Traders Brief - Negative sentiment should prevail

HLInvest

Publish date: Fri, 19 Oct 2018, 04:23 PM

MARKET REVIEW

Asia stock markets ended on a softer tone following the Fed’s meeting minutes, which could be indicating a tighter monetary moving forward to keep the economy steady. Shanghai Composite Index and Nikkei 225 lost 2.94% and 0.80%, respectively, while Hang Seng Index (-0.03%) ended flattish.

On the local front, prior to the 11MP midterm review, sentiment was negative with FBM KLCI (- 0.15%) closed in the red led by Sime Plantation and IHH, accompanied by negative market breadth (472 decliners vs 338 gainers). Market traded volumes stood at 2.00bn, worth RM2.03bn. Nevertheless, most of the steel counters such as MASTEEL and SSTEEL managed to trade actively higher.

Wall Street extended another day of losses as investors were still having concerns over unsettled US-China trade war, the interest up-cycle tone by the Federal Reserve as well as steep valuations in US tech stocks. The Dow and S&P500 declined 1.27% and 1.44%, respectively, while Nasdaq plunged 2.06%.

TECHNICAL OUTLOOK: KLCI

After the FBM KLCI rebounded from the 1,682 level last week, it has formed an immediate resistance along 1,743. The MACD Indicator continued to stay below zero, but the RSI and Stochastic oscillators are turning positive after surging above the oversold region. With the mixed technical readings, the FBM KLCI could trend sideways between the 1,720-1,755 levels.

We believe market participants will need to digest the 11MP midterm review presented by Tun Mahathir, suggesting that the economy may grow at a slower pace of 4.5%-5.5% and fiscal deficit targeted to be at 3% to GDP in 2020. While the realignment and re-calibration of is positive towards Malaysia’s fiscal status by 2020, the short term market movements on the FBM KLCI is likely to trend sideways ahead of the Budget 2019 that will be tabled on 2nd of November.

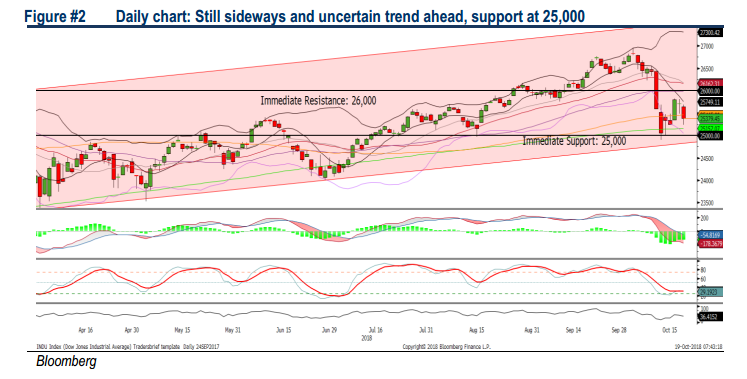

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded from the recent low of 24,899, but selling pressure remained rampant and the key index fell for the second consecutive day. The MACD Line is hovering below zero, while both the RSI and Stochastic oscillators are trending below 50. With most of the indicators suggesting that the momentum is weak at this juncture, we believe the Dow could remain sluggish and trade near the SMA200 and 25,000 support zones. Meanwhile, the upside will be capped around 26,000.

As negative catalysts such as trade disputes, interest rates and 10-year Treasury yield that has risen sharply recently were taking the limelight in the news flow, we believe the markets could trade on a heightened volatility over the near term. Nevertheless, should there be any better-than-expected US corporate earnings this month, it should cushion the downside risk on Wall Street.

Source: Hong Leong Investment Bank Research - 19 Oct 2018