Tradersbrief - Spillover Buying From Wall Street to be Expected

HLInvest

Publish date: Wed, 17 Oct 2018, 04:18 PM

MARKET REVIEW

Key regional benchmark indices ended mostly mixed after the mild pullback on Wall Street as well as rising geopolitical tension between Saudi Arabia and the international community following the disappearance of the Saudi Arabian journalist Jamal Khashoggi. The Nikkei 225 and Hang Seng Index Gaines 1.25% and 0.07%, respectively, but the Shanghai Composite Index fell 0.85%.

On the local front, market sentiment was stable and the FBM KLCI (+0.47%) managed to end in the positive territory. Market volumes and values declined 25% and 20% to 1.53bn and RM1.62bn, respectively. Market breadth was negative with decliners leading advancers by a ratio of 4-to-3. Nevertheless, selected export-related stocks like Top Glove and Vitrox traded actively higher.

Wall Street gained momentum after last week’s sell down as investors focused on upbeat corporate earnings from Goldman Sachs and Morgan Stanley. The Dow and S&P500 rallied 2.17% and 2.15%, respectively.

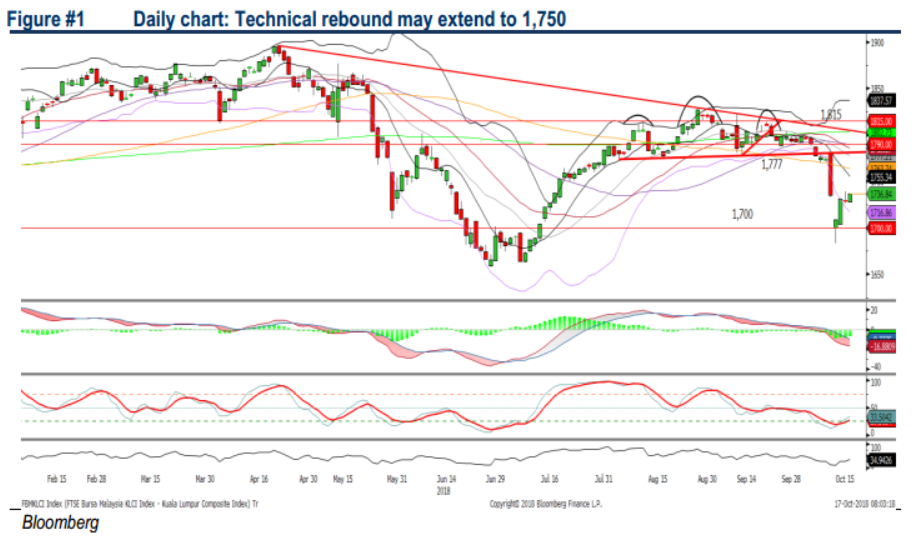

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to extend its rebound yesterday after hitting the 1,682 level last week. The MACD Line is hovering below zero. While the RSI and Stochastic oscillators are suggesting that the key index is oversold and is likely to continue its course of rebound. Upside resistance will be pegged around 1,750-1,760, while support will be located around 1,700- 1,715.

On the local bourse, we noticed buying interest was milder compared to the selling activities last week as market participants could be staying sidelines ahead of the 11MP midterm review and the lacklustre tone could persist over the near term. The KLCI’s trading range will be located within 1,725-1,750.

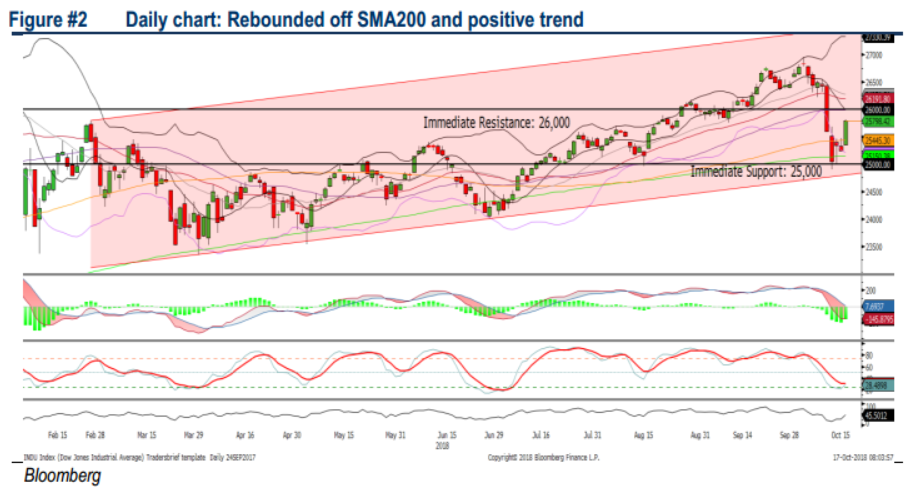

TECHNICAL OUTLOOK: DOW JONES

The Dow managed to rebound above the SMA200 level last week and stay on its long term uptrend course at this juncture despite the weakening MACD indicator. Both the RSI and Stochastic oscillators are improving (turning up after oversold status). Resistance will be envisaged around 26,000, while support will be set along 25,000.

We believe the current upbeat earnings could be short lived as concerns over trade discussions and geopolitical tensions issues could resurface after the corporate earnings season and that could pose further downside risk to the stock markets. Hence, the Dow’s upside could be limited around 26,000.

TECHNICAL TRACKER: COMFORT GLOVES

Look beyond FY19 as prospects remain firm with a positive FY19-21 EPS CAGR of 11%. We believe the sluggish 1HFY19 results (mainly driven by the one-off logistics expense related to restrictions slapped by the US FDA) and FDA Import Alert list have been largely priced in as valuations are undemanding at 14.1x FY20E P/E (50% below peers), supported by positive 11% FY19-21 EPS CAGR and potential further boost in US sales following the Pacewell’s acquisition as it possesses a 510(k) FDA license.

Source: Hong Leong Investment Bank Research - 17 Oct 2018