Traders Brief - Wait-and-see Mode Amongst Investors

HLInvest

Publish date: Wed, 10 Oct 2018, 10:17 AM

MARKET REVIEW

Most of the Asia’s stock markets (Nikkei 225 declined 1.32%, while Hang Seng Index slipped 0.17%) ended lower, but Shanghai Composite Index managed to recoup earlier losses after China’s central bank cutting the reserve requirement ratio for banks over the weekend and the central and the key index turned marginally positive for the session.

Meanwhile, stocks on the local front saw another day of declining move with the FBM KLCI slid 0.09% to 1,774.15 pts following the conclusion of the “Malaysia: A New Dawn” investors conference. Market breadth was unexciting as there were more losers (469) than gainers (345) for the session. Most of the construction stocks were still traded negatively following the challenging outlook in the sector.

Wall Street ended weaker on another session led by selling pressure within materials and industrial sector amid rising concerns over lower demand from China, which may cause a slow down towards the global activity, eventually. The Dow and S&P500 dropped 0.21% and 0.14%, respectively.

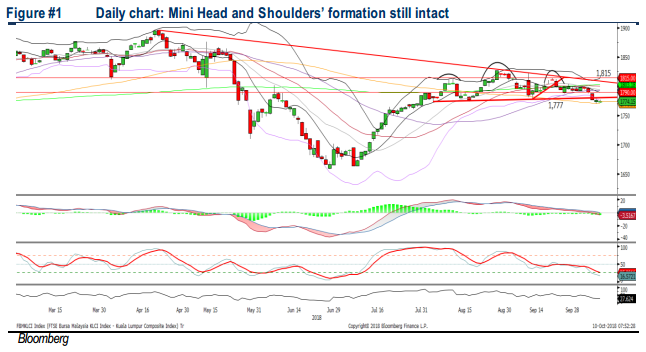

TECHNICAL OUTLOOK: KLCI

Another down day on the FBM KLCI and is hovering below the Head and Shoulders’ neckline of 1,777. Meanwhile, the MACD continues to hover below zero and both momentum oscillators (RSI and Stochastic) oscillators are trending below 50 into the oversold region. Despite the oversold situation on FBM KLCI, we believe the trend is likely to stay weak over the near term, unless the key index could close above the resistance of 1,777. Support will be located around 1,760, followed by 1,733.

We expect negative sentiment to spillover on the local front, tracking weaker performance on Wall Street and investors are likely to deploy a wait-and-see approach ahead of both the 11MP midterm review (18 Oct) and Budget 2019 (2 Nov) events. Nevertheless, O&G sector may trade actively following a rebound in Brent crude oil prices, which is hovering near USD85 level.

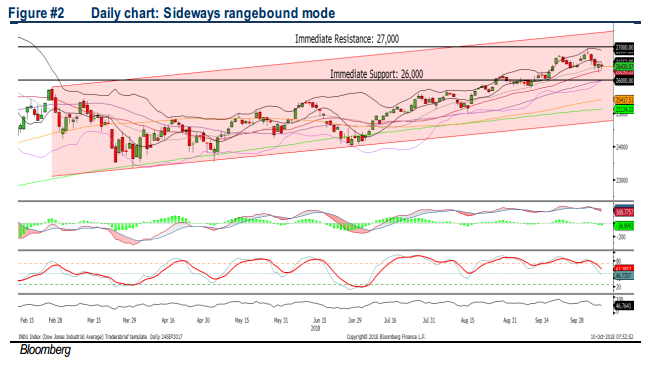

TECHNICAL OUTLOOK: DOW JONES

The Dow retraced from the recent high of 26,952 level and has turned sideways near the SMA30 level. However, the MACD Indicator is trending weaker after forming the “sell” signal. Also, both the RSI and Stochastic oscillators have violated below 50. We opine that the Dow could trend within the rangbound of 26,000-27,000 levels over the near term.

Despite the 10-year treasury yield retreating from the multi-year high, the concerns over interest rate upcycle environment could dampen the sentiment moving forward. Also, the unsettled trade war between US and China may pose downside risk towards stock markets. Hence, we opine that the Dow’s upside will be limited over the near term and the resistance will be located around 27,000.

Source: Hong Leong Investment Bank Research - 10 Oct 2018