Traders Brief - More downside risk in store

HLInvest

Publish date: Tue, 09 Oct 2018, 09:29 AM

MARKET REVIEW

Regional benchmark indices ended sharply lower, tracking the negative performance on Wall Street amid growing trade tension between the US and China, coupled with rising interest rate environment. Shanghai Composite Index resumed after a long public holiday, posting steep decline of 3.72% as PBOC cut the reserve requirement for banks over the weekend. Meanwhile, Nikkei 225 and Hang Seng Index fell 0.80% and 1.39%, respectively.

Beside the weak regional sentiment, stocks on the local front were also dragged by the statement by finance minister, cancelling MMC-Gamuda’s contract for MRT2’s underground portion, which attracted huge selling pressure on the construction sector. Market breadth was negative with losers outpaced gainers by a ratio of 7-to-2, accompanied by market traded volumes of 2.37bn, worth RM1.82bn.

Wall Street trended mixed at the end of the session after the Dow pared down losses and traded into the positive territory. Investors’ were still cautious on the back of higher 10-year treasury yields, which may attract potential interest rate hike in the future by the Fed amid stronger economy outlook. The Dow rose marginally by 0.15%, but S&P500 and Nasdaq slipped 0.04% and 0.67%, respectively.

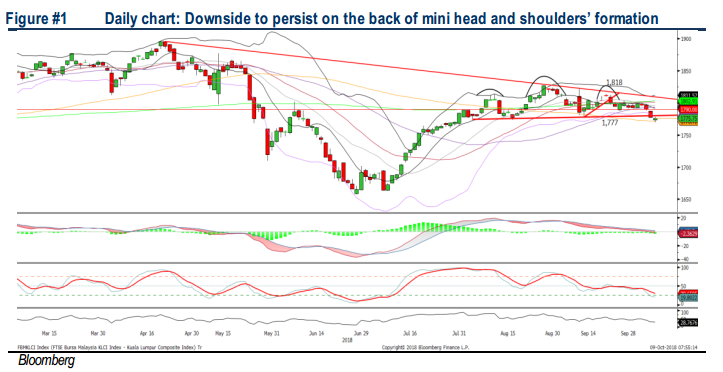

TECHNICAL OUTLOOK: KLCI

The FBM KLCI extended the negative momentum after the downward violation below 1,780. The MACD Indicator has tripped and stayed below zero over the past two trading days. The RSI and Stochastic oscillators are hovering below 50; indicating that the momentum is negative at this juncture. We opine that the upside will be capped along 1,780, followed by 1,800. The support will be anchored around 1,760, followed by 1,733.

We believe the sentiment on the broader market could remain negative amid the challenging outlook on construction sector. Also, investors could be awaiting more clarity during the 11MP midterm review (18 Oct) and Budget 2019 (2 Nov). Hence, we believe that traders should stay cautious on construction stocks as cancellation of selected projects may pose downside risk on their corporate earnings moving forward.

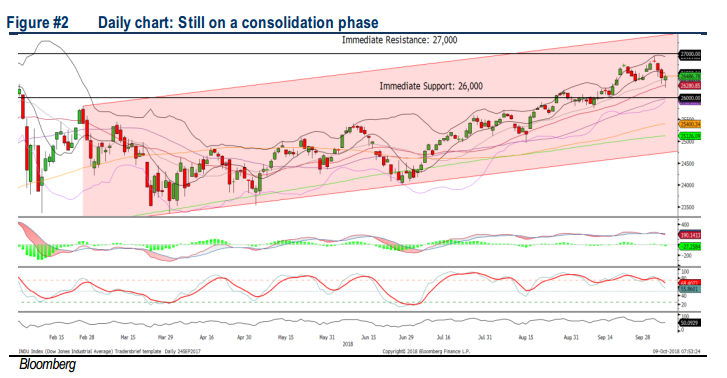

TECHNICAL OUTLOOK: DOW JONES

The Dow has snapped a 3-day losing streak, but the rebound was minor and the key index is still hovering within the retracement phase. The MACD Indicator has issued a “sell” signal, while both the RSI and Stochastic oscillators are pointing downwards. We see further downside move to the market as technical readings are suggesting that the momentum is still negative. Support will be located around 26,000, while the resistance is pegged around 27,000.

In the US, with the unsettled trade developments between the US and China as well as the concerns over interest rate up-cycle outlook, we believe these may extend the selling pressure on Wall Street. Also, traders may be focusing on the upcoming reporting season in the US that will be starting this week. Hence, the Dow’s upside is likely to be limited around 27,000.

Source: Hong Leong Investment Bank Research - 9 Oct 2018