the domestic growth to moderate for the time being, in view of the huge national debt of near to RM1 trillion, which was explained by our Finance Minister post-GE14. With the ongoing realignment process, the situation in Malaysia will stay tepid before getting any better.

…but we opine the reform is on the way. Still, we anticipate that the new Cabinet members with solid credentials may navigate Malaysia through the choppy waters. Hence, crafting of new effective policies, improving the transparency through open tenders in various industries and concrete execution will be highly expected in the future. Post-GE14, we are aware of significant reduction of government spending and restructuring of several GLCs to minimise leakages. We think these measures would be able to improve the fiscal situation in Malaysia moving forward.

All eyes on Budget 2019. With this short term uncertainty and weaker business environment, we believe investors would be deploying the wait-and-see mentality at least until the 11MP mid-term review (18 Oct) and Budget 2019 (2 Nov) to understand the growth direction for Malaysia in order for them to further invest into the local bourse. We opine that the upcoming Budget 2019 will be on a “belt-tightening mode” as PH-led government will be looking for ways to reduce inefficient usage of government’s resources in the past to grow “New Malaysia” more effectively. However, should there be any positive surprise in the Budget 2019; we would reckon more upside towards the stock market.

We have formulated the table above using several moving averages and market participants are likely to stay focus on Technology, Industrial Products and Finance stocks over the next few weeks.

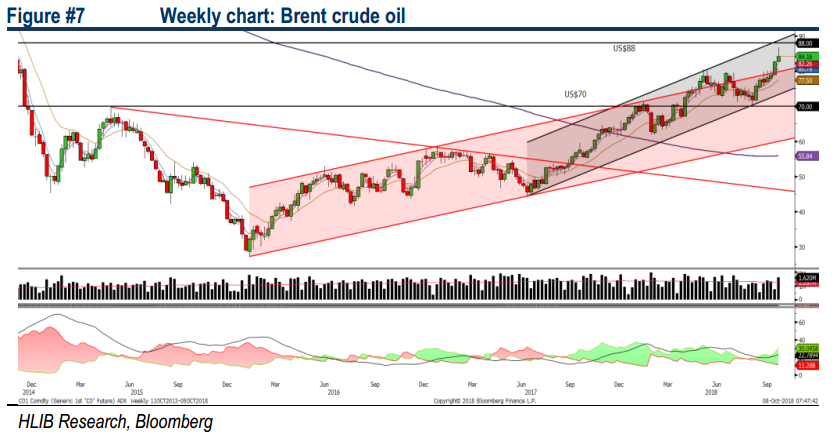

4Q18 retail strategy. Given the potential lacklustre mood amongst investors ahead of the Budget 2019 as well as unsettled trade development between the US and its trading partners, we still favour defensive sectors such as pharmaceutical/ healthcare to cushion the downside risk. In the meantime, we are inclined towards trading opportunities within the export-driven and O&G sectors on the back of weaker ringgit outlook and stronger Brent crude oil prices, respectively.

Strategy 1: Defensive sector. To navigate through the potential downside risk in 4Q18 amid the unsettled trade discussions between US and China, investors are advice to take some exposure within the defensive sector with solid fundamental, especially the strong net cash and potential steady dividends being paid out over the years. Under this defensive space, we would favour PHARMA.

Strategy 2: Weaker ringgit outlook. With the interest rate upcycle in the US, we believe USD may strengthen against ringgit at least for the near term. Hence, with the near depreciation bias in 4Q18, we would take opportunity within export-oriented sector (semiconductors, gloves, EMS and wood-based) as stronger USD would bode well for their revenue and earnings moving forward. For this segment, we prefer SALUTE, SUPERMAX and POHUAT.

Strategy 3: Up trending Brent oil prices. The Brent crude oil is currently hovering above USD85, nearing our previous target of USD88 (based on technical analysis head and shoulders formation). With this strong surge in oil prices, it is likely to attract traders’ attention on O&G stocks to trade higher. In this regard, we like DAYANG and UZMA for This Sector.

Strategy 4: Potential revival of water-theme. With the conclusion of the Selangor water asset restructuring episode, it would unlock the water infrastructure-related spending moving forward, reducing the non-revenue water situation within Selangor. Hence, we would look into water-related stock like DANCO and HSSEB.

Source: Hong Leong Investment Bank Research - 8 Oct 2018