Traders Brief - Technical Rebound Likely to Extend

HLInvest

Publish date: Mon, 15 Oct 2018, 11:04 AM

MARKET REVIEW

Asia’s stock markets managed to recoup earlier losses, despite a significant plunge in Wall Street (Dow tumbled more than 500 points on Thursday) following comments from Donald Trump, criticizing the Fed’s monetary policy. The Nikkei 225 rose 0.46%, while Shanghai Composite Index and Hang Seng Index gained 0.91% and 2.12%, respectively. On the local front, the FBM KLCI managed to recover in tandem with the regional markets and the key index rebounded 1.30% to 1,730.74 pts. Market breadth was bullish with 578 gainers vs 334 losers, accompanied by traded volumes of 2.22bn, worth RM2.49bn. Most of the export-oriented stocks within the semiconductor and gloves sector traded actively in the positive territory.

Wall Street managed to snap two-day losing streak and rebounded into the positive territory, the Dow recovered 287.16 pts or 1.15% after diving more than 1,377.74 pts over the previous two trading days. On the WoW basis, the Dow ended lower by 3.96% amid rising concerns over interest rate upcycle environment, rich technology valuations and a potential economic slowdown amid increasing borrowing costs.

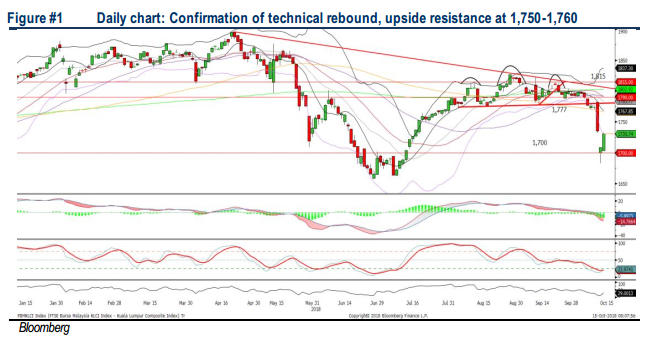

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded last Friday after forming a hammer candle last week; suggesting that the buying support is strong. However, we may anticipate short term traders to take profit over the near term. Hence, the upside could be capped around 1,750-1,760, while support will be located around 1,680-1,700.

After the heavy selling activities last week, we believe the downside risk would be limited over the near term and the key index could be due for a technical rebound, tracking the rebound on Wall Street. Also, we believe export-driven sectors such as technology and gloves could see further trading opportunities amid weakening bias ringgit outlook (USDMYR at RM4.15 level). Meanwhile, traders could be monitoring the 11MP midterm review and Budget 2019 that will be held 18th of October and 2nd November, respectively for more clarity.

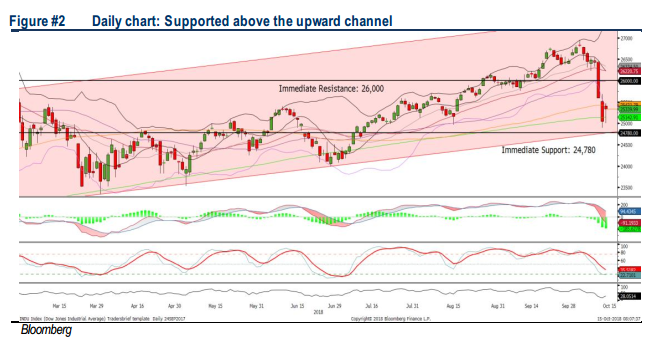

TECHNICAL OUTLOOK: DOW JONES

The Dow steadied around 25,000 psychological level after plunging near to 4.0% last week. However, the MACD Line is hovering below zero. Should there be any downward violation below the SMA200 (25,142), it could resume the selling pressure towards 24,500. Meanwhile, the resistance will be envisaged around 26,000.

Despite the positive trading tone at the end of last week, investors could continue to watch out the 10-year Treasury yield as it has hit around 3.26% last week as well as the Fed’s interest rate tone moving forward. Hence, we opine that the Dow’s upside may be limited around 27,000 level.

TECHNICAL TRACKER: BCM ALLIANCE

Steady growth ahead amid stable commercial laundry equipment and growing medical devices industries. Despite facing challenges in the commercial laundry equipment sales (2QFY18 revenue -7.7% YoY), we remain sanguine on BCMALL, spearheaded by the robust medical devices segment (+139% YoY) after acquiring a 51% stake in healthcare company Cypress Medic S/B in Feb. Valuation is attractive at 8.3x (6.9x ex-cash) FY19 P/E (37% below historical 13.2x P/E since listing), supported by a resilient 7% FY19 EPS growth and net cash of RM15m or 3.6sen/share; Technically, BCM is likely to test RM0.25-0.275 levels after a brief sideways trend.

Source: Hong Leong Investment Bank Research - 15 Oct 2018